Tax Excemption Forms

What is the Tax Excemption Form?

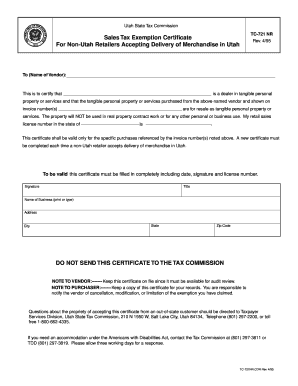

The tax excemption form is a document used by individuals or businesses to apply for a reduction or exemption from certain taxes. This form is essential for taxpayers seeking to clarify their tax obligations and ensure compliance with local, state, or federal regulations. Various types of tax excemption forms exist, including those for property taxes, sales taxes, and income taxes, each tailored to specific circumstances and eligibility criteria.

Steps to Complete the Tax Excemption Form

Completing the tax excemption form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your claim for exemption, such as proof of income, property ownership, or disability status. Next, carefully fill out the form, providing all required information, including personal details and specific reasons for the exemption. After completing the form, review it for any errors or omissions. Finally, submit the form according to your local guidelines, whether online, by mail, or in person.

Eligibility Criteria

Eligibility for a tax excemption varies based on the type of exemption sought. Common criteria include age, income level, disability status, and the nature of the property or business. For example, many states offer property tax exemptions for senior citizens or disabled individuals. It is important to review the specific requirements for the exemption you are applying for to ensure you meet all necessary qualifications.

Legal Use of the Tax Excemption Form

The legal use of the tax excemption form is governed by various regulations at the federal, state, and local levels. To be considered valid, the form must be completed accurately and submitted within the designated timeframe. Additionally, the information provided must be truthful and supported by appropriate documentation. Failure to comply with these legal requirements can result in penalties, including denial of the exemption or further legal action.

Required Documents

When applying for a tax excemption, specific documents may be required to substantiate your claim. Commonly required documents include proof of income, identification, property deeds, and any relevant medical documentation for disability claims. It is advisable to check the specific requirements for your state or locality to ensure you provide all necessary paperwork with your application.

Form Submission Methods

Tax excemption forms can typically be submitted through various methods, including online submissions, mail, or in-person delivery. The preferred method may vary by jurisdiction, so it is important to verify the submission guidelines for your specific form. Online submissions often provide quicker processing times, while mailing the form may require additional time for delivery and handling.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for various tax excemption forms, particularly those related to federal taxes. These guidelines outline the eligibility criteria, required documentation, and submission procedures. Understanding these guidelines is crucial for ensuring compliance and maximizing the potential for tax savings. It is recommended to consult the IRS website or a tax professional for detailed information on federal tax excemptions.

Quick guide on how to complete tax excemption forms

Complete Tax Excemption Forms effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Tax Excemption Forms on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and electronically sign Tax Excemption Forms with ease

- Locate Tax Excemption Forms and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Tax Excemption Forms and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is excemption in relation to eSigning documents?

Excemption refers to the circumstances under which certain documents may be exempted from standard eSigning processes. With airSlate SignNow, you can easily identify and manage excemptions to ensure compliance with legal and regulatory requirements, making your document management more efficient.

-

How does airSlate SignNow handle excemptions in electronic signatures?

airSlate SignNow provides features that allow users to set up custom workflows for handling excemptions in electronic signatures. This means that if certain documents require special handling, our platform enables a streamlined process to ensure proper oversight and compliance.

-

Are there any costs associated with managing excemptions in airSlate SignNow?

There are no additional costs for managing excemptions in our eSigning platform. Our pricing plans cover all the necessary features to manage and process excemptions, providing you with a cost-effective solution without hidden fees.

-

What are the benefits of using airSlate SignNow for excemptions?

Using airSlate SignNow for managing excemptions comes with numerous benefits, including enhanced workflow efficiency and improved compliance. Our solution minimizes the risk of oversight, ensuring that your team is always informed about which documents require special treatment.

-

Can airSlate SignNow integrate with other tools for handling excemptions?

Yes, airSlate SignNow seamlessly integrates with various applications and systems to effectively manage excemptions. This allows you to leverage existing tools you may already use while enhancing your eSignature process.

-

How secure is airSlate SignNow when dealing with excemptions?

Security is a top priority at airSlate SignNow, particularly when handling excemptions. Our platform employs advanced encryption and security protocols to ensure that all documents, including those under excemption, are protected from unauthorized access.

-

Can I customize my excemption workflows in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your workflows to efficiently handle excemptions based on your organizational needs. You can set specific rules and triggers to optimize your document management process.

Get more for Tax Excemption Forms

- Members of the clergyinternal revenue service irs tax forms

- 56 f notice concerning fiduciary relationship irs tax forms

- Publication 1693 rev 10 2022 social security administrationinternal revenue service ssairs reporter form

- Afdcenergygovlaws319alternative fuel excise tax credit energy form

- 2021 trcf 1000 tax form r1 pocono mountain school district

- How to transfer your car title in missourihow to transfer your car title in missourimissouri dor forms renewals power of

- Hometreasurygovtic slt form and instructionstic slt form and instructionsus department of the treasury

- Electronic tax administration advisory committee releases annual report form

Find out other Tax Excemption Forms

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word