Dc Commercial Income Expense Tax Year Form 308c 2019-2026

What is the DC Commercial Income Expense Tax Year Form 308c

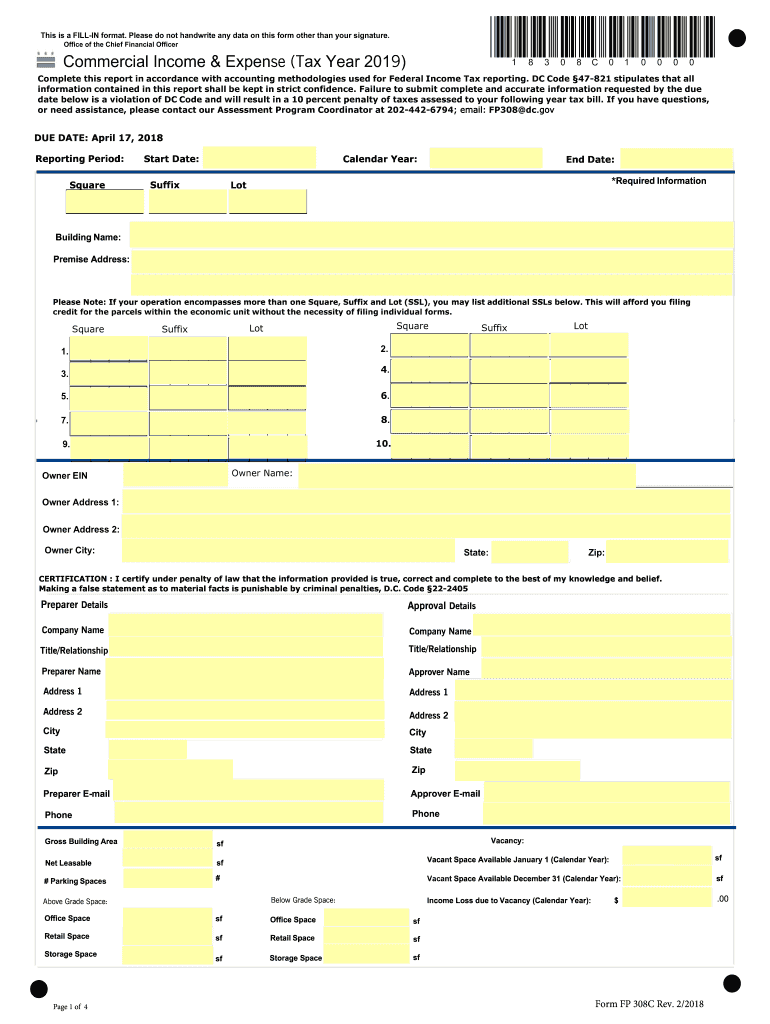

The DC Commercial Income Expense Tax Year Form 308c is a crucial document required for businesses operating in Washington, D.C. This form is specifically designed for commercial entities to report their income and expenses for a given tax year. It plays a vital role in determining the taxable income of the business, ensuring compliance with local tax laws.

The form captures various financial details, including gross receipts, allowable deductions, and net income. By accurately completing this form, businesses can fulfill their tax obligations and avoid potential penalties. Understanding the purpose and requirements of the DC Commercial Income Expense Tax Year Form 308c is essential for any business operating in the district.

Steps to Complete the DC Commercial Income Expense Tax Year Form 308c

Completing the DC Commercial Income Expense Tax Year Form 308c involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide to assist you:

- Gather Financial Records: Collect all necessary documents, including income statements, receipts, and expense reports.

- Fill Out Basic Information: Enter your business name, address, and tax identification number at the top of the form.

- Report Income: List all sources of income, including sales and other revenue streams, in the designated sections.

- Detail Expenses: Provide a comprehensive account of all business expenses, ensuring to categorize them appropriately.

- Calculate Net Income: Subtract total expenses from total income to determine your net income for the tax year.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

Following these steps will help ensure that your form is completed correctly, minimizing the risk of errors that could lead to complications with the DC Office of Tax and Revenue.

How to Obtain the DC Commercial Income Expense Tax Year Form 308c

Obtaining the DC Commercial Income Expense Tax Year Form 308c is a straightforward process. The form can be accessed through the DC Office of Tax and Revenue's official website. Here are the steps to acquire the form:

- Visit the Official Website: Navigate to the DC Office of Tax and Revenue website.

- Locate the Forms Section: Look for the section dedicated to business tax forms.

- Download the Form: Find the DC Commercial Income Expense Tax Year Form 308c and download it in PDF format.

Alternatively, businesses can request a physical copy by contacting the DC Office of Tax and Revenue directly. Ensuring you have the correct version of the form is essential for compliance with current tax regulations.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for businesses submitting the DC Commercial Income Expense Tax Year Form 308c. The following dates are important to keep in mind:

- Annual Filing Deadline: Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year.

- Extensions: Businesses may apply for an extension, but they must still estimate and pay any taxes owed by the original deadline to avoid penalties.

- Payment Deadlines: Ensure that any taxes due are paid by the filing deadline to prevent interest and penalties.

Staying informed about these deadlines helps ensure timely compliance and avoids unnecessary fees.

Key Elements of the DC Commercial Income Expense Tax Year Form 308c

Understanding the key elements of the DC Commercial Income Expense Tax Year Form 308c is essential for accurate completion. The form includes several critical sections:

- Business Information: This section requires the business name, address, and tax identification number.

- Income Reporting: Businesses must detail all sources of income, including sales and other revenue.

- Expense Categories: The form provides specific categories for expenses, such as operating costs, wages, and rent.

- Net Income Calculation: A section for calculating net income by subtracting total expenses from total income.

Familiarity with these elements ensures that businesses can accurately report their financial information and comply with tax regulations.

Legal Use of the DC Commercial Income Expense Tax Year Form 308c

The legal use of the DC Commercial Income Expense Tax Year Form 308c is governed by local tax laws and regulations. This form must be completed accurately and submitted on time to fulfill legal obligations. Failure to do so can result in penalties, including fines or interest on unpaid taxes.

Additionally, businesses should retain copies of the completed form and all supporting documents for at least three years, as the DC Office of Tax and Revenue may request these during audits or reviews. Understanding the legal implications of submitting this form is essential for maintaining compliance and protecting your business's interests.

Quick guide on how to complete 2017 d 2440 fill in otr office of tax and revenue dcgov

Your assistance manual on preparing your Dc Commercial Income Expense Tax Year Form 308c

If you are curious about how to finalize and submit your Dc Commercial Income Expense Tax Year Form 308c, here are some concise tips to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow profile to enhance the way you manage documents online. airSlate SignNow is an extremely intuitive and effective document platform that enables you to edit, generate, and finalize your tax documents with ease. With its editing tools, you can navigate between text, checkboxes, and electronic signatures and revisit to adjust answers as necessary. Optimize your tax handling with advanced PDF modifications, electronic signing, and straightforward sharing.

Follow the instructions below to finish your Dc Commercial Income Expense Tax Year Form 308c in just minutes:

- Establish your account and start processing PDFs within no time.

- Utilize our directory to obtain any IRS tax document; explore different versions and schedules.

- Click Get form to access your Dc Commercial Income Expense Tax Year Form 308c in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding electronic signature (if necessary).

- Review your file and correct any errors.

- Save changes, print your document, send it to your recipient, and download it to your device.

Reference this manual to submit your taxes electronically using airSlate SignNow. Please be aware that paper filing can lead to increased return errors and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 d 2440 fill in otr office of tax and revenue dcgov

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Do I have to fill out a form if I want to take admission in any of the colleges of Haryana through the NEET 2017? I am from Delhi and have the Delhi quota.

If you’ve got a good score in NEET, you can try to get a Haryana college through All India Counselling. If you have Haryana Domicile then you can also apply through Haryana State counselling. But since you’ve mentioned that you’re from Delhi, I presume you don’t have Haryana Domicile. So your only way of getting a Haryana college is through All India Counselling. And obviously this answer is only for Govt. Colleges.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

Create this form in 5 minutes!

How to create an eSignature for the 2017 d 2440 fill in otr office of tax and revenue dcgov

How to make an electronic signature for your 2017 D 2440 Fill In Otr Office Of Tax And Revenue Dcgov in the online mode

How to create an electronic signature for your 2017 D 2440 Fill In Otr Office Of Tax And Revenue Dcgov in Google Chrome

How to generate an electronic signature for putting it on the 2017 D 2440 Fill In Otr Office Of Tax And Revenue Dcgov in Gmail

How to create an electronic signature for the 2017 D 2440 Fill In Otr Office Of Tax And Revenue Dcgov straight from your smart phone

How to generate an electronic signature for the 2017 D 2440 Fill In Otr Office Of Tax And Revenue Dcgov on iOS

How to make an eSignature for the 2017 D 2440 Fill In Otr Office Of Tax And Revenue Dcgov on Android

People also ask

-

What is a DC income and expense report?

A DC income and expense report is a financial document that outlines the revenue and expenditures of a business operating in Washington, D.C. This report is essential for monitoring financial performance, making informed decisions, and ensuring compliance with local regulations. Utilizing airSlate SignNow can streamline the process of creating and signing these reports.

-

How can airSlate SignNow help with my DC income and expense report?

airSlate SignNow provides an efficient platform for preparing, sending, and eSigning your DC income and expense reports. With its user-friendly interface, you can easily customize templates, collaborate with team members, and securely store your documents online. This ultimately saves time and enhances accuracy in your financial reporting.

-

What features does airSlate SignNow offer for DC income and expense reports?

Key features of airSlate SignNow for DC income and expense reports include customizable templates, automated workflows, secure eSignature capabilities, and cloud-based storage. These features simplify the document management process, allowing you to focus on analyzing your financial data instead of getting bogged down by paperwork.

-

Is airSlate SignNow cost-effective for managing DC income and expense reports?

Yes, airSlate SignNow offers a cost-effective solution for managing your DC income and expense reports. With flexible pricing plans tailored to different business sizes and needs, you can choose the most suitable option without overspending. This affordability makes it a great choice for small businesses and freelancers alike.

-

Can I integrate airSlate SignNow with other financial tools for my DC income and expense report?

Absolutely! airSlate SignNow supports integrations with various accounting and financial tools, enhancing your ability to manage your DC income and expense reports. By connecting it with platforms like QuickBooks or Xero, you can sync financial data seamlessly, minimizing manual data entry and errors.

-

What are the benefits of eSigning DC income and expense reports?

eSigning DC income and expense reports offers numerous benefits, including speed, security, and convenience. With airSlate SignNow, you can complete the signing process remotely, reducing turnaround times and ensuring that documents are legally binding. This feature is invaluable for busy professionals needing efficient document processing.

-

Is it easy to track changes in my DC income and expense report using airSlate SignNow?

Yes, airSlate SignNow makes it easy to track changes in your DC income and expense reports. The platform provides audit trails and version history, allowing you to see who made changes and when. This transparency is crucial for maintaining accurate financial records.

Get more for Dc Commercial Income Expense Tax Year Form 308c

- Form 05 portfolio overview sheet cengage learning

- Ontario superior court of justice plaintiffs claim cour form

- Bowling fundraiser pledge sheet form

- Completed tm3 form

- American analytical laboratories llc form

- Lawn service contract template form

- Lawncare contract template form

- Lawn service lawn care contract template form

Find out other Dc Commercial Income Expense Tax Year Form 308c

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe