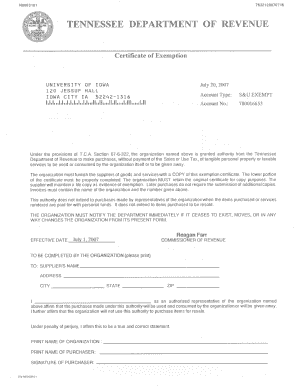

Tax Exempt Form Tn 2007

What is the Tennessee Sales Tax Exemption Form?

The Tennessee sales tax exemption form is a document that allows eligible individuals or businesses to make purchases without paying sales tax. This form is particularly important for organizations that qualify for tax-exempt status, such as non-profits, government entities, and certain educational institutions. By completing this form, buyers can provide sellers with proof of their tax-exempt status, ensuring that they do not incur unnecessary sales tax charges on eligible purchases.

How to Use the Tennessee Sales Tax Exemption Form

To effectively use the Tennessee sales tax exemption form, individuals or businesses must first ensure they meet the eligibility criteria for tax exemption. Once eligibility is confirmed, the form can be presented to sellers at the time of purchase. It is essential to complete the form accurately, providing all required information, including the purchaser's name, address, and the reason for the exemption. Sellers will retain a copy of the completed form for their records, which is necessary for compliance with state tax regulations.

Steps to Complete the Tennessee Sales Tax Exemption Form

Completing the Tennessee sales tax exemption form involves several key steps:

- Obtain the correct form, which can often be found online or through state tax offices.

- Fill in the required information, including the purchaser's details and the nature of the exemption.

- Sign and date the form to validate it.

- Provide the completed form to the seller at the time of the purchase.

- Keep a copy for your records to ensure compliance with tax laws.

Eligibility Criteria for the Tennessee Sales Tax Exemption Form

Eligibility for the Tennessee sales tax exemption form typically includes various categories of purchasers. Non-profit organizations, government agencies, and certain educational institutions often qualify. Additionally, specific purchases related to manufacturing or agriculture may also be exempt. It is crucial for applicants to review the state guidelines to ensure they meet the necessary criteria before submitting the form.

Required Documents for the Tennessee Sales Tax Exemption Form

When applying for a Tennessee sales tax exemption, individuals or businesses may need to provide supporting documentation. This can include proof of tax-exempt status, such as a letter from the IRS confirming 501(c)(3) status for non-profits, or other relevant identification. It is advisable to check with the state tax authority for a complete list of required documents to ensure a smooth application process.

Legal Use of the Tennessee Sales Tax Exemption Form

The legal use of the Tennessee sales tax exemption form is governed by state tax laws. Proper completion and submission of this form are essential for maintaining compliance with tax regulations. Misuse of the form, such as using it for ineligible purchases, can result in penalties, including fines or back taxes owed. Therefore, it is important to understand the legal implications and ensure that the form is used correctly.

Quick guide on how to complete tax exempt form tn

Effortlessly Prepare Tax Exempt Form Tn on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Tax Exempt Form Tn on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to Alter and eSign Tax Exempt Form Tn with Ease

- Locate Tax Exempt Form Tn and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Exempt Form Tn to ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax exempt form tn

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form tn

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is a Tennessee sales tax exemption form?

A Tennessee sales tax exemption form is a legal document used by eligible organizations to claim exemptions from sales tax on purchases. This form is critical for nonprofits, educational institutions, and certain government agencies operating in Tennessee, allowing them to save on tax expenses while complying with state laws.

-

How can airSlate SignNow help me with the Tennessee sales tax exemption form?

airSlate SignNow simplifies the process of creating, signing, and managing your Tennessee sales tax exemption form. With our user-friendly interface, you can easily fill out the form, obtain necessary signatures, and securely store the document for future reference. This streamlining helps reduce paperwork and saves time.

-

Is airSlate SignNow cost-effective for managing tax exemption forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your Tennessee sales tax exemption form and other documents. Our pricing plans are designed to suit various business needs, ensuring that organizations of all sizes can benefit from our efficient eSigning and document management features without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing tax exemption forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRMs and document management tools. This means you can effortlessly integrate your workflow for handling the Tennessee sales tax exemption form with your existing systems, making the entire process more efficient.

-

What features does airSlate SignNow offer for handling the Tennessee sales tax exemption form?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage, specifically for the Tennessee sales tax exemption form. These features ensure that you have a comprehensive, organized, and secure way to manage all necessary documents for your tax exemption processes.

-

How do I ensure my Tennessee sales tax exemption form is compliant?

To ensure compliance when using the Tennessee sales tax exemption form, it’s essential to provide accurate information and complete all required fields. airSlate SignNow's platform offers guidance and templates that adhere to state regulations, helping you create compliant documents efficiently.

-

Is it easy to send the Tennessee sales tax exemption form for signatures?

Yes, sending the Tennessee sales tax exemption form for signatures is incredibly easy with airSlate SignNow. You can quickly enter the recipient's email and hit send, allowing multiple parties to sign digitally in a secure manner, reducing delays typically caused by traditional signing methods.

Get more for Tax Exempt Form Tn

Find out other Tax Exempt Form Tn

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form