FS 32 Miscellaneous Events Georgia Department of Revenue 2022-2026

What is the FS 32 Miscellaneous Events

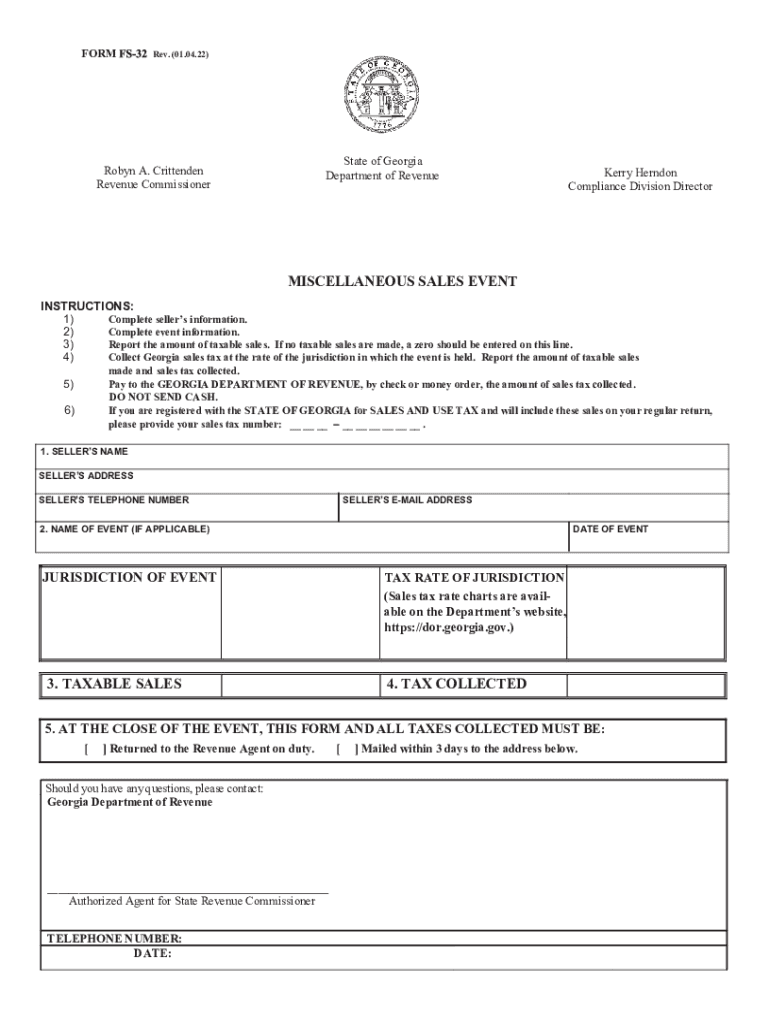

The FS 32 Miscellaneous Events form is a document issued by the Georgia Department of Revenue. It is used to report various types of sales events that may not fit into standard categories. This form is essential for businesses that engage in activities that generate taxable sales but do not fall under typical sales classifications. Understanding the purpose of this form is crucial for compliance with state tax regulations.

Steps to complete the FS 32 Miscellaneous Events

Completing the FS 32 Miscellaneous Events form involves several key steps. First, gather all necessary information regarding the sales events you need to report. This includes details such as the nature of the event, dates, and total sales amounts. Next, accurately fill out the form, ensuring that all sections are completed and that the information is correct. Finally, review the completed form for accuracy before submission to avoid any potential issues with the Georgia Department of Revenue.

Legal use of the FS 32 Miscellaneous Events

The FS 32 Miscellaneous Events form must be used in accordance with Georgia tax laws. It serves as a legal document to report taxable sales events, and failure to use it correctly can lead to penalties. It is important to ensure that all reported events are legitimate and that the form is submitted within the required deadlines. Proper use of this form helps maintain compliance with state regulations and protects your business from legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the FS 32 Miscellaneous Events form are critical for compliance. Typically, businesses must submit this form by specific dates determined by the Georgia Department of Revenue. Keeping track of these deadlines is essential to avoid late fees or penalties. It is advisable to check the department's official schedule for any updates or changes to filing dates to ensure timely submission.

Required Documents

When completing the FS 32 Miscellaneous Events form, certain documents may be required. These can include sales receipts, invoices, or any other documentation that supports the reported sales events. Having these documents ready can facilitate the completion of the form and ensure that all information provided is accurate and verifiable. It is important to maintain thorough records to support your submissions.

Form Submission Methods

The FS 32 Miscellaneous Events form can be submitted through various methods. Businesses may have the option to file online, via mail, or in person at designated locations. Each submission method may have different requirements and processing times, so it is important to choose the one that best suits your needs. Online submission is often the fastest and most efficient method, allowing for quicker processing and confirmation.

Quick guide on how to complete fs 32 miscellaneous events georgia department of revenue

Complete FS 32 Miscellaneous Events Georgia Department Of Revenue effortlessly on any device

Web-based document administration has become increasingly popular among businesses and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage FS 32 Miscellaneous Events Georgia Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign FS 32 Miscellaneous Events Georgia Department Of Revenue with ease

- Find FS 32 Miscellaneous Events Georgia Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow attends to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign FS 32 Miscellaneous Events Georgia Department Of Revenue and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fs 32 miscellaneous events georgia department of revenue

Create this form in 5 minutes!

How to create an eSignature for the fs 32 miscellaneous events georgia department of revenue

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

How to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the GA tax rate 2024 when filing electronically?

The GA tax rate 2024 for electronic filing remains consistent with previous years, making it a straightforward process for businesses. With a special focus on digital documentation, airSlate SignNow helps streamline your eSigning process, ensuring compliance with the GA tax rate 2024 requirements efficiently.

-

How does airSlate SignNow accommodate the GA tax rate 2024 in its features?

airSlate SignNow is designed to adapt to state-specific tax regulations, including the GA tax rate 2024. The platform provides templates and automated reminders to ensure that your documents reflect the latest tax information, facilitating a smooth tax filing experience.

-

What pricing options are available for airSlate SignNow regarding GA tax rate 2024?

Our pricing plans are tailored to meet the needs of various businesses while considering the GA tax rate 2024. Offering a range of affordable options, airSlate SignNow ensures that you can manage your documentation and compliance efficiently without overspending.

-

Can airSlate SignNow help me stay updated on changes to the GA tax rate 2024?

Yes, airSlate SignNow offers resources and updates that keep you informed about any changes to the GA tax rate 2024. Our platform not only enables eSigning but also provides access to helpful guides and notifications regarding tax rate adjustments.

-

What integrations does airSlate SignNow offer that relate to the GA tax rate 2024?

airSlate SignNow integrates seamlessly with a variety of accounting and tax software, allowing you to manage documents related to the GA tax rate 2024 efficiently. These integrations streamline your workflows, making it easier to stay compliant with tax regulations while managing your documents.

-

How can I ensure compliance with the GA tax rate 2024 using airSlate SignNow?

By using airSlate SignNow’s automated features, you can easily create, send, and eSign documents that adhere to the GA tax rate 2024 regulations. The platform includes essential compliance checks and customizable templates to support your business's requirements.

-

Is airSlate SignNow suitable for small businesses concerned about the GA tax rate 2024?

Absolutely! airSlate SignNow offers an affordable and user-friendly solution for small businesses navigating the GA tax rate 2024. Our intuitive platform allows small businesses to manage their eSignatures and documentation effectively without the complexity often associated with tax filings.

Get more for FS 32 Miscellaneous Events Georgia Department Of Revenue

Find out other FS 32 Miscellaneous Events Georgia Department Of Revenue

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later