West Virginia Form Cnf 120 W 2012

What is the West Virginia Form Cnf 120 W

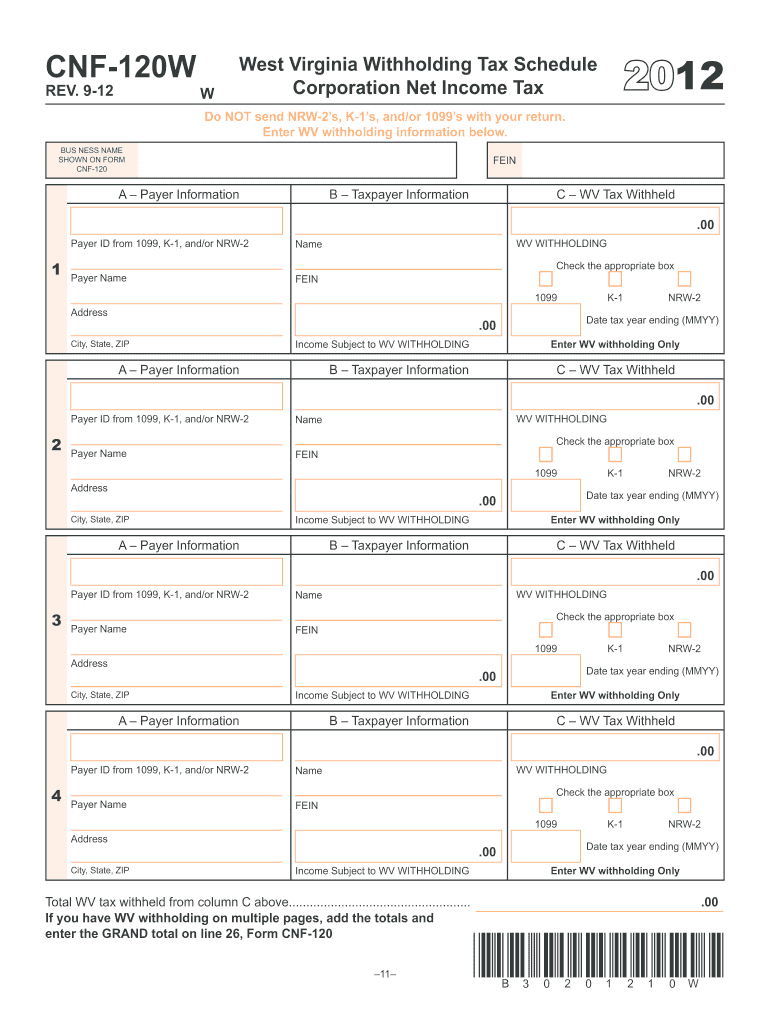

The West Virginia Form Cnf 120 W is a specific tax form used for reporting certain income and tax information to the state of West Virginia. This form is particularly relevant for individuals and businesses that need to report their income accurately and comply with state tax regulations. It includes sections for personal identification, income details, and deductions, ensuring that taxpayers provide comprehensive information to the West Virginia State Tax Department.

How to use the West Virginia Form Cnf 120 W

Using the West Virginia Form Cnf 120 W involves several steps to ensure accurate completion. First, gather all necessary documentation, including income statements and deduction records. Next, fill out the form by entering your personal information, income details, and any applicable deductions. It is important to double-check the information for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the state.

Steps to complete the West Virginia Form Cnf 120 W

Completing the West Virginia Form Cnf 120 W can be done in a systematic manner:

- Gather all required documents, such as W-2s, 1099s, and other income statements.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income from all sources accurately.

- Include any deductions or credits you are eligible for, following the instructions provided on the form.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the designated address.

Legal use of the West Virginia Form Cnf 120 W

The West Virginia Form Cnf 120 W is legally recognized for tax reporting purposes. It must be completed accurately and submitted by the specified deadlines to avoid penalties. The form adheres to state tax laws and regulations, ensuring that taxpayers fulfill their obligations while maintaining compliance with the law. Proper use of this form helps in avoiding legal issues related to tax reporting and ensures that taxpayers are eligible for any applicable refunds or credits.

Form Submission Methods

The West Virginia Form Cnf 120 W can be submitted through various methods, providing flexibility for taxpayers. You may choose to file the form electronically via a secure online platform, which is often faster and more efficient. Alternatively, you can print the completed form and mail it to the appropriate state tax office. In-person submission may also be available, depending on local regulations and office hours. It is advisable to check the specific guidelines for submission methods to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the West Virginia Form Cnf 120 W are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the form must be filed by April fifteenth of the following tax year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines and to mark your calendar accordingly to ensure timely filing.

Quick guide on how to complete west virginia form cnf 120 w 2012

Your assistance manual on how to prepare your West Virginia Form Cnf 120 W

If you’re looking to learn how to complete and submit your West Virginia Form Cnf 120 W, here are a few brief guidelines to simplify the tax submission process.

To start, you simply need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document management solution that lets you modify, create, and finalize your income tax documents effortlessly. Using its editor, you can toggle between text, checkboxes, and electronic signatures and revisit to adjust information as needed. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your West Virginia Form Cnf 120 W in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to bring up your West Virginia Form Cnf 120 W in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to place your legally-binding electronic signature (if required).

- Review your document and rectify any mistakes.

- Save changes, print a copy for yourself, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return mistakes and delay reimbursements. Before electronically filing your taxes, be sure to check the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct west virginia form cnf 120 w 2012

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

Create this form in 5 minutes!

How to create an eSignature for the west virginia form cnf 120 w 2012

How to make an electronic signature for the West Virginia Form Cnf 120 W 2012 online

How to make an electronic signature for your West Virginia Form Cnf 120 W 2012 in Chrome

How to create an electronic signature for signing the West Virginia Form Cnf 120 W 2012 in Gmail

How to make an eSignature for the West Virginia Form Cnf 120 W 2012 from your mobile device

How to generate an electronic signature for the West Virginia Form Cnf 120 W 2012 on iOS

How to create an eSignature for the West Virginia Form Cnf 120 W 2012 on Android devices

People also ask

-

What is the West Virginia Form Cnf 120 W and why is it important?

The West Virginia Form Cnf 120 W is a critical document used for various business transactions within the state. It serves as a confirmation of certain legal and financial agreements, ensuring compliance with state regulations. Understanding how to properly complete and file the West Virginia Form Cnf 120 W can help streamline your business processes and avoid potential legal issues.

-

How can airSlate SignNow help me with the West Virginia Form Cnf 120 W?

airSlate SignNow provides an intuitive platform to easily create, send, and eSign the West Virginia Form Cnf 120 W. With our user-friendly interface, you can quickly fill out the form, obtain necessary signatures, and securely store your documents. This simplifies the process and saves valuable time for your business.

-

What are the pricing options for using airSlate SignNow for the West Virginia Form Cnf 120 W?

AirSlate SignNow offers flexible pricing plans to accommodate different business needs, starting from a basic plan to more comprehensive options. Each plan includes features that facilitate the efficient handling of documents like the West Virginia Form Cnf 120 W. You can choose a plan that fits your budget while ensuring you have access to essential tools for document management.

-

Does airSlate SignNow integrate with other software I use for the West Virginia Form Cnf 120 W?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications, enhancing your workflow when managing the West Virginia Form Cnf 120 W. Whether you use CRM systems, cloud storage, or other productivity tools, our integrations make it easy to incorporate electronic signatures into your existing processes.

-

What features does airSlate SignNow offer for managing the West Virginia Form Cnf 120 W?

AirSlate SignNow includes several features designed to simplify the management of the West Virginia Form Cnf 120 W, such as customizable templates, automated reminders, and secure cloud storage. These tools ensure that your documents are organized, accessible, and compliant with legal standards, making the signing process efficient.

-

How secure is the process of signing the West Virginia Form Cnf 120 W with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the West Virginia Form Cnf 120 W. Our platform uses advanced encryption and complies with industry standards to protect your data. You can trust that your information is safe during the signing process.

-

Can I track the status of my West Virginia Form Cnf 120 W with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your West Virginia Form Cnf 120 W in real-time. You will receive notifications when your document is viewed, signed, or completed, ensuring you are always informed about the progress.

Get more for West Virginia Form Cnf 120 W

- Blue cross and blue shield of minnesota and stella form

- Wellmark prior form

- Please allow up to 2 weeks of processing of application once all paperwork form

- C 2319222 attachment b blue distinction centers for transplant bdct form

- From checklist below has been received to the program and support specialist form

- Referral form to kootenai clinic gastroenterology ampamp endoscopy

- Cascade west veterinary hospital veterinarian in centralia wa form

- Alcohol or drug problem form

Find out other West Virginia Form Cnf 120 W

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement