Printable W 9 Form State of Maine

What is the Printable W-9 Form for the State of Maine?

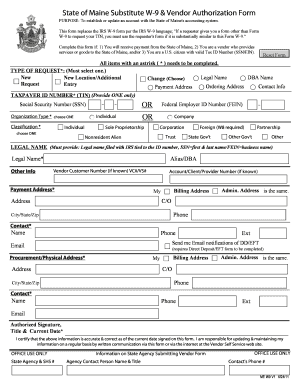

The Printable W-9 Form is a tax document used by individuals and businesses in the State of Maine to provide their taxpayer identification information to other entities. This form is essential for reporting income to the IRS and is often requested by clients or vendors before payments are made. The W-9 form collects details such as the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number or an Employer Identification Number (EIN).

How to Use the Printable W-9 Form in Maine

Using the Printable W-9 Form in Maine involves several straightforward steps. First, download the form from a reliable source. Next, fill in your personal or business information accurately. Ensure that the name and TIN match the records held by the IRS to avoid discrepancies. Once completed, submit the form to the requesting party, typically a client or vendor, who will use it to report payments made to you. It is important to keep a copy for your records.

Steps to Complete the Printable W-9 Form for Maine

Completing the Printable W-9 Form involves a few key steps:

- Download the W-9 form from a trusted source.

- Fill in your name as it appears on your tax return.

- If applicable, provide your business name.

- Enter your address, including city, state, and ZIP code.

- Indicate your taxpayer identification number (TIN).

- Sign and date the form to certify that the information is correct.

Legal Use of the Printable W-9 Form in Maine

The Printable W-9 Form is legally recognized by the IRS and is crucial for tax compliance. It serves as a declaration of your taxpayer status and ensures that the entity requesting it has the correct information to report payments. Failing to provide a W-9 when requested can lead to backup withholding on payments, meaning that the payer may withhold a portion of your income for tax purposes. Therefore, it is important to respond promptly to any requests for this form.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines regarding the use of the W-9 Form. According to these guidelines, the form should be filled out accurately and completely to avoid issues with tax reporting. The IRS does not require the W-9 to be submitted with your tax return; instead, it should be kept on file by the requesting entity. If there are any changes to your information, such as a name change or a change in business structure, a new W-9 should be submitted to reflect those changes.

Filing Deadlines and Important Dates for Maine Tax Returns

Filing deadlines for Maine tax returns generally align with federal deadlines. Typically, individual tax returns are due on April fifteenth of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to be aware of these deadlines to avoid penalties and interest on late payments. Additionally, if you are self-employed or a business entity, estimated tax payments may be required quarterly.

Quick guide on how to complete printable w 9 form state of maine

Effortlessly prepare Printable W 9 Form State Of Maine on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Printable W 9 Form State Of Maine on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest way to modify and electronically sign Printable W 9 Form State Of Maine without stress

- Find Printable W 9 Form State Of Maine and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Printable W 9 Form State Of Maine and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Maine tax and how does it impact document signing?

Maine tax refers to the state taxes imposed on individuals and businesses in Maine. Understanding Maine tax is essential when signing documents related to business transactions or agreements. Using airSlate SignNow, you can easily eSign documents that include tax implications, ensuring compliance with Maine tax regulations.

-

How can airSlate SignNow help with Maine tax document management?

AirSlate SignNow simplifies the management of documents related to Maine tax obligations. With features like templates and easy collaboration, you can create, send, and sign tax-related documents efficiently. This streamlines the process and helps ensure that your Maine tax documents are accurately completed.

-

What are the pricing options for airSlate SignNow when dealing with Maine tax?

AirSlate SignNow offers flexible pricing plans that cater to businesses dealing with Maine tax transactions. Our affordable pricing structures ensure that you can access powerful eSigning features without breaking the bank. Check our website for specific plans tailored to your needs regarding Maine tax documentation.

-

Can I integrate airSlate SignNow with other tools for Maine tax purposes?

Yes, airSlate SignNow integrates seamlessly with various tools that can help streamline your Maine tax processes. You can connect with accounting software, document management systems, and more. This allows for a more efficient approach to handling Maine tax documents and facilitates smooth workflows.

-

What features does airSlate SignNow offer for Maine tax-related documents?

AirSlate SignNow includes features such as customizable templates, document collaboration, and secure eSigning, which are especially useful for Maine tax documents. These features not only enhance efficiency but also ensure accuracy and compliance with Maine tax requirements. Real-time tracking of document status provides peace of mind.

-

Is airSlate SignNow suitable for businesses of all sizes handling Maine tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes needing to manage Maine tax documentation effectively. Whether you're a small business or a large corporation, the platform's scalability and user-friendly interface make it a perfect fit for any business dealing with Maine tax.

-

How does airSlate SignNow ensure the security of Maine tax documents?

Security is a top priority for airSlate SignNow, especially concerning sensitive Maine tax documents. The platform employs advanced encryption and security protocols to protect your data. You can eSign and manage your Maine tax documents with confidence, knowing they are secure.

Get more for Printable W 9 Form State Of Maine

Find out other Printable W 9 Form State Of Maine

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors