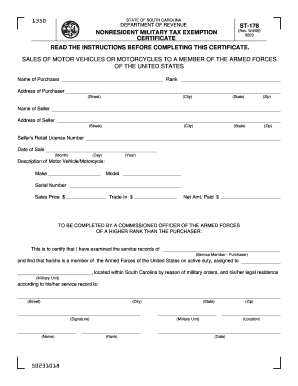

St 178 Form

What is the ST-178?

The ST-178 is a South Carolina tax exemption form used by businesses and individuals to claim certain tax exemptions. This form is particularly relevant for those who qualify for exemptions from sales and use taxes, such as nonprofit organizations and specific governmental entities. Understanding the purpose of the ST-178 is essential for ensuring compliance with state tax regulations while taking advantage of available exemptions.

How to Use the ST-178

To effectively use the ST-178, applicants must complete the form accurately, providing necessary information about the entity claiming the exemption. This includes the name, address, and type of organization. Once completed, the form should be submitted to the vendor from whom goods or services are being purchased. It is crucial to retain a copy of the form for your records, as it serves as proof of the exemption status during audits or inquiries by the South Carolina Department of Revenue.

Steps to Complete the ST-178

Completing the ST-178 involves several key steps:

- Gather necessary information about your organization, including its legal name and address.

- Indicate the specific exemption type being claimed on the form.

- Provide the vendor's information where the exemption will be applied.

- Sign and date the form to certify that the information provided is accurate.

After filling out the form, ensure it is delivered to the vendor before the purchase to ensure the exemption is honored.

Legal Use of the ST-178

The ST-178 must be used in accordance with South Carolina tax laws. It is legally binding when completed correctly and submitted to vendors. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties and fines. Therefore, it is essential to understand the specific criteria for exemption eligibility and ensure that all information provided is truthful and accurate.

Required Documents for the ST-178

When preparing to submit the ST-178, certain documents may be required to support your claim. These can include:

- Proof of nonprofit status, if applicable.

- Documentation that verifies the organization's purpose for claiming the exemption.

- Any additional forms or certifications that the vendor may require.

Having these documents ready can help facilitate a smoother process when claiming tax exemptions.

Filing Deadlines / Important Dates

While the ST-178 itself does not have a specific filing deadline, it is important to submit it at the time of purchase to ensure the exemption is applied. Keeping track of any changes in tax laws or deadlines related to tax exemption claims is crucial for compliance. Regularly checking with the South Carolina Department of Revenue can provide updates on important dates and any changes to the exemption process.

Quick guide on how to complete st 178

Complete St 178 seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-conscious substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle St 178 on any device with airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to modify and eSign St 178 effortlessly

- Locate St 178 and click on Obtain Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finalize button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign St 178 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the South Carolina DOR tax and why is it important?

The South Carolina DOR tax refers to the taxes administered by the South Carolina Department of Revenue. Understanding this tax is crucial for businesses operating in South Carolina to ensure compliance and avoid penalties. Efficient handling of tax documents is essential, and that's where airSlate SignNow can help streamline the process.

-

How can airSlate SignNow assist with South Carolina DOR tax documentation?

airSlate SignNow provides an easy-to-use platform for sending and electronically signing tax documents related to the South Carolina DOR tax. With features like secure storage and fast retrieval, you can manage your tax documents efficiently. This ensures you stay organized and compliant with state regulations.

-

What are the pricing options for using airSlate SignNow for South Carolina DOR tax documents?

airSlate SignNow offers various pricing plans that cater to the diverse needs of businesses dealing with South Carolina DOR tax documentation. Whether you are a small business or a larger enterprise, there’s a plan that can fit your budget. The cost-effectiveness of our solutions helps you save time and money.

-

Are there any key features of airSlate SignNow that support South Carolina DOR tax compliance?

Yes, airSlate SignNow offers features such as automated workflows, templates, and real-time tracking that are essential for managing South Carolina DOR tax-related documents. These features ensure that you can easily collaborate with your team and maintain compliance with tax regulations. Enhanced security measures also protect sensitive tax data.

-

Can airSlate SignNow integrate with accounting software for South Carolina DOR tax management?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage South Carolina DOR tax documents alongside your financial records. This integration helps in maintaining accuracy and ensures that all tax-related documents are readily accessible. Take advantage of our robust API for more flexibility.

-

How does eSigning with airSlate SignNow simplify the South Carolina DOR tax filing process?

eSigning with airSlate SignNow simplifies the South Carolina DOR tax filing process by eliminating the need for physical signatures and paper documents. This not only speeds up the filing process but also reduces the chances of mistakes. With our user-friendly interface, you can complete required filings quickly and efficiently.

-

What benefits does airSlate SignNow provide for businesses dealing with the South Carolina DOR tax?

Using airSlate SignNow offers several benefits for businesses dealing with the South Carolina DOR tax, such as increased efficiency, reduced paperwork, and enhanced compliance. Automating signature processes saves time, allowing your team to focus on other critical tasks. Moreover, our solution is designed to make tax management straightforward and stress-free.

Get more for St 178

- National honor society volunteer hours form 2021

- Nursing past papers pdf form

- Nlc application form

- Earn rs 10 000 per day without investment form

- State form 55018fill out and use this pdf

- Tx unps school nutrition programs claims form sites duke sites duke

- Sco clc pbt 21 4 consent to change name consent to change name form

- Dv 125 request for service of protective order douments one petitioner form

Find out other St 178

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile