Delaware Form W3 9801 2017

What is the Delaware Form W-3 9801

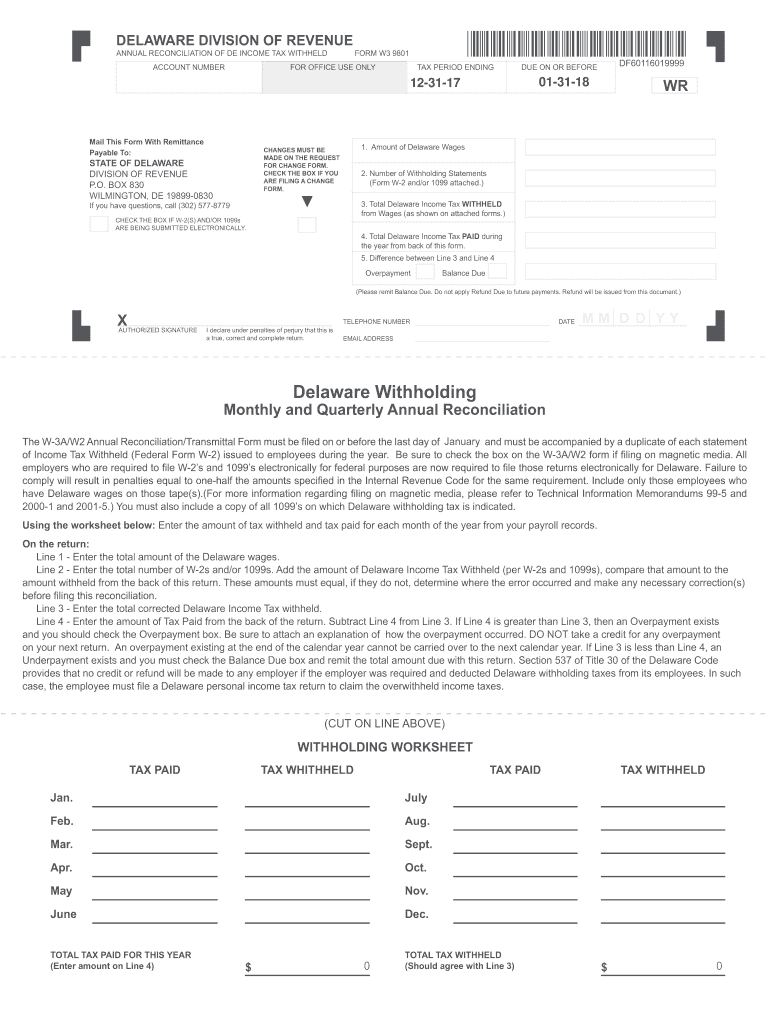

The Delaware Form W-3 9801 is a crucial document used for the annual reconciliation of income tax withheld from employees in the state of Delaware. This form is essential for employers to report the total amount of state income tax withheld during the year. It serves as a summary of the information reported on individual W-2 forms submitted by employers for their employees. The Delaware Division of Revenue requires this form to ensure accurate tax collection and compliance with state tax laws.

How to use the Delaware Form W-3 9801

Using the Delaware Form W-3 9801 involves several key steps. First, employers must gather all W-2 forms issued to employees for the tax year. Next, they need to calculate the total amount of state income tax withheld from these forms. Once the totals are compiled, employers can fill out the W-3 9801, ensuring that all information matches the data reported on the W-2 forms. After completing the form, it must be submitted to the Delaware Division of Revenue, either electronically or by mail, depending on the employer's preference.

Steps to complete the Delaware Form W-3 9801

Completing the Delaware Form W-3 9801 requires careful attention to detail. Follow these steps:

- Collect all W-2 forms issued to employees for the year.

- Calculate the total state income tax withheld from all W-2 forms.

- Fill out the W-3 9801 form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form to the Delaware Division of Revenue by the specified deadline.

Filing Deadlines / Important Dates

It is essential for employers to be aware of the filing deadlines associated with the Delaware Form W-3 9801. Typically, the form must be submitted by January 31 of the following year after the tax year ends. Employers should also keep in mind that any associated payments for withheld taxes are due at the same time. Staying informed about these deadlines helps avoid penalties and ensures compliance with state tax regulations.

Legal use of the Delaware Form W-3 9801

The Delaware Form W-3 9801 has legal significance as it serves as an official record of tax withholding for employees. Employers are required by law to file this form accurately and on time to avoid potential penalties. The form must be filled out in accordance with the guidelines set forth by the Delaware Division of Revenue. Failure to comply with these requirements can result in legal consequences, including fines and increased scrutiny from tax authorities.

Key elements of the Delaware Form W-3 9801

Several key elements must be included when completing the Delaware Form W-3 9801. These include:

- The employer's name, address, and federal employer identification number (FEIN).

- The total number of W-2 forms submitted.

- The total amount of state income tax withheld.

- Signature of the employer or authorized representative.

Ensuring that all these elements are accurately reported is crucial for the validity of the form.

Quick guide on how to complete 2011 delaware annual reconciliation 2017 2019 form

Your assistance manual on how to prepare your Delaware Form W3 9801

If you’re pondering how to generate and dispatch your Delaware Form W3 9801, here are a few brief guidelines to simplify the process of tax submission.

To commence, you only need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, produce, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Delaware Form W3 9801 in just a few minutes:

- Create your account and begin working on PDFs in minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Delaware Form W3 9801 in our editor.

- Enter the required fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and delayed refunds. Additionally, before e-filing your taxes, check the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2011 delaware annual reconciliation 2017 2019 form

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the 2011 delaware annual reconciliation 2017 2019 form

How to create an eSignature for your 2011 Delaware Annual Reconciliation 2017 2019 Form in the online mode

How to generate an electronic signature for the 2011 Delaware Annual Reconciliation 2017 2019 Form in Google Chrome

How to make an electronic signature for signing the 2011 Delaware Annual Reconciliation 2017 2019 Form in Gmail

How to make an eSignature for the 2011 Delaware Annual Reconciliation 2017 2019 Form straight from your mobile device

How to make an eSignature for the 2011 Delaware Annual Reconciliation 2017 2019 Form on iOS devices

How to generate an eSignature for the 2011 Delaware Annual Reconciliation 2017 2019 Form on Android devices

People also ask

-

What is the Delaware Form W-3 for 2018?

The Delaware Form W-3 for 2018 is a summary of all W-2 forms submitted by employers to report income and withheld taxes for employees in the state. It consolidates the wage and tax information for easy submission to the Delaware Department of Revenue. Using airSlate SignNow can help you manage and eSign this form seamlessly.

-

How can airSlate SignNow help with filing the Delaware Form W-3 for 2018?

airSlate SignNow provides a streamlined solution for sending and eSigning the Delaware Form W-3 for 2018. With its user-friendly interface, you can easily fill out, sign, and submit the necessary documents without hassle, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for Delaware Form W-3 for 2018?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Depending on your requirements for features like document management and storage, you can choose a plan that best fits your budget while simplifying the process for the Delaware Form W-3 for 2018.

-

What are the key features of airSlate SignNow for managing the Delaware Form W-3 for 2018?

Key features of airSlate SignNow include eSignature capabilities, document tracking, and cloud storage. These tools help ensure that your Delaware Form W-3 for 2018 is processed swiftly and securely, allowing you to focus on your business operations.

-

Can I integrate airSlate SignNow with other software for filing the Delaware Form W-3 for 2018?

Absolutely! airSlate SignNow integrates with various accounting and payroll software systems, making it easier to manage the Delaware Form W-3 for 2018. These integrations help streamline the data transfer process, enhancing accuracy and saving time.

-

What benefits does airSlate SignNow offer for eSigning the Delaware Form W-3 for 2018?

Using airSlate SignNow to eSign the Delaware Form W-3 for 2018 offers numerous benefits, including increased efficiency and reduced turnaround time. The platform enables multiple signers, secure storage of signed documents, and easy access from any device.

-

Is it easy to create the Delaware Form W-3 for 2018 using airSlate SignNow?

Yes, creating the Delaware Form W-3 for 2018 with airSlate SignNow is straightforward. The platform provides templates and customizable fields, allowing you to input necessary information efficiently and ensuring you submit a complete form.

Get more for Delaware Form W3 9801

- Temporary liquor permit ct form

- Physical therapy order template form

- Top of the rock 3 on 3 basketball tournament form

- Age height weight name are example of form

- A study on job satisfaction of bank employees form

- Oklahoma notary discount association form

- Lawyer contract template form

- Layaway contract template 787752522 form

Find out other Delaware Form W3 9801

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer