Tax Years Affected If Known 2017-2026

Understanding the Tax Years Affected if Known

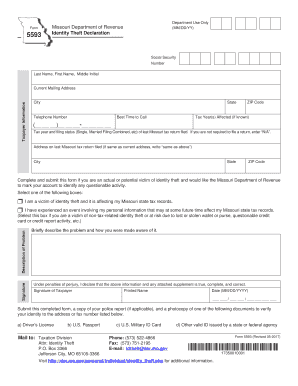

The Tax Years Affected if Known form is essential for taxpayers who need to specify which tax years are relevant to their claims or amendments. This form is particularly useful when addressing issues such as revenue theft or discrepancies in tax filings. By clearly identifying the affected years, taxpayers can streamline the resolution process with the IRS or state tax authorities. It is crucial to ensure that all relevant years are accurately reported to avoid complications in tax assessments or refunds.

Steps to Complete the Tax Years Affected if Known

Completing the Tax Years Affected if Known form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your tax filings for the years in question. This includes previous tax returns, any correspondence with tax authorities, and records of income or deductions. Next, fill out the form by clearly indicating each affected tax year. Be thorough in providing any additional information that may support your claim. Finally, review the completed form for accuracy before submission.

Legal Use of the Tax Years Affected if Known

The legal use of the Tax Years Affected if Known form is governed by both state and federal tax regulations. This form serves as a formal declaration to tax authorities regarding specific years that may require review or adjustment. It is important to understand that submitting this form does not automatically guarantee a favorable outcome; it must be supported by valid claims and documentation. Adhering to legal guidelines ensures that your submission is recognized and processed appropriately.

Required Documents for the Tax Years Affected if Known

To successfully complete the Tax Years Affected if Known form, certain documents are required. These typically include:

- Copies of tax returns for the affected years.

- Correspondence with the IRS or state tax agencies.

- Documentation of income, such as W-2s or 1099s.

- Records of any deductions or credits claimed.

Having these documents on hand will facilitate the completion of the form and support your claims effectively.

State-Specific Rules for the Tax Years Affected if Known

Each state may have its own regulations regarding the Tax Years Affected if Known form. It is essential to familiarize yourself with Missouri's specific rules and guidelines to ensure compliance. This may include deadlines for submission, additional documentation requirements, and procedures for addressing disputes related to revenue theft. Understanding these nuances can help taxpayers navigate the complexities of state tax law more effectively.

Filing Deadlines and Important Dates

Filing deadlines for the Tax Years Affected if Known form can vary based on the specific circumstances of the taxpayer. It is crucial to be aware of the relevant deadlines to avoid penalties or delays in processing. Generally, forms should be submitted as soon as the affected tax years are identified. Keeping track of important dates, such as the end of the tax year or deadlines for amendments, will help ensure timely compliance with tax regulations.

Quick guide on how to complete tax years affected if known

Finish Tax Years Affected if Known effortlessly on any gadget

Managing documents online has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Tax Years Affected if Known on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Tax Years Affected if Known with ease

- Locate Tax Years Affected if Known and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Years Affected if Known and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax years affected if known

Create this form in 5 minutes!

People also ask

-

What is Missouri identity verification and how does it relate to airSlate SignNow?

Missouri identity verification is the process of confirming a person's identity in compliance with local regulations. airSlate SignNow incorporates Missouri identity standards to ensure that all eSignatures are valid and legally binding. This feature is essential for businesses in Missouri that require secure and compliant document signing.

-

How does airSlate SignNow enhance the eSigning experience for Missouri residents?

airSlate SignNow provides an intuitive platform for Missouri residents to easily eSign documents from anywhere. With our robust features, users can complete transactions quickly while maintaining compliance with Missouri identity verification requirements. This streamlines the signing process and enhances efficiency for both individuals and businesses.

-

What pricing plans are available for airSlate SignNow in Missouri?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs in Missouri. Our plans provide excellent value while adhering to Missouri identity standards, including essential features like document templates and integrations. You can choose a plan that best fits your requirements and budget.

-

Can airSlate SignNow integrate with other tools used in Missouri businesses?

Yes, airSlate SignNow seamlessly integrates with popular business applications commonly used in Missouri. These integrations enable users to enhance their workflows while ensuring that Missouri identity verification remains intact. Our platform supports integration with CRMs, document management systems, and more.

-

What security measures does airSlate SignNow implement to protect Missouri identity information?

airSlate SignNow takes the security of your Missouri identity information very seriously. We implement robust encryption and adhere to compliance standards to protect all eSigned documents and stored data. This ensures that your identity information remains confidential and secure throughout the signing process.

-

Are eSignatures created with airSlate SignNow valid for legal use in Missouri?

Yes, eSignatures created with airSlate SignNow are legally binding and fully compliant with Missouri laws. Our platform supports Missouri identity verification to ensure the authenticity and integrity of all signed documents. This gives users confidence that their agreements are enforceable in court.

-

What are the key benefits of using airSlate SignNow for Missouri identity management?

Using airSlate SignNow for Missouri identity management offers key benefits such as streamlined document signing and enhanced compliance. The platform simplifies the eSignature process while ensuring that all Missouri identity verification requirements are met. This leads to improved productivity and reduced turnaround times for document transactions.

Get more for Tax Years Affected if Known

- Transfer on death quitclaim deed from individual to individual with alternate beneficiary washington form

- Transfer on death quitclaim deed from individual to individual without provision for successor beneficiary washington form

- Wa appeal form

- Quitclaim deed from corporation to husband and wife washington form

- Warranty deed from corporation to husband and wife washington form

- Quitclaim deed from corporation to individual washington form

- Warranty deed from corporation to individual washington form

- Quitclaim deed from corporation to llc washington form

Find out other Tax Years Affected if Known

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement