Form 14446 Department of the Treasury Internal RevenueForm 14446 Department of the Treasury Internal Revenue14446 Consentimiento 2022-2026

Understanding the taxpayer consent form

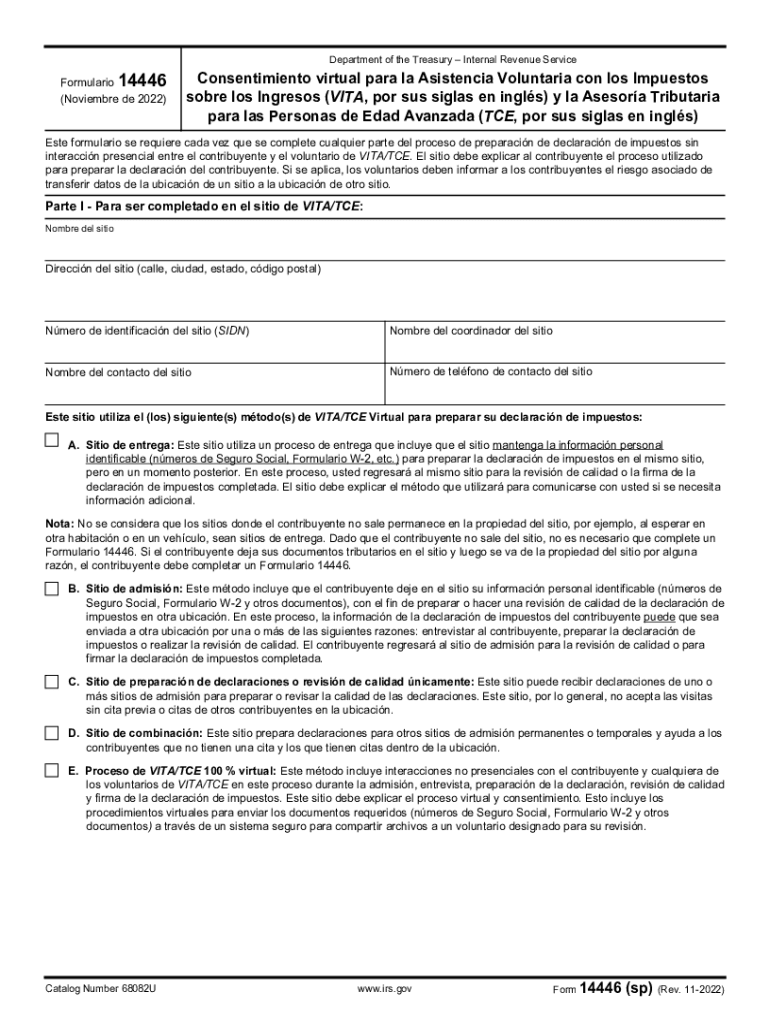

The taxpayer consent form, specifically Form 14446, is a document used by taxpayers to provide consent for the Internal Revenue Service (IRS) to share their tax information with designated third parties. This form is particularly relevant for individuals seeking assistance with their tax matters, as it ensures that authorized representatives can access necessary information on their behalf. Understanding the purpose and implications of this form is essential for taxpayers who wish to streamline their communication with the IRS.

Steps to complete the taxpayer consent form

Completing the taxpayer consent form involves several key steps to ensure accuracy and compliance. First, taxpayers should gather all necessary personal information, including their Social Security number and tax identification details. Next, they must clearly identify the third party to whom they are granting access, providing their name and contact information. It is also important to specify the tax years for which consent is granted, as this will limit the scope of the information shared. Finally, the taxpayer must sign and date the form, confirming their consent.

Legal use of the taxpayer consent form

The legal use of the taxpayer consent form is governed by IRS regulations and ensures that taxpayers maintain control over their sensitive information. By signing this form, taxpayers authorize the IRS to disclose their tax information to the specified third party, which can include tax professionals or family members. This consent is crucial for ensuring that representatives can assist effectively while also protecting taxpayer privacy. Compliance with IRS guidelines is essential to avoid any potential legal issues.

How to obtain the taxpayer consent form

Taxpayers can obtain the taxpayer consent form (Form 14446) directly from the IRS website or through authorized tax professionals. It is available as a downloadable PDF, making it easy to access and complete. Additionally, many tax preparation software programs include this form as part of their offerings, allowing users to fill it out digitally. Ensuring that you have the most current version of the form is important for compliance and accuracy.

Key elements of the taxpayer consent form

Several key elements must be included in the taxpayer consent form to ensure its validity. These include the taxpayer's full name, Social Security number, and contact information. The form must also clearly identify the third party authorized to receive the information, along with their contact details. Additionally, taxpayers should specify the tax years covered by the consent, as this delineates the scope of access granted. Finally, the taxpayer's signature and date are required to validate the consent.

Filing deadlines and important dates

While the taxpayer consent form itself does not have a specific filing deadline, it is essential to consider the timing of its submission in relation to tax deadlines. Taxpayers should ensure that the form is completed and submitted to the IRS before any deadlines related to tax filings or payments. Keeping track of important dates, such as the annual tax filing deadline, can help ensure that the consent form is utilized effectively in conjunction with other tax-related documents.

Quick guide on how to complete form 14446 department of the treasury internal revenueform 14446 department of the treasury internal revenue14446

Complete Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento effortlessly on any device

Web-based document handling has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools needed to create, amend, and electronically sign your documents swiftly without delays. Manage Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento without hassle

- Locate Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14446 department of the treasury internal revenueform 14446 department of the treasury internal revenue14446

Create this form in 5 minutes!

People also ask

-

What is a taxpayer consent form mortgage?

A taxpayer consent form mortgage is a document that allows a lender to obtain a borrower's tax information directly from the IRS. This form streamlines the mortgage process by providing necessary financial details to verify a borrower's income, thus speeding up loan approval.

-

How does airSlate SignNow simplify the taxpayer consent form mortgage process?

airSlate SignNow provides an intuitive platform to electronically sign and send a taxpayer consent form mortgage with ease. This reduces paperwork and minimizes delays, ensuring that lenders can quickly get the tax information needed for mortgage approval.

-

Is using airSlate SignNow for taxpayer consent forms secure?

Yes, airSlate SignNow takes security seriously, implementing end-to-end encryption and secure data storage. When handling taxpayer consent form mortgage documents, you can trust that your sensitive information will be protected.

-

What are the benefits of using an electronic taxpayer consent form mortgage?

An electronic taxpayer consent form mortgage offers numerous benefits, including speed, convenience, and reduced costs. By opting for eSignatures with airSlate SignNow, both lenders and borrowers can complete transactions quickly and efficiently without the hassle of printing or mailing documents.

-

Can I integrate airSlate SignNow with other mortgage software?

Absolutely! airSlate SignNow integrates seamlessly with various mortgage software and CRM systems, enhancing your workflow. This integration allows you to manage taxpayer consent form mortgage requests alongside your existing tools, streamlining the entire process.

-

What are the pricing options for using airSlate SignNow for taxpayer consent forms?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes. Our packages are designed to provide cost-effective solutions for managing taxpayer consent form mortgage documents while maintaining access to all essential features.

-

How can airSlate SignNow enhance document management for mortgage professionals?

With airSlate SignNow, mortgage professionals can efficiently manage all documentation, including taxpayer consent form mortgages. Features like tracking, reminders, and cloud storage enable effective organization and oversight of all essential papers needed in the mortgage process.

Get more for Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento

- 5 day notice to remedy breach of lease or lease terminates residential nevada form

- 5 day notice to pay rent or lease terminates residential nevada form

- Nevada breach form

- Nevada pay rent form

- 7 day notice to terminate week to week lease residential from landlord to tenant nevada form

- Assignment of lien corporation or llc nevada form

- Conditional release progress payment form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property nevada form

Find out other Form 14446 Department Of The Treasury Internal RevenueForm 14446 Department Of The Treasury Internal Revenue14446 Consentimiento

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement