3372, Michigan Sales and Use Tax Certificate of State of Michigan Mi Form

What is the 3372, Michigan Sales And Use Tax Certificate?

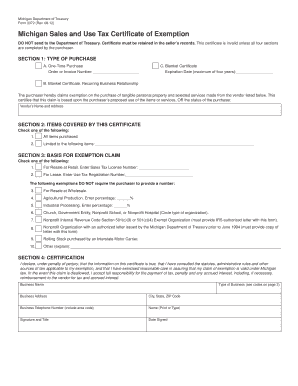

The 3372 form, officially known as the Michigan Sales and Use Tax Certificate, is a crucial document used in the state of Michigan. This certificate allows businesses to purchase goods and services without paying sales tax, provided they meet specific criteria. It is primarily utilized by businesses that resell products or use them in manufacturing. Understanding the purpose and legal implications of this certificate is essential for compliance with Michigan tax laws.

How to Use the 3372, Michigan Sales And Use Tax Certificate

Using the 3372 form correctly involves presenting it to suppliers when making tax-exempt purchases. Businesses must ensure that the certificate is filled out accurately, including the seller's name, address, and the nature of the business. It is important to note that the certificate should only be used for eligible purchases, such as items intended for resale or manufacturing. Misuse of the certificate can lead to penalties and back taxes owed to the state.

Steps to Complete the 3372, Michigan Sales And Use Tax Certificate

Completing the 3372 form requires careful attention to detail. Here are the steps to follow:

- Obtain the 3372 form from the Michigan Department of Treasury website or authorized sources.

- Fill in your business information, including the name, address, and tax identification number.

- Indicate the type of purchases that will be made tax-exempt.

- Sign and date the form to certify that the information provided is accurate.

- Provide the completed form to your suppliers at the time of purchase.

Legal Use of the 3372, Michigan Sales And Use Tax Certificate

The legal use of the 3372 form is governed by Michigan tax laws. Businesses must ensure that they qualify for the exemption and use the certificate only for eligible transactions. It is essential to maintain accurate records of all tax-exempt purchases made using the certificate. In the event of an audit, businesses must be prepared to demonstrate compliance with the regulations surrounding the use of the 3372 form.

Key Elements of the 3372, Michigan Sales And Use Tax Certificate

Several key elements make up the 3372 form, including:

- Business Information: This includes the name, address, and tax identification number of the business.

- Type of Exemption: The specific reason for claiming a tax exemption must be clearly stated.

- Signature: The certificate must be signed by an authorized representative of the business.

- Date: The date of the certificate's issuance is also required.

Eligibility Criteria for the 3372, Michigan Sales And Use Tax Certificate

To be eligible for the 3372 form, businesses must meet certain criteria set by the state of Michigan. Generally, eligibility includes:

- Being a registered business in Michigan with a valid tax identification number.

- Intending to purchase items for resale or for use in manufacturing.

- Maintaining proper documentation to support the tax-exempt status of purchases.

Quick guide on how to complete 3372 michigan sales and use tax certificate of state of michigan mi

Complete 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi with ease

- Find 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form browsing, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tax certificate exemption in Michigan?

A tax certificate exemption in MI refers to a document that allows certain taxpayers to be exempt from local taxes, often depending on specific criteria such as income level or property use. Understanding the nuances of this exemption can signNowly benefit eligible individuals or organizations in Michigan looking to save on taxes.

-

How do I apply for a tax certificate exemption in MI?

To apply for a tax certificate exemption in MI, you typically need to complete a specific application form and provide documentation that verifies your eligibility. Submissions are usually made to your local tax authority, and it's important to stay updated on any deadlines to ensure your exemption is processed for the current tax year.

-

What are the benefits of obtaining a tax certificate exemption in MI?

Obtaining a tax certificate exemption in MI can provide signNow financial advantages by reducing your tax liability, allowing you to allocate funds towards other important business operations. Additionally, being tax-exempt can improve your cash flow and enhance your competitive edge in the market.

-

Are there fees associated with obtaining a tax certificate exemption in MI?

Typically, there are no fees associated with applying for a tax certificate exemption in MI; however, it is advisable to verify with your local tax authority for any potential costs related to processing your application. Being informed can prevent unforeseen expenses while seeking your tax benefits.

-

Can airSlate SignNow assist with tax certificate exemption documentation?

Yes, airSlate SignNow can assist you in managing and signing documentation related to your tax certificate exemption in MI. Our platform simplifies the process of preparing, sending, and securely signing essential tax documents, ensuring you maintain compliance and organization during your application.

-

What features does airSlate SignNow offer for tax certificate exemption processes?

airSlate SignNow offers features such as customizable templates, reusable documents, and real-time notifications that facilitate efficient document management for tax certificate exemptions in MI. These tools help streamline the submission process, ensuring that your applications are timely and error-free.

-

How does airSlate SignNow ensure security for tax certificate exemption documents?

airSlate SignNow prioritizes security by employing advanced encryption methods and authentication protocols to protect your tax certificate exemption documents. Our platform ensures that sensitive information remains confidential and secure throughout the signing and storage process.

Get more for 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi

Find out other 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed