Formulario 3911

What is the Formulario 3911

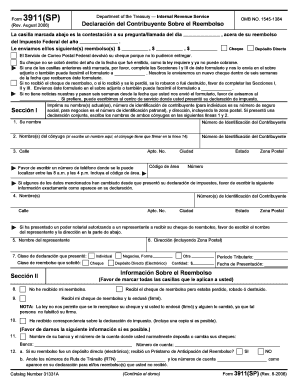

The Formulario 3911, also known as the IRS Form 3911, is a crucial document for taxpayers in the United States. It is used to request a refund trace for a tax refund that has not been received. This form allows individuals to inquire about the status of their refund and ensures that the IRS can assist in locating any missing funds. The form is available in Spanish, making it accessible for Spanish-speaking taxpayers who need to navigate the refund process effectively.

How to use the Formulario 3911

Using the Formulario 3911 involves filling out specific sections to provide the IRS with the necessary information to trace your refund. Taxpayers must include their name, address, Social Security number, and details about the tax return for which they are requesting a refund trace. It is essential to ensure that all information is accurate to avoid delays in processing. Once completed, the form can be submitted to the IRS for review.

Steps to complete the Formulario 3911

Completing the Formulario 3911 can be straightforward if you follow these steps:

- Gather your tax documents, including your tax return and any correspondence from the IRS.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the tax year for which you are requesting a refund trace.

- Indicate the amount of the expected refund.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, ensure that it is sent to the correct IRS address, which can be found on the IRS website or in the instructions accompanying the form.

Legal use of the Formulario 3911

The Formulario 3911 is legally recognized as a formal request to the IRS. When completed correctly, it allows taxpayers to assert their rights to a refund. It is essential to understand that submitting this form does not guarantee a refund; it simply initiates the process for the IRS to investigate the status of your refund. Compliance with IRS guidelines when using this form is crucial to ensure that your request is processed efficiently.

Required Documents

When submitting the Formulario 3911, certain documents may be required to support your request. These can include:

- A copy of your tax return for the year in question.

- Any IRS correspondence related to your refund.

- Proof of identity, such as a driver's license or Social Security card.

Having these documents ready can help expedite the refund tracing process and provide the IRS with the necessary information to assist you effectively.

Form Submission Methods

The Formulario 3911 can be submitted to the IRS through various methods. Taxpayers can choose to send the form by mail or submit it electronically, depending on their preference and the specific instructions provided by the IRS. It is advisable to check the latest guidelines on the IRS website for the most efficient submission method and to ensure that your form reaches the appropriate department.

Quick guide on how to complete formulario 3911

Effortlessly Prepare Formulario 3911 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Formulario 3911 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Formulario 3911 with Ease

- Find Formulario 3911 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you would like to send your form, either via email, text message (SMS), invitation link, or by downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Formulario 3911 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 3911

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is form 3911 español?

Form 3911 español is a specific document used to request a trace of your federal tax refund in Spanish. This form is essential for Spanish-speaking taxpayers who need assistance with their refund status. Utilizing airSlate SignNow can help you complete and eSign this form efficiently.

-

How can I use airSlate SignNow to fill out form 3911 español?

With airSlate SignNow, you can easily access and fill out form 3911 español online. The platform provides templates that simplify the process, allowing you to complete your documents swiftly. Additionally, eSigning your form through SignNow ensures that it is secure and legally binding.

-

Is airSlate SignNow free to use for form 3911 español?

While airSlate SignNow offers a free trial, using it for form 3911 español may require a subscription after the trial period. The platform's pricing is competitive, providing various plans based on your needs. Investing in SignNow enhances your document management capabilities beyond just form 3911 español.

-

What features does airSlate SignNow offer for form 3911 español?

AirSlate SignNow provides several features for form 3911 español, including document templates, eSigning, and tracking capabilities. These tools ensure that you can manage your documents effectively and remain informed about their status. The user-friendly interface also makes the process smooth for all users.

-

Can I integrate airSlate SignNow with other applications for form 3911 español?

Yes, airSlate SignNow can be integrated with various applications to streamline your workflow when handling form 3911 español. Integrations with platforms like Google Drive, Dropbox, and CRM systems enable you to manage your documents more efficiently. This connectivity enhances your productivity.

-

How does airSlate SignNow ensure the security of my form 3911 español?

AirSlate SignNow takes security seriously by implementing encryption and secure data storage for all documents, including form 3911 español. By using two-factor authentication and compliance with legal standards, you can trust that your sensitive information is protected. This commitment to security allows you to eSign documents with confidence.

-

What are the benefits of using airSlate SignNow for form 3911 español?

Using airSlate SignNow for form 3911 español offers numerous benefits, such as increased efficiency and reduced paper usage. The ability to eSign simplifies the submission process, allowing you to get your refund status faster. Overall, this solution enhances your document management while catering to Spanish-speaking users.

Get more for Formulario 3911

- Floridarevenuecomformslibrarycurrentinstructions for f 1120n corporate incomefranchise tax return

- Taxcoloradogov sites tax2022 colorado employee withholding certificate dr 0004 form

- 2021 income tax formsindividuals ampamp families colorado

- Dr 1002 colorado salesuse tax rates form

- Revenuesupporttngov200549005 sales use taxsales ampamp use taxtennessee department of revenue form

- Form dr 601g ampquotgovernmental leasehold intangible personal property tax

- Form e 500 sales and use tax return general instructions

- Bmv 4856 form

Find out other Formulario 3911

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe