W 8 Form 1992-2026

What is the W-8 Form?

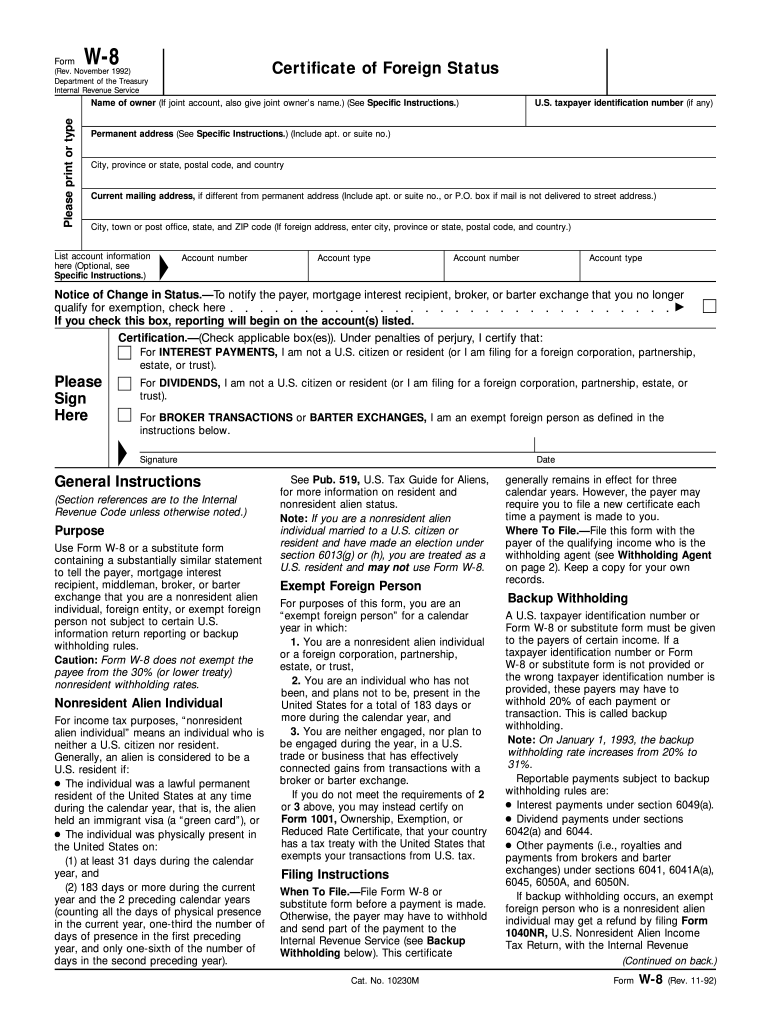

The W-8 form is an essential document used by foreign individuals and entities to certify their foreign status for tax purposes in the United States. This form is primarily utilized to claim tax treaty benefits and to avoid or reduce withholding taxes on certain types of income received from U.S. sources. The form is issued by the Internal Revenue Service (IRS) and is crucial for non-resident aliens and foreign businesses to ensure compliance with U.S. tax laws.

How to Obtain the W-8 Form

Obtaining the W-8 form is straightforward. The form can be downloaded directly from the IRS website in PDF format. It is important to ensure that you are using the most current version of the form, as outdated versions may not be accepted by financial institutions or the IRS. Additionally, some organizations may provide the form through their platforms, particularly if they require it for transactions involving foreign clients or partners.

Steps to Complete the W-8 Form

Completing the W-8 form involves several key steps:

- Identify the correct version of the W-8 form needed for your situation, such as W-8BEN for individuals or W-8BEN-E for entities.

- Provide your name, country of citizenship, and address. Ensure that all information is accurate and matches your official documents.

- Claim any applicable tax treaty benefits by providing the necessary information regarding your country of residence.

- Sign and date the form to certify that the information provided is true and correct.

It is advisable to review the completed form for accuracy before submission to avoid delays or issues with processing.

Legal Use of the W-8 Form

The W-8 form is legally binding and must be filled out accurately to reflect your status as a foreign individual or entity. It is essential for compliance with U.S. tax regulations and helps to prevent unnecessary withholding taxes on income. Misrepresentation or failure to submit the form when required can lead to penalties, including higher withholding rates and legal repercussions.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the W-8 form, it is crucial to provide it to the withholding agent before receiving any income subject to withholding. If the form is not submitted in a timely manner, the withholding agent may be required to withhold taxes at the maximum rate. It is advisable to keep track of any changes in your status that may require you to update or resubmit the form.

Examples of Using the W-8 Form

The W-8 form is commonly used in various scenarios, including:

- A foreign artist receiving royalties from a U.S. company for performances.

- A non-resident alien receiving dividends from U.S. stocks.

- A foreign business providing services to a U.S. client.

In each case, the W-8 form helps to establish the foreign status of the individual or entity, ensuring appropriate tax treatment under U.S. law.

Quick guide on how to complete w8 form

Discover the simplest method to complete and endorse your W 8 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to complete and endorse your W 8 Form and related forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle documents swiftly and in compliance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools all readily available within a user-friendly interface.

Only a few steps are required to complete to fill out and endorse your W 8 Form:

- Upload the editable template to the editor by clicking the Get Form button.

- Review the details you need to enter in your W 8 Form.

- Move between the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the sections with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Cover areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred choice.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finalized W 8 Form in the Documents directory within your account, download it, or transfer it to your chosen cloud storage. Our service also provides adaptable form sharing. There’s no need to print your templates when filing them at the appropriate public office - accomplish it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Give it a try now!

Create this form in 5 minutes or less

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

Some large USA institutions want me to fill a W8 Form. I am a Canadian. What tax implications does this have for me? Would it affect me in the future? What happens after I fill it out?

That is dependent upon if you are working as an employee for that company(/ies). It’s similar to a W-4 form, which most American’s are more familiar with but designed for non-US Citizens who are working in the US or a nation that has a tax treaty with the US.This is a more indepth link from the IRS. Who needs to fill out IRS tax form W-8?

-

Being in a sole proprietorship business in the Philippines, do I need to fill out any W8/W9 forms in order to be paid by a company that was recently bought by a US corporation?

NOT a W-9 as that is for domestic vendors.You do not even have to fill out a W-8BEN (probably the actual correct form) if you wish to have US taxes taken out of your payments and paid to the IRS. It is only required if you wish to have no US taxes withheld on your payment.

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

Real Estate in New York City: How can a foreigner rent an apartment in NY without a credit score?

You should provide the following, no credit score or tax returns needed:- Employment verification letter- Two recent pay stubs that verify the salary claims in the EV letter- Two most recent bank statements that show a reasonable amount of cash- Photo ID in the form of a passport or visaGenerally, the above should be plenty, but it does depend on the landlord.The landlord will likely have you fill out a W8 form, as well - common with foreign renters.You may also be able to use a corporate guarantor service like Insurent. Not all landlords accept them, due to certain constraints or preferences, but worth checking.Some landlords will accept a full year's payment up-front; however, this can only be done in free market buildings (rent stabilized buildings have some rules against this). Even in free market buildings, it's up to the landlord whether or not to accept full payment, additional security, or some form of back rent up-front.When emailing brokers / leasing offices, make sure to inquire about their international leasing policies, so you don't risk wasting any time on buildings that have strict or unreasonable policies.Good luck and welcome to New York!

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

How do I fill the W8-BEN-E form for engaging as a service provider for a US based company?

Which specific question do you have an issue with ? I’ve done it in the past and can guide you on any specific issue you have …

Create this form in 5 minutes!

How to create an eSignature for the w8 form

How to create an eSignature for the W8 Form online

How to create an eSignature for your W8 Form in Chrome

How to make an electronic signature for putting it on the W8 Form in Gmail

How to make an eSignature for the W8 Form from your smart phone

How to make an electronic signature for the W8 Form on iOS devices

How to create an eSignature for the W8 Form on Android devices

People also ask

-

What is a W 8 Form and when do I need it?

The W 8 Form is an IRS document used by foreign individuals or entities to signNow their foreign status and claim benefits under tax treaties. You typically need to submit a W 8 Form when you receive income from U.S. sources, ensuring the correct withholding tax rate is applied. airSlate SignNow simplifies the process of completing and submitting your W 8 Form, making it easy to stay compliant.

-

How does airSlate SignNow help with signing a W 8 Form?

With airSlate SignNow, you can easily upload, fill out, and eSign your W 8 Form from any device. Our user-friendly interface allows for quick navigation and completion, ensuring your form is signed and sent securely. Plus, you can keep track of the document's status in real-time, enhancing your workflow.

-

Is there a cost associated with using airSlate SignNow for the W 8 Form?

airSlate SignNow offers various pricing plans, including a free trial, so you can assess its features for managing your W 8 Form without any upfront investment. Once you decide to subscribe, we provide affordable options that cater to different business needs, ensuring you get the best value for your money.

-

Can I integrate airSlate SignNow with other apps for managing the W 8 Form?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your ability to manage the W 8 Form alongside other business processes. Whether you use CRM systems, cloud storage, or accounting software, our integrations streamline your workflow and improve efficiency. This means you can work smarter and ensure your documents are always accessible.

-

What are the benefits of using airSlate SignNow for the W 8 Form?

Using airSlate SignNow for your W 8 Form offers numerous benefits including enhanced security, faster processing times, and reduced paper waste. Our eSigning solution ensures that your form is legally binding and compliant with regulations. Additionally, you can manage all your documents in one place, simplifying your administrative tasks.

-

How secure is my data when using airSlate SignNow for the W 8 Form?

airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. When you complete and submit your W 8 Form, your personal and financial information is protected at all times. You can have peace of mind knowing that your data is safe from unauthorized access.

-

Can I store my completed W 8 Form in airSlate SignNow?

Yes, airSlate SignNow allows you to securely store your completed W 8 Form within the platform. This feature enables you to easily access your forms whenever needed, ensuring that you have all important documents at your fingertips. Organizing your paperwork has never been easier!

Get more for W 8 Form

Find out other W 8 Form

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy