Form 1049 Client's Statement of Self Employment

What is the Form 1049 Client's Statement of Self Employment

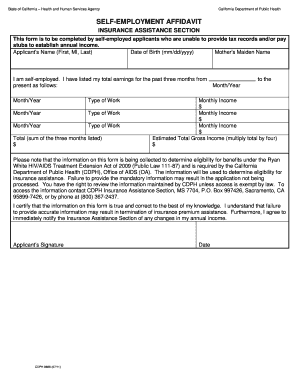

The Form 1049, also known as the Client's Statement of Self Employment, is a crucial document for individuals who are self-employed. This form is primarily used to report income and expenses related to self-employment activities. It provides a detailed overview of an individual's earnings, which can be essential for tax purposes, especially when filing income tax returns. The information contained in the 1049 tax form helps the IRS assess the taxpayer's financial situation and determine their tax liability accurately.

How to use the Form 1049 Client's Statement of Self Employment

Using the Form 1049 involves several key steps. First, gather all necessary documentation related to your self-employment income and expenses, such as invoices, receipts, and bank statements. Next, accurately fill out the form by entering your total income and detailing your business expenses. It's important to ensure that all figures are correct and supported by documentation. Once completed, the form can be submitted alongside your tax return to the IRS, providing a comprehensive view of your self-employment activities.

Steps to complete the Form 1049 Client's Statement of Self Employment

Completing the Form 1049 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial documents, including income statements and expense receipts.

- Begin filling out the form by entering your total self-employment income.

- List all allowable business expenses, ensuring that you categorize them correctly.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 1049 Client's Statement of Self Employment

The legal use of the Form 1049 is vital for ensuring compliance with IRS regulations. This form must be completed accurately to avoid potential penalties or audits. It serves as a formal declaration of your self-employment income and expenses, which the IRS uses to verify your tax filings. Properly filling out and submitting the 1049 tax form can protect you from legal issues related to misreporting income or failing to report self-employment earnings.

Key elements of the Form 1049 Client's Statement of Self Employment

Several key elements are essential when filling out the Form 1049. These include:

- Your full name and contact information.

- A detailed account of your total self-employment income.

- A comprehensive list of business expenses, categorized appropriately.

- Your signature and the date of completion.

Each of these elements plays a critical role in ensuring that the form is complete and accurate, which is necessary for proper tax reporting.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 1049. It is important to follow these guidelines to ensure compliance. According to the IRS, the form must be submitted as part of your annual tax return if you are self-employed and earn a certain threshold of income. Additionally, the IRS outlines acceptable methods for documenting income and expenses, emphasizing the importance of maintaining accurate records to support your claims on the form.

Quick guide on how to complete form 1049 clients statement of self employment

Complete Form 1049 Client's Statement Of Self Employment effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and smoothly. Handle Form 1049 Client's Statement Of Self Employment on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 1049 Client's Statement Of Self Employment easily

- Obtain Form 1049 Client's Statement Of Self Employment and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Alter and eSign Form 1049 Client's Statement Of Self Employment and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1049 clients statement of self employment

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1049 tax form and how can it be used in airSlate SignNow?

The 1049 tax form is utilized for reporting certain tax-related information. With airSlate SignNow, you can easily create, send, and eSign 1049 tax forms, streamlining the process and ensuring all signatures are collected efficiently. This allows you to manage your tax documentation digitally and securely.

-

How does airSlate SignNow enhance the processing of 1049 tax forms?

airSlate SignNow enhances the processing of 1049 tax forms by offering automated workflows and eSignature capabilities. This eliminates the need for paper and manual handling, ensuring that your 1049 tax forms are completed quickly and accurately. Additionally, the platform provides reminders and tracking features to ensure that all necessary signatures are obtained swiftly.

-

What pricing plans are available for airSlate SignNow for handling 1049 tax forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when dealing with 1049 tax forms. Each plan includes features tailored for document management and electronic signatures, enabling your team to optimize their workflow. You can choose a plan that best fits your volume of 1049 tax form processing.

-

Are there any integrations available for facilitating the 1049 tax form process in airSlate SignNow?

Yes, airSlate SignNow integrates with numerous apps and services that can facilitate the process of managing 1049 tax forms. Whether you need to connect with accounting software or cloud storage solutions, these integrations help streamline document workflows. This connectivity ensures that all your 1049 tax form needs are met seamlessly.

-

What are the security measures in place for 1049 tax forms handled through airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 1049 tax form. The platform employs advanced encryption and secure access controls to protect your data. Additionally, all documents are stored securely in compliance with data protection regulations, giving you peace of mind.

-

Can I track the status of my 1049 tax forms sent via airSlate SignNow?

Yes, airSlate SignNow provides robust tracking features for all documents you send, including the 1049 tax form. You can monitor when the document has been viewed, signed, and completed through an intuitive dashboard. This transparency helps you manage your paperwork efficiently and ensures nothing is overlooked.

-

How can airSlate SignNow improve collaboration on 1049 tax form submissions?

airSlate SignNow facilitates collaboration on 1049 tax forms by allowing multiple users to review and eSign documents simultaneously. This real-time collaboration feature speeds up the approval process, ensuring that all stakeholders can contribute without delays. You can easily send reminders and updates, keeping everyone on the same page.

Get more for Form 1049 Client's Statement Of Self Employment

Find out other Form 1049 Client's Statement Of Self Employment

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast