Overview of the Revised Form 5471 Information Return of

Overview of the Schedule P Form

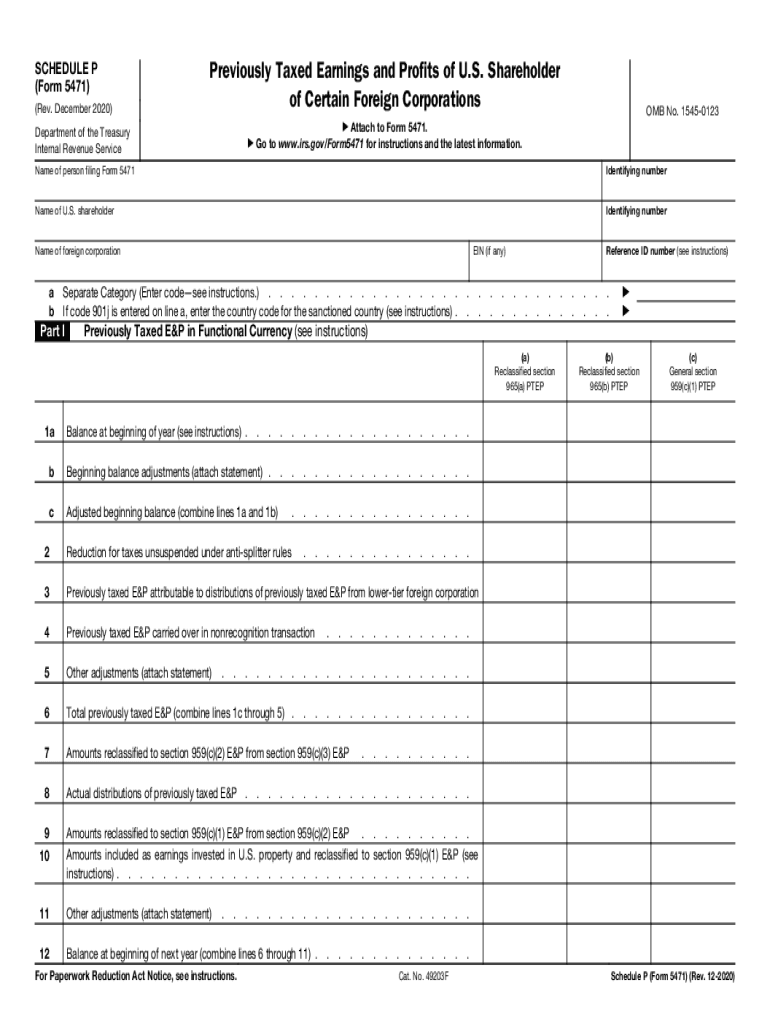

The Schedule P form, officially known as the 5471 Schedule P, is a critical document for U.S. taxpayers who have foreign corporations. This form is part of the Information Return of U.S. Persons With Respect to Certain Foreign Corporations. It provides essential information about the foreign corporation’s income, deductions, and other financial details. Understanding the nuances of this form is vital for compliance with IRS regulations, especially for those involved in international business activities.

Steps to Complete the Schedule P Form

Completing the Schedule P form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the foreign corporation, including income statements and balance sheets. Next, fill out the form by providing detailed information about the corporation's income, deductions, and shareholders. It's important to review the instructions provided by the IRS to avoid common pitfalls. Once completed, ensure that all figures are accurate and that the form is signed and dated before submission.

IRS Guidelines for the Schedule P Form

The IRS has established specific guidelines for filing the Schedule P form. Taxpayers must adhere to these guidelines to avoid penalties. The form must be filed along with the taxpayer's annual income tax return. Additionally, it is essential to ensure that all information is complete and accurate, as discrepancies may lead to audits or further inquiries from the IRS. Familiarizing oneself with these guidelines can help streamline the filing process and ensure compliance.

Filing Deadlines for the Schedule P Form

Timely filing of the Schedule P form is crucial to avoid penalties. The form is typically due on the same date as the taxpayer's income tax return, which is usually April 15 for individuals. However, if an extension is filed, the deadline may be extended to October 15. It is important to keep track of these dates to ensure that the form is submitted on time, thus avoiding any potential fines or complications with the IRS.

Penalties for Non-Compliance with the Schedule P Form

Failure to file the Schedule P form or inaccuracies in the information provided can result in significant penalties. The IRS may impose fines for late filings, with amounts varying based on the duration of the delay. Additionally, inaccuracies can lead to audits, which may result in further financial penalties or legal repercussions. Understanding these potential consequences emphasizes the importance of careful preparation and timely submission of the Schedule P form.

Digital vs. Paper Version of the Schedule P Form

Taxpayers have the option to file the Schedule P form either digitally or via paper submission. Filing electronically can streamline the process, reduce the likelihood of errors, and provide immediate confirmation of receipt. Conversely, paper submissions may take longer to process and confirm. Regardless of the method chosen, ensuring that the form is completed accurately and submitted on time is essential for compliance.

Quick guide on how to complete overview of the revised form 5471 information return of

Complete Overview Of The Revised Form 5471 Information Return Of seamlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the desired form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Overview Of The Revised Form 5471 Information Return Of on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Overview Of The Revised Form 5471 Information Return Of effortlessly

- Locate Overview Of The Revised Form 5471 Information Return Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Overview Of The Revised Form 5471 Information Return Of and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2020 IRS 5471 foreign form used for?

The 2020 IRS 5471 foreign form is used by U.S. citizens and residents to report their interests in foreign corporations. This form primarily helps the IRS monitor compliance with tax regulations regarding foreign income and assets. It's crucial to file this form accurately to avoid penalties.

-

How can airSlate SignNow assist with the 2020 IRS 5471 foreign form?

airSlate SignNow can simplify the process of preparing and electronically signing documents related to the 2020 IRS 5471 foreign form. With its user-friendly interface, businesses can ensure that all necessary forms are filled out correctly and securely. This efficiency helps reduce the stress of tax season.

-

Are there any costs associated with using airSlate SignNow for the 2020 IRS 5471 foreign form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including usage scenarios involving the 2020 IRS 5471 foreign form. The pricing is designed to be cost-effective, providing valuable features without breaking the bank. You can choose a plan that best fits your organization's document signing needs.

-

What features does airSlate SignNow offer for managing the 2020 IRS 5471 foreign form?

airSlate SignNow provides features like customizable templates, real-time document tracking, and secure cloud storage that are beneficial when managing the 2020 IRS 5471 foreign form. Additionally, eSignature capabilities streamline the process of getting necessary approvals. This enhances the efficiency and effectiveness of filing tax-related documents.

-

Is airSlate SignNow legally compliant for electronic signatures on the 2020 IRS 5471 foreign form?

Absolutely! airSlate SignNow complies with eSignature laws, ensuring that electronic signatures on the 2020 IRS 5471 foreign form are legally binding. This compliance guarantees that you can trust the platform for your critical document transactions and tax filings. You can confidently use SignNow to manage your foreign corporation reporting.

-

Can I integrate airSlate SignNow with other applications for the 2020 IRS 5471 foreign form?

Yes, airSlate SignNow offers integrations with various applications that can enhance your experience with the 2020 IRS 5471 foreign form. Whether you use cloud storage solutions or accounting software, integrating these tools can streamline document management. This functionality allows for a more cohesive workflow.

-

How does airSlate SignNow enhance collaboration for the 2020 IRS 5471 foreign form?

airSlate SignNow enhances collaboration by allowing multiple users to view and comment on the 2020 IRS 5471 foreign form simultaneously. This fosters effective communication among team members and stakeholders. Teams can work together efficiently to ensure all details are correct before submission.

Get more for Overview Of The Revised Form 5471 Information Return Of

Find out other Overview Of The Revised Form 5471 Information Return Of

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy