FR 800Q Sales and Use Tax Quarterly Return Fill in Version Otr Cfo Dc Form

What is the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc

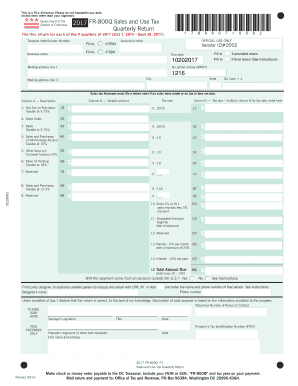

The FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc is a tax form used by businesses in Washington, D.C., to report sales and use tax collected during a specific quarter. This form is essential for compliance with local tax regulations and ensures that businesses accurately report their taxable sales and any use tax owed. The form is designed to be filled out electronically, streamlining the submission process and reducing errors associated with manual entry.

Steps to complete the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc

Completing the FR 800Q involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data for the reporting period, including total sales, exempt sales, and any deductions. Next, access the fillable version of the form, which allows for easy entry of information. Carefully input the required data into the designated fields, ensuring that all calculations are correct. Finally, review the completed form for any errors before submitting it electronically or printing it for mailing.

Legal use of the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc

The legal use of the FR 800Q form is governed by tax laws in Washington, D.C. To be considered valid, the form must be filled out accurately and submitted by the specified deadlines. Electronic submissions must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), ensuring that eSignatures are legally binding. Businesses must retain copies of submitted forms for their records, as they may be required for audits or inquiries from tax authorities.

Key elements of the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc

Key elements of the FR 800Q include sections for reporting total sales, exempt sales, and the total amount of sales and use tax due. The form also requires the business's identification information, such as the name, address, and tax identification number. Additionally, there are areas for deductions and credits that may apply, which can affect the total tax liability. Accurate completion of these elements is crucial for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the FR 800Q are typically set on a quarterly basis. Businesses must submit their returns by the last day of the month following the end of each quarter. For example, the deadline for the first quarter ending March 31 is April 30. It is essential for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The FR 800Q can be submitted through various methods to accommodate different preferences. Businesses can file electronically through the official tax portal, which allows for immediate processing and confirmation of submission. Alternatively, the form can be printed and mailed to the appropriate tax authority. In-person submissions may also be possible at designated tax offices, providing another option for those who prefer face-to-face interactions. Each method has its own advantages, so businesses should choose the one that best fits their needs.

Quick guide on how to complete 2017 fr 800q sales and use tax quarterly return fill in version otr cfo dc

Effortlessly prepare FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc with ease

- Obtain FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc and then click Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to share your document, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Edit and electronically sign FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2017 fr 800q sales and use tax quarterly return fill in version otr cfo dc

The best way to make an e-signature for a PDF in the online mode

The best way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to generate an e-signature straight from your smart phone

How to make an e-signature for a PDF on iOS devices

How to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc?

The FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc is a standardized tax form used by businesses to report sales and use taxes collected during a quarter. It simplifies the tax reporting process, ensuring compliance with local regulations and is available in a fill-in version for easy digital completion.

-

How can airSlate SignNow help with the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc?

airSlate SignNow provides a user-friendly platform that allows businesses to fill out, sign, and submit the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc electronically. The solution is designed to streamline document workflows, reduce errors, and enhance compliance, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the FR 800Q Sales And Use Tax Quarterly Return?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a subscription fee, the cost is justified by the ease of use, enhanced efficiency, and time saved when completing forms like the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc.

-

What features does airSlate SignNow provide for tax form management?

airSlate SignNow includes features such as customizable templates, electronic signatures, and the ability to manage multiple users. These features are particularly useful for managing the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc, providing businesses with a comprehensive tool to handle their tax documentation seamlessly.

-

Can I integrate airSlate SignNow with other accounting software for managing the FR 800Q Sales And Use Tax Quarterly Return?

Absolutely! airSlate SignNow can be integrated with a variety of accounting and financial software. This integration allows for smoother data transfer and management of the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc, reducing manual data entry and potential errors.

-

What are the benefits of using airSlate SignNow for the FR 800Q Sales And Use Tax Quarterly Return?

Using airSlate SignNow for the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc offers multiple benefits, including improved accuracy, quicker turnaround times, and enhanced compliance. The platform also allows users to track document status, ensuring that important tax forms are submitted on time.

-

How secure is my information when using airSlate SignNow for tax returns?

airSlate SignNow prioritizes security, implementing encryption and secure access controls to protect your data. When filling out the FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc, you can trust that your sensitive information is safeguarded against unauthorized access.

Get more for FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc

- Letter from tenant to landlord about sexual harassment wisconsin form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children wisconsin form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure wisconsin form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497430599 form

- Wisconsin tenant landlord 497430600 form

- Wi tenant landlord form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497430602 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497430603 form

Find out other FR 800Q Sales And Use Tax Quarterly Return Fill in Version Otr Cfo Dc

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement