Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio Form

Understanding the Ohio 2 Wage and Tax Statement

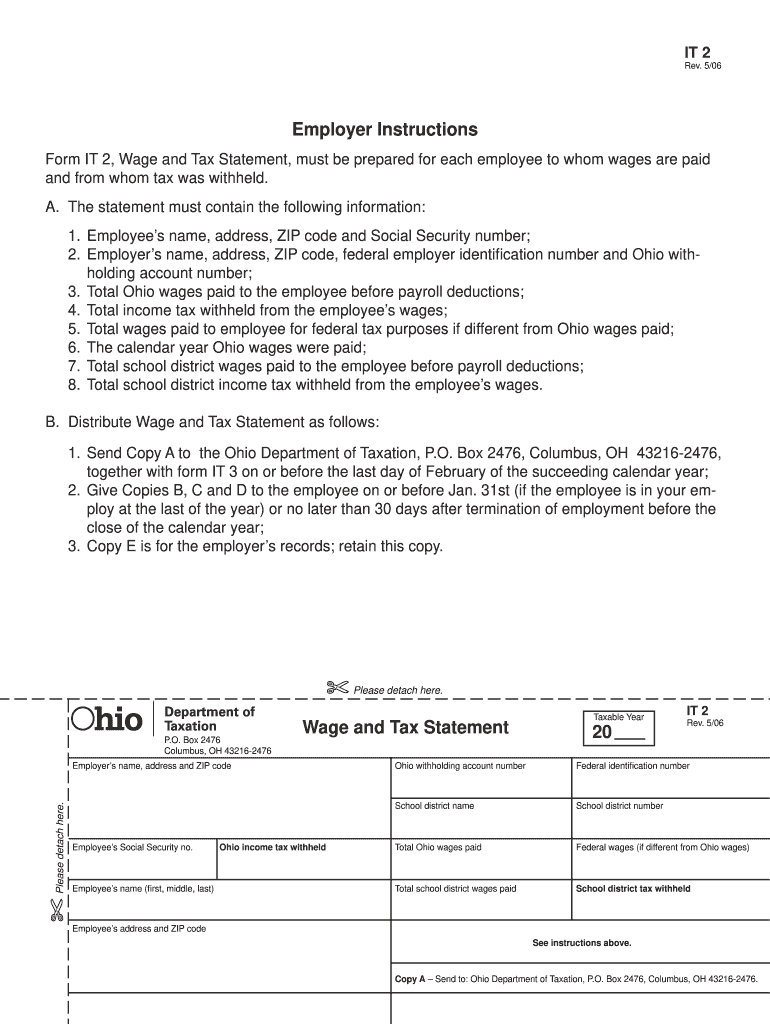

The Ohio 2 Wage and Tax Statement is a crucial document used by employers to report wages paid to employees and the taxes withheld from those wages. This form is essential for both employers and employees, as it provides a summary of earnings and tax contributions for the year. Employers must accurately complete this form to ensure compliance with state and federal tax regulations.

Key information included in the Ohio 2 form encompasses employee details, total wages, and tax withholdings. It serves as a record for employees to verify their income and tax contributions when filing their annual tax returns.

Steps to Complete the Ohio 2 Wage and Tax Statement

Completing the Ohio 2 form involves several important steps to ensure accuracy and compliance. Here is a concise guide to help you through the process:

- Gather necessary information: Collect employee details, including Social Security numbers, total wages, and tax withholding amounts.

- Fill out the form: Input the gathered information into the appropriate fields of the Ohio 2 form. Ensure accuracy to avoid discrepancies.

- Review for errors: Double-check all entries for accuracy, including names, numbers, and totals.

- Submit the form: File the completed Ohio 2 form with the appropriate tax authorities, either electronically or by mail, depending on your business's filing requirements.

Legal Use of the Ohio 2 Wage and Tax Statement

The Ohio 2 Wage and Tax Statement is legally binding and must be completed in accordance with state and federal regulations. Employers are required to provide this form to employees by the designated deadline, typically by January 31 of the following year. Failure to comply with these regulations can result in penalties for employers.

Additionally, the information reported on the Ohio 2 form is used by the state to verify tax contributions and ensure compliance with tax laws. Therefore, accurate reporting is essential for both legal and financial reasons.

Filing Deadlines for the Ohio 2 Wage and Tax Statement

Timely filing of the Ohio 2 form is crucial for compliance. Employers must submit this form by January 31 each year for the previous tax year. This deadline ensures that employees receive their wage statements in a timely manner, allowing them to prepare their tax returns accurately.

It is important for employers to keep track of these deadlines to avoid potential penalties and interest charges for late submissions. Staying organized and adhering to filing schedules can help maintain compliance with tax regulations.

Obtaining the Ohio 2 Wage and Tax Statement

Employers can obtain the Ohio 2 Wage and Tax Statement through various channels. The form is available online through state tax authority websites, where it can be downloaded and printed. Additionally, employers may use payroll software that includes the Ohio 2 form as part of their reporting features.

It is advisable to ensure that the most current version of the form is used, as tax regulations and forms may change from year to year. Regularly checking for updates can help maintain compliance and accuracy in reporting.

Examples of Using the Ohio 2 Wage and Tax Statement

The Ohio 2 form is utilized in various scenarios, including:

- Employers reporting wages for full-time employees.

- Businesses providing wage statements for part-time or seasonal workers.

- Employers using the form to report bonuses or other forms of compensation.

In each of these cases, the Ohio 2 form serves as an essential tool for accurate wage reporting and tax compliance, ensuring that both employers and employees fulfill their tax obligations.

Quick guide on how to complete wage and tax statement 20 employer instructions ohio tax ohio

Complete Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a flawless eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio effortlessly

- Locate Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit businesses in Ohio 2?

airSlate SignNow is an innovative solution for businesses in Ohio 2 looking to streamline document management. It allows users to send and electronically sign documents easily, thus improving efficiency. With its user-friendly interface and cost-effective pricing, businesses can save time and reduce operational costs.

-

How does airSlate SignNow pricing work for users in Ohio 2?

The pricing for airSlate SignNow is designed to be affordable for businesses in Ohio 2, offering various plans that cater to different needs. Users can choose from monthly or annual subscriptions based on their document signing volume. With competitive rates, it's a cost-effective solution for businesses of all sizes.

-

What are the key features of airSlate SignNow for Ohio 2 users?

airSlate SignNow offers several key features that are especially beneficial for users in Ohio 2. These include the ability to create templates for frequently used documents, automatic reminders for signers, and comprehensive tracking of document statuses. These features enhance efficiency and standardize document management practices.

-

Can airSlate SignNow integrate with other tools commonly used in Ohio 2?

Yes, airSlate SignNow seamlessly integrates with a variety of tools commonly used by businesses in Ohio 2, such as CRM systems, cloud storage, and project management applications. This integration capability ensures a smooth workflow, enabling users to manage their documents without disrupting existing processes.

-

Is airSlate SignNow compliant with eSignature laws in Ohio 2?

Absolutely, airSlate SignNow adheres to all relevant eSignature laws in Ohio 2, ensuring that your digitally signed documents are legally binding. This compliance provides peace of mind for businesses that need to ensure the authenticity and legality of their documents. Users can confidently use airSlate SignNow for their electronic signing needs.

-

What kind of customer support is available for users in Ohio 2?

For users in Ohio 2, airSlate SignNow offers robust customer support options including live chat, email assistance, and an extensive knowledge base. This support ensures that users can quickly get help with any issues they encounter while using the platform. The goal is to provide excellent service to facilitate a smooth user experience.

-

How can airSlate SignNow enhance collaboration for teams in Ohio 2?

airSlate SignNow enhances team collaboration for businesses in Ohio 2 by allowing multiple users to work on documents simultaneously and manage the signing process together. Features like shared templates and real-time updates promote teamwork and efficiency. This collaborative environment is vital for fast-paced business operations.

Get more for Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio

- Borough council taxi application form

- Westminster change of circumstances form

- Northern birth certificate application form

- Hm courts tribunals service form

- Diversity form

- Jury service expenses claim form pdf

- Northern ireland high court form

- Wwwnuhcomsgpatients visitorsdocumentsnuhs application for release of medical information form a

Find out other Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order