Form 14446 Spanish 2016

What is the Form 14446 Spanish

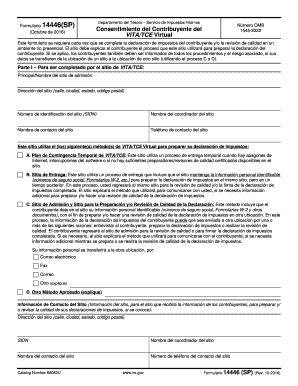

The Form 14446 Spanish is a specific document utilized by individuals and businesses to facilitate certain processes with the Internal Revenue Service (IRS) in the Spanish language. This form serves as a means for Spanish-speaking taxpayers to communicate their needs and fulfill their obligations effectively. It is essential for ensuring that all necessary information is conveyed accurately, allowing for smoother interactions with the IRS.

How to use the Form 14446 Spanish

Using the Form 14446 Spanish involves several key steps. First, ensure that you have the correct version of the form, which is tailored for Spanish speakers. Next, fill out the form with accurate and complete information, taking care to follow any specific instructions provided. Once completed, the form can be submitted electronically or in paper format, depending on your preference and the requirements of the IRS.

Steps to complete the Form 14446 Spanish

Completing the Form 14446 Spanish requires attention to detail. Here are the steps to follow:

- Gather all necessary information, including personal identification and financial details.

- Download the Form 14446 Spanish from an official source.

- Carefully fill out each section, ensuring that all entries are accurate.

- Review the completed form for any errors or omissions.

- Submit the form through the preferred method, whether online, by mail, or in person.

Legal use of the Form 14446 Spanish

The legal use of the Form 14446 Spanish is governed by IRS regulations that ensure compliance with federal tax laws. When filled out correctly, this form is considered a valid document for tax-related purposes. It is important to adhere to all guidelines and requirements outlined by the IRS to maintain the form's legal standing.

Key elements of the Form 14446 Spanish

Several key elements are crucial when working with the Form 14446 Spanish. These include:

- Identification Information: Personal details such as name, address, and taxpayer identification number.

- Purpose of the Form: A clear explanation of why the form is being submitted.

- Signature: A signature is required to validate the document.

Form Submission Methods

The Form 14446 Spanish can be submitted through various methods, accommodating different preferences and needs. You may choose to submit the form electronically via the IRS website, which allows for quicker processing. Alternatively, you can mail a physical copy to the appropriate IRS address or deliver it in person at a local IRS office. Each method has its own advantages, so consider your circumstances when deciding how to submit the form.

Quick guide on how to complete form 14446 spanish

Complete Form 14446 Spanish effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 14446 Spanish on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 14446 Spanish effortlessly

- Obtain Form 14446 Spanish and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from a device of your choosing. Edit and eSign Form 14446 Spanish to ensure smooth communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14446 spanish

Create this form in 5 minutes!

People also ask

-

What is form 14446 Spanish?

Form 14446 Spanish is a document provided by the IRS that assists Spanish-speaking taxpayers in understanding their rights under the Affordable Care Act. This form is designed to ensure that Spanish speakers have access to essential information regarding health insurance and tax obligations.

-

How can I fill out form 14446 Spanish using airSlate SignNow?

With airSlate SignNow, you can easily fill out form 14446 Spanish by uploading your document to our platform. The intuitive interface allows you to input data conveniently, ensuring that your form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 14446 Spanish?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and often considered cost-effective for the services provided, particularly when handling documents like form 14446 Spanish.

-

What are the benefits of eSigning form 14446 Spanish with airSlate SignNow?

eSigning form 14446 Spanish with airSlate SignNow offers the benefits of speed and security. You can quickly obtain signatures without the hassle of printing and scanning, and our platform provides a secure environment for sensitive information, ensuring compliance with regulations.

-

Can airSlate SignNow integrate with other tools I use for managing form 14446 Spanish?

Absolutely! airSlate SignNow seamlessly integrates with a variety of tools such as CRM systems, document management solutions, and payment processors, enhancing your workflow when handling form 14446 Spanish or other documents.

-

Is it easy to share form 14446 Spanish using airSlate SignNow?

Yes, sharing form 14446 Spanish using airSlate SignNow is straightforward. Once you've completed the form, you can send it directly to recipients via email or share a secure link, making collaboration efficient and hassle-free.

-

What features does airSlate SignNow offer for form 14446 Spanish processing?

airSlate SignNow provides a range of features for processing form 14446 Spanish, including customizable templates, tracking capabilities, and automated reminders for signers. These features streamline the document management process and enhance productivity.

Get more for Form 14446 Spanish

Find out other Form 14446 Spanish

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document