University of Iowa N0003101 2015-2026

Understanding the Tennessee Sales Tax Exemption Certificate

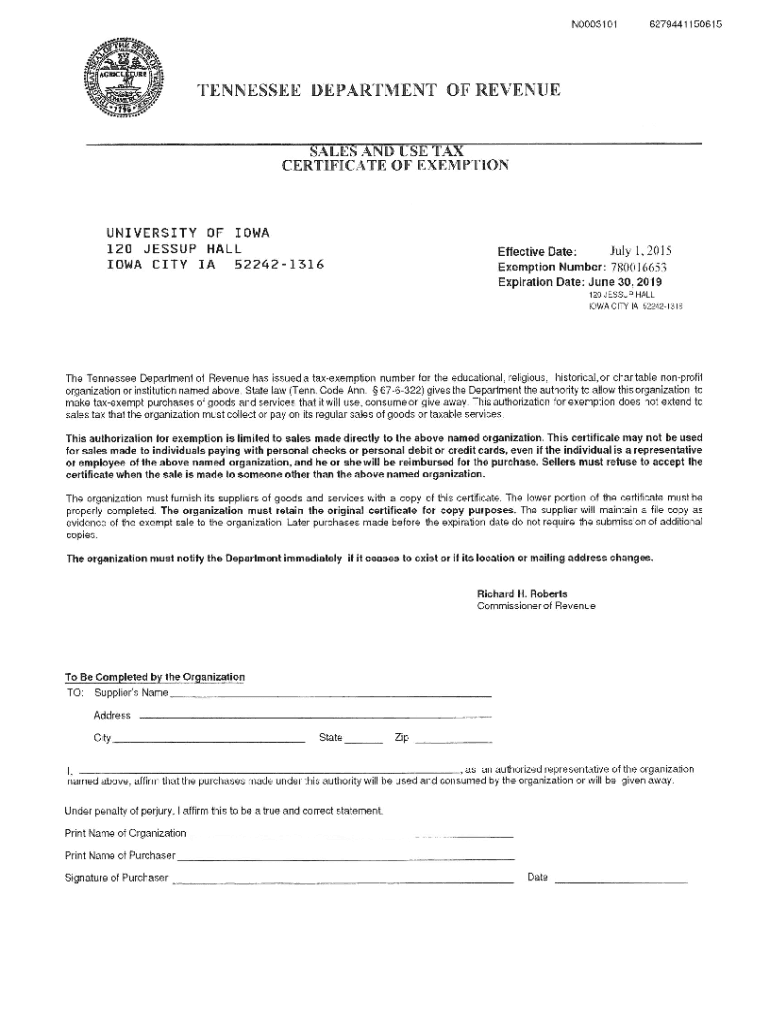

The Tennessee sales tax exemption certificate is a crucial document for businesses and individuals looking to make tax-exempt purchases in Tennessee. This certificate allows eligible buyers to avoid paying sales tax on qualifying purchases, which can lead to significant savings. It is essential to understand the legal framework surrounding this certificate to ensure compliance with state regulations.

The certificate is typically used by organizations that qualify as tax-exempt entities, such as non-profits, government agencies, and certain educational institutions. When making a purchase, the buyer presents this certificate to the seller, who must keep it on file for their records. This process helps maintain transparency and accountability in tax-exempt transactions.

Steps to Complete the Tennessee Sales Tax Exemption Form

Completing the Tennessee sales tax exemption form involves several straightforward steps. Begin by downloading the appropriate form, often referred to as the tax exempt form TN. Ensure you have the correct version for your specific needs, as there may be variations based on the type of exemption sought.

Next, fill in your organization's details, including the name, address, and tax identification number. Clearly indicate the reason for the exemption and provide any necessary supporting documentation. Once the form is completed, it should be signed by an authorized representative of the organization. This signature is vital for the form's validity.

Eligibility Criteria for the Tennessee Sales Tax Exemption

To qualify for a sales tax exemption in Tennessee, certain criteria must be met. Generally, organizations must be recognized as tax-exempt under federal law, such as 501(c)(3) status for non-profit organizations. Additionally, the purchases made with the exemption certificate must be directly related to the organization's exempt purpose.

It is important to note that not all purchases are eligible for exemption. For example, items purchased for personal use or for resale do not qualify. Understanding these criteria can help organizations avoid potential compliance issues and ensure that they are using the exemption certificate correctly.

Legal Use of the Tennessee Sales Tax Exemption Certificate

The legal use of the Tennessee sales tax exemption certificate requires adherence to specific guidelines set forth by the state. The certificate must be presented at the time of purchase, and sellers are responsible for keeping a copy on file to substantiate the tax-exempt sale in case of an audit.

Failure to comply with these regulations can lead to penalties, including the potential for the seller to be liable for the unpaid sales tax. Therefore, both buyers and sellers should understand their responsibilities regarding the use of the exemption certificate to ensure compliance with Tennessee tax laws.

Filing Deadlines and Important Dates

While the Tennessee sales tax exemption certificate itself does not have a specific filing deadline, it is important to be aware of related tax deadlines that may affect your organization. For instance, businesses must file their sales tax returns regularly, and any tax-exempt purchases should be documented appropriately during these filings.

Staying informed about important dates, such as the annual renewal of tax-exempt status for certain organizations, can help ensure that your organization remains compliant and avoids any disruptions in its tax-exempt purchasing capabilities.

Examples of Using the Tennessee Sales Tax Exemption Certificate

There are various scenarios in which the Tennessee sales tax exemption certificate can be used effectively. For instance, a non-profit organization purchasing supplies for an event can present the certificate to avoid sales tax on eligible items. Similarly, a government agency procuring equipment for public use can utilize the exemption to save on costs.

Understanding these examples can help organizations identify opportunities to leverage the sales tax exemption certificate, ultimately benefiting their financial operations and supporting their missions.

Quick guide on how to complete 2015 university of iowa n0003101

Complete University Of Iowa N0003101 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents rapidly without delays. Manage University Of Iowa N0003101 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign University Of Iowa N0003101 effortlessly

- Obtain University Of Iowa N0003101 and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Adjust and eSign University Of Iowa N0003101 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 university of iowa n0003101

Create this form in 5 minutes!

How to create an eSignature for the 2015 university of iowa n0003101

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What are the key changes to sales tax in Tennessee for 2024?

In 2024, businesses in Tennessee will see several key changes to the sales tax structure, including adjustments to rates and potential new exemptions. It's important to stay updated on these changes to ensure compliance and optimize your business operations. Using tools like airSlate SignNow can help streamline documentation related to sales tax in Tennessee 2024.

-

How can airSlate SignNow help manage sales tax documentation in Tennessee?

airSlate SignNow offers a user-friendly platform that simplifies the signing and management of necessary sales tax documents in Tennessee. With features like templates and automated workflows, you can efficiently handle all documentation related to sales tax in Tennessee 2024, ensuring accuracy and compliance.

-

What is the pricing structure of airSlate SignNow for businesses dealing with sales tax?

airSlate SignNow provides a flexible pricing structure designed to accommodate businesses of all sizes, especially those managing sales tax in Tennessee 2024. Our plans cater to different needs, ensuring that you can select a package that fits your budget and operational requirements while benefiting from our e-signature solutions.

-

Are there any features specific to sales tax management in airSlate SignNow?

Yes, airSlate SignNow includes features that specifically assist in sales tax management, such as document templates, audit trails, and compliance notifications. These tools are designed to help you navigate the complexities of sales tax in Tennessee 2024, making it easier to stay compliant and organized.

-

Can businesses integrate airSlate SignNow with their existing sales tax software?

Absolutely! airSlate SignNow offers seamless integrations with various sales tax software, making it easier for businesses to collaborate and manage documentation. This capability is particularly beneficial for users managing sales tax in Tennessee 2024, ensuring that all systems work in harmony.

-

What are the benefits of using airSlate SignNow for sales tax compliance?

Using airSlate SignNow for sales tax compliance provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Businesses can quickly send and manage necessary documents related to sales tax in Tennessee 2024, allowing for smoother operations and improved compliance.

-

How user-friendly is the airSlate SignNow platform for managing sales tax documents?

The airSlate SignNow platform is designed for ease of use, making it accessible even for those who may not be tech-savvy. With a simple interface, businesses can efficiently manage and eSign documents related to sales tax in Tennessee 2024, ensuring a smooth experience without the hassle.

Get more for University Of Iowa N0003101

- New york motor vehicle inspector form

- Registration information and authorization to register ohio simple 2012

- Bmv 3772 2007 form

- Vehicle title 2007 form

- Ohio bmv printable power of attorney 2004 form

- Obmv record request form 2009

- Driving affidavit 2012 form

- Speaker evaluation form speaker39s name salem state university salemstate

Find out other University Of Iowa N0003101

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation