SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED to Michigan 2018-2026

What is the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan

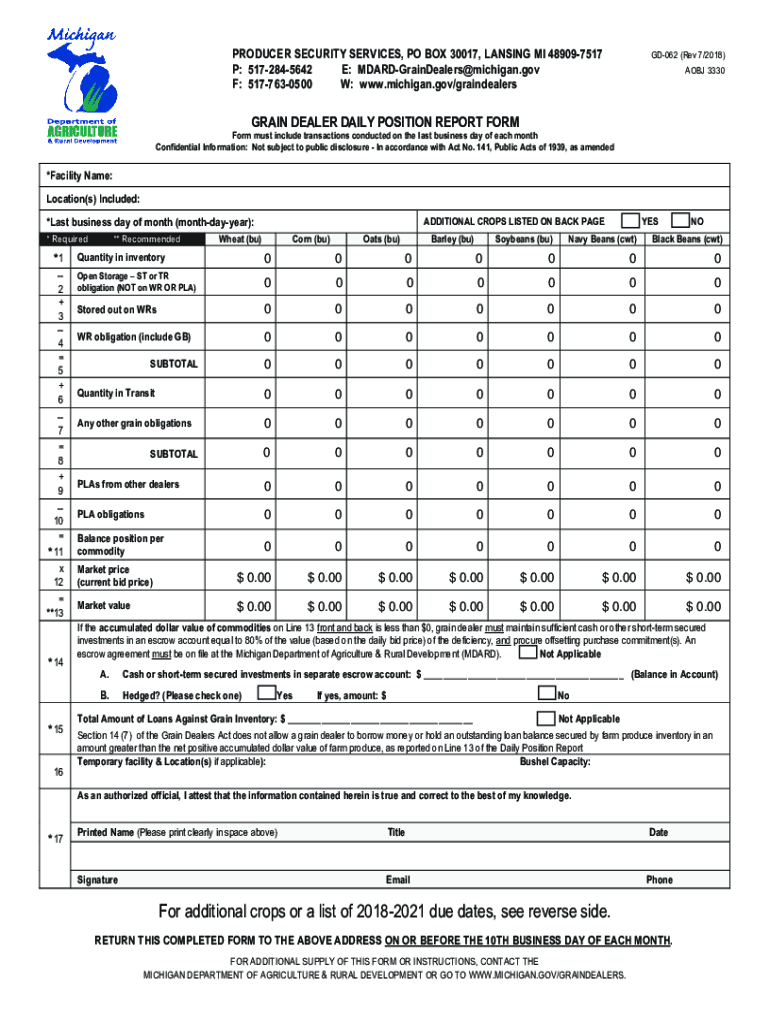

The SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan is a specific document required by local districts within Michigan for tax-related purposes. This form is essential for ensuring compliance with state tax regulations and facilitates the proper assessment and collection of taxes. It encompasses various components that districts must address, including property taxes, income taxes, and other local levies. Understanding this form is crucial for districts to maintain transparency and accountability in their financial dealings.

How to use the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan

Using the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan involves several straightforward steps. First, districts must gather all relevant financial data necessary for completion. This includes previous tax records, financial statements, and any additional documentation required by the state. Next, districts should accurately fill out the form, ensuring that all sections are completed to avoid delays or penalties. Finally, the completed form must be submitted to the appropriate state or local authority, adhering to specified submission methods and deadlines.

Key elements of the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan

Key elements of the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan include various sections that address different tax obligations. These elements typically cover:

- Identification of the district and relevant tax year

- Breakdown of tax revenues and expenditures

- Compliance with state tax regulations

- Submission of supporting documentation

- Signature and certification by authorized officials

Each of these components plays a vital role in ensuring that the district meets its financial responsibilities and maintains compliance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan are critical for compliance. Typically, districts must submit this form by a specific date each year, often aligned with the end of the fiscal year. It is essential to check the current year's deadlines, as they may vary. Missing these deadlines can result in penalties or complications in tax assessments, making timely submission crucial for all districts.

Required Documents

To successfully complete the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan, districts must gather several required documents. These may include:

- Previous year’s tax returns

- Financial statements and budgets

- Documentation of property assessments

- Records of any tax exemptions claimed

- Supporting documentation for revenue sources

Having these documents ready will streamline the completion process and ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with the requirements of the SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan can result in significant penalties. These may include fines, increased scrutiny from state tax authorities, and potential legal repercussions. Additionally, non-compliance may lead to delays in tax revenue collection, impacting the district's budget and services. It is vital for districts to understand these risks and prioritize timely and accurate submissions.

Create this form in 5 minutes or less

Find and fill out the correct section 5 taxes amp other forms districts need to michigan

Create this form in 5 minutes!

How to create an eSignature for the section 5 taxes amp other forms districts need to michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan refers to the specific tax forms and documentation required by school districts in Michigan. These forms are essential for compliance with state regulations and ensure proper funding and financial management within the districts.

-

How can airSlate SignNow help with SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

airSlate SignNow provides an efficient platform for sending and eSigning SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan. Our solution streamlines the document management process, making it easier for districts to handle their tax forms securely and efficiently.

-

What features does airSlate SignNow offer for managing SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

Our platform includes features such as customizable templates, automated workflows, and secure eSignature capabilities specifically designed for SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan. These tools enhance productivity and ensure compliance with state requirements.

-

Is airSlate SignNow cost-effective for handling SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

Yes, airSlate SignNow is a cost-effective solution for managing SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan. Our pricing plans are designed to fit the budgets of school districts while providing robust features that simplify document management.

-

Can airSlate SignNow integrate with other systems for SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

Absolutely! airSlate SignNow offers seamless integrations with various software systems that districts may already be using. This ensures that managing SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan is as efficient as possible.

-

What are the benefits of using airSlate SignNow for SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

Using airSlate SignNow for SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps districts focus on their core mission while ensuring compliance with tax documentation.

-

How secure is airSlate SignNow for handling SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect all documents, including SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan, ensuring that sensitive information remains confidential.

Get more for SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan

Find out other SECTION 5 TAXES & OTHER FORMS DISTRICTS NEED TO Michigan

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service