Mytaxlawyer Orgfresh Start Program BoronOffer in Compromise Fresh Start Program in BoronTax Relief 2021-2026

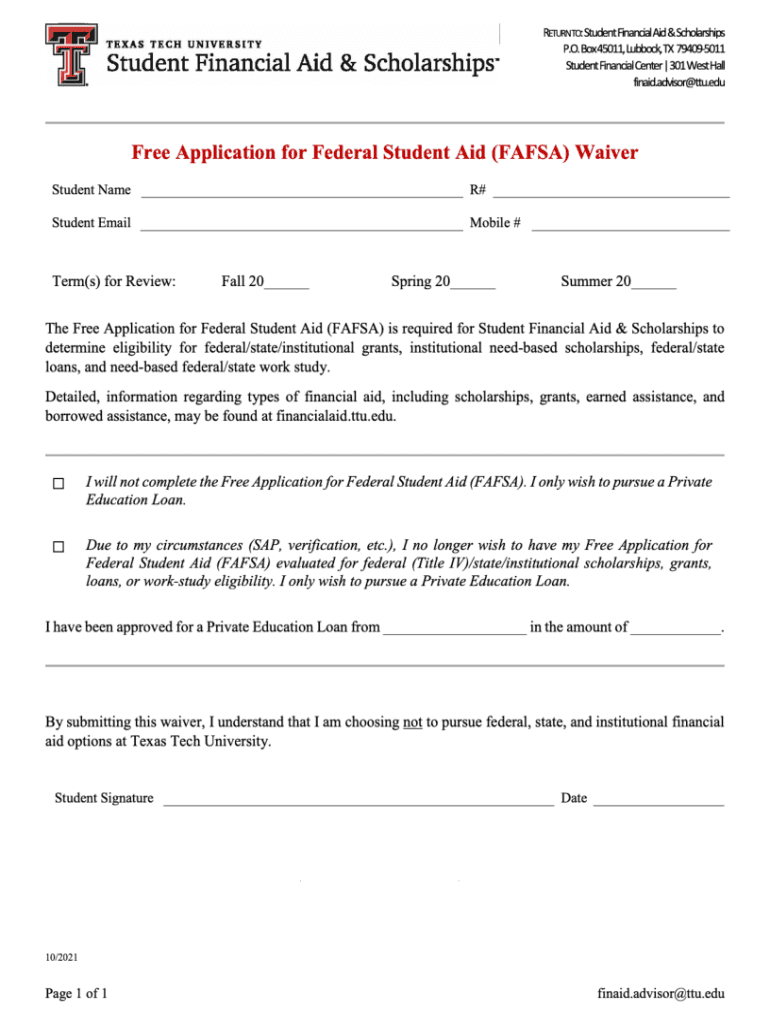

Understanding the FAFSA Waiver

The FAFSA waiver is a formal document that allows students to opt out of the Free Application for Federal Student Aid (FAFSA) process. This form is particularly relevant for students who may not require federal financial aid or who are ineligible for it. By submitting a FAFSA waiver, students can streamline their financial aid process, focusing instead on other funding opportunities that may be available to them. Understanding the implications of this waiver is crucial for students aiming to navigate their financial options effectively.

Eligibility Criteria for the FAFSA Waiver

To qualify for the FAFSA waiver, students must meet specific eligibility criteria. Generally, this includes being enrolled in an eligible program at an accredited institution and demonstrating that federal aid is not necessary for their educational expenses. Additionally, students may need to provide documentation that supports their decision to opt out, such as proof of alternative funding sources or personal circumstances that affect their financial situation.

Steps to Complete the FAFSA Waiver Form

Completing the FAFSA waiver form involves several key steps to ensure accuracy and compliance. First, students should gather necessary documentation, such as identification and any financial statements that support their waiver request. Next, they need to fill out the FAFSA waiver form accurately, providing all required information. Once completed, the form should be submitted to the appropriate financial aid office at their institution. It is advisable to keep a copy of the submitted form for personal records.

Submitting the FAFSA Waiver Online

Submitting the FAFSA waiver online offers a convenient and efficient way to manage the form. Many institutions provide an online portal where students can fill out and submit their waivers electronically. This method not only saves time but also ensures that the submission is received promptly. When submitting online, students should ensure that they receive a confirmation of their submission, which serves as proof that the waiver has been filed.

Implications of the FAFSA Waiver

Choosing to submit a FAFSA waiver can have significant implications for a student’s financial aid options. By opting out, students may miss out on federal aid opportunities, such as grants and low-interest loans. It is essential for students to weigh the benefits of alternative funding sources against the potential loss of federal support. Additionally, understanding how this decision affects their overall financial aid package is crucial for making informed choices about their education financing.

Resources for the FAFSA Waiver Process

Students navigating the FAFSA waiver process can benefit from various resources. Many educational institutions offer guidance through their financial aid offices, providing information on eligibility, documentation, and submission procedures. Additionally, online resources and forums can offer insights from other students who have successfully completed the waiver process. Utilizing these resources can help students make informed decisions and ensure a smooth experience with their financial aid journey.

Quick guide on how to complete mytaxlawyerorgfresh start program boronoffer in compromise fresh start program in borontax relief

Complete Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without delays. Handle Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-driven task today.

How to alter and eSign Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief effortlessly

- Find Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically developed by airSlate SignNow for those tasks.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mytaxlawyerorgfresh start program boronoffer in compromise fresh start program in borontax relief

Create this form in 5 minutes!

People also ask

-

What is the FAFSA opt out form Texas?

The FAFSA opt out form Texas allows students and parents to formally decline to share their FAFSA information with certain educational institutions. By completing this form, individuals can ensure their data is kept private, which is particularly important for students concerned about their personal information.

-

How can I access the FAFSA opt out form Texas?

You can easily access the FAFSA opt out form Texas through the Texas Higher Education Coordinating Board's website or by visiting airSlate SignNow. With our platform, you can conveniently fill out and eSign the form online, streamlining the process.

-

Is there a fee to use the FAFSA opt out form Texas service?

Using airSlate SignNow to manage your FAFSA opt out form Texas is cost-effective. We offer various pricing plans, including options for individual users and businesses, ensuring you have an affordable solution for eSigning and sending documents.

-

What are the benefits of using airSlate SignNow for the FAFSA opt out form Texas?

By using airSlate SignNow for your FAFSA opt out form Texas, you enjoy an easy-to-use interface, quick document preparation, and secure eSigning capabilities. Our platform simplifies the process, allowing you to focus on what matters most—your education.

-

Can I track the status of my FAFSA opt out form Texas submission?

Yes, with airSlate SignNow, you can track the status of your FAFSA opt out form Texas submission in real-time. Our document management features allow you to receive notifications once your form has been viewed, signed, or completed.

-

Does airSlate SignNow integrate with other educational platforms for FAFSA processes?

Absolutely! airSlate SignNow integrates seamlessly with various educational platforms to enhance your FAFSA submission process. This means you can easily manage the FAFSA opt out form Texas alongside other documents and applications.

-

What security features does airSlate SignNow provide for the FAFSA opt out form Texas?

When using airSlate SignNow for your FAFSA opt out form Texas, your data is protected with industry-standard encryption and secure servers. We prioritize the privacy of your information, ensuring that your documents are safe from unauthorized access.

Get more for Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief

- Identity theft recovery package west virginia form

- Aging parent package west virginia form

- Sale of a business package west virginia form

- Legal documents for the guardian of a minor package west virginia form

- New state resident package west virginia form

- Commercial property sales package west virginia form

- General partnership package west virginia form

- Statutory medical power of attorney and living will west virginia form

Find out other Mytaxlawyer orgfresh start program boronOffer In Compromise Fresh Start Program In BoronTax Relief

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast