Form 150 206 029

What is the Form 150-206-029

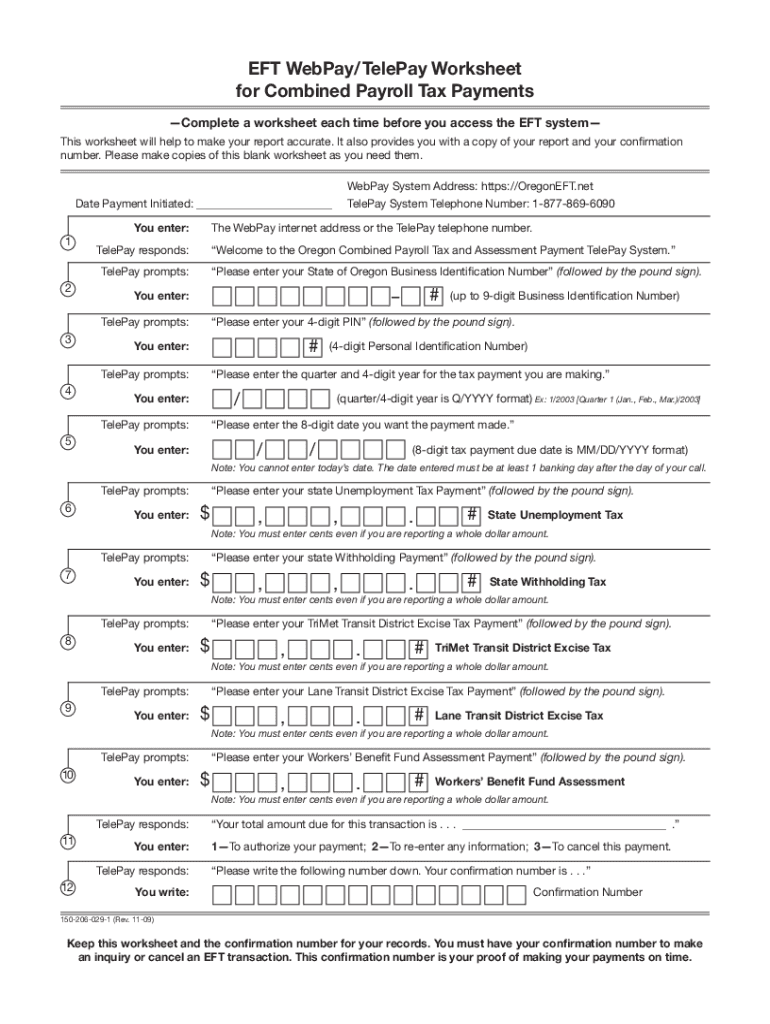

The Form 150-206-029, commonly referred to as the Oregon 029, is a state-specific document used primarily for reporting combined payroll tax obligations in Oregon. This form is essential for employers to accurately report wages, withholdings, and other payroll-related information to the Oregon Department of Revenue. It ensures compliance with state tax regulations and helps maintain accurate records for both the employer and the state.

How to use the Form 150-206-029

Using the Form 150-206-029 involves several key steps. First, employers must gather all necessary payroll data, including employee wages and tax withholdings. Next, the form should be filled out with accurate information reflecting the payroll period being reported. Once completed, the form can be submitted electronically or via mail, depending on the employer's preference and the submission guidelines provided by the Oregon Department of Revenue. It is crucial to ensure that all information is accurate to avoid penalties.

Steps to complete the Form 150-206-029

Completing the Form 150-206-029 requires careful attention to detail. Follow these steps:

- Gather all payroll records for the reporting period.

- Enter the total wages paid to employees during the period.

- Calculate and input the total state tax withheld.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the form electronically through the Oregon Department of Revenue's online portal or mail it to the appropriate address.

Key elements of the Form 150-206-029

The Form 150-206-029 includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Employer identification details, including name and address.

- Payroll period dates.

- Total wages paid to employees.

- Total state tax withheld from employee wages.

- Signature of the person responsible for the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 150-206-029 are critical to avoid penalties. Employers must submit the form by the designated due date, which is typically the end of the month following the end of the payroll period. For example, if the payroll period ends on December 31, the form must be filed by January 31 of the following year. It is advisable to check the Oregon Department of Revenue's website for any updates or changes to these deadlines.

Penalties for Non-Compliance

Failure to comply with the filing requirements of the Form 150-206-029 can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential audits. Employers are encouraged to file the form accurately and on time to avoid these consequences, which can impact both their financial standing and reputation.

Quick guide on how to complete form 150 206 029

Effortlessly prepare Form 150 206 029 on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Handle Form 150 206 029 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Form 150 206 029 with ease

- Locate Form 150 206 029 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools that are specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 150 206 029 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 'oregon 029' in relation to airSlate SignNow?

The term 'oregon 029' refers to a specific feature set and compliance standards offered by airSlate SignNow to enhance eSignatures. With 'oregon 029', businesses can ensure that their documents meet local regulations while providing a seamless signing experience. This feature is ideal for companies operating in Oregon or those looking to comply with state laws.

-

How much does airSlate SignNow cost for users in Oregon?

The pricing for airSlate SignNow caters to businesses of all sizes, including those in Oregon. Plans start at a competitive rate, offering a range of features, including the 'oregon 029' compliance options, which can be beneficial for your organization. By choosing airSlate SignNow, you gain access to a cost-effective solution for efficient document management.

-

What features are included with airSlate SignNow's 'oregon 029' offering?

airSlate SignNow's 'oregon 029' package includes essential features such as secure eSigning, customizable workflows, and automatic notifications. These functionalities streamline the signing process while ensuring compliance with Oregon regulations. Users can also leverage templates to further enhance efficiency.

-

How does airSlate SignNow benefit businesses in Oregon?

Businesses in Oregon can signNowly benefit from airSlate SignNow by simplifying their document signing processes. The 'oregon 029' feature ensures that all signatures are legally compliant, which helps to reduce the risk of disputes. Additionally, the solution saves time and resources, enabling teams to focus on more critical tasks.

-

Are there any integrations available with airSlate SignNow for Oregon-based companies?

Yes, airSlate SignNow offers various integrations that cater to the needs of Oregon-based companies. This includes compatibility with popular applications such as Google Drive, Salesforce, and more, ensuring that 'oregon 029' users can seamlessly incorporate eSignatures into their existing workflows. These integrations enhance productivity and document management.

-

Can I access airSlate SignNow on mobile devices in Oregon?

Absolutely, airSlate SignNow is fully optimized for mobile devices, allowing users in Oregon to access 'oregon 029' features on the go. Whether using a smartphone or tablet, you can quickly send and sign documents anytime, anywhere. This flexibility supports remote work and enhances collaboration.

-

How secure is airSlate SignNow for users concerned about document safety in Oregon?

Security is a top priority for airSlate SignNow, especially for users in Oregon utilizing the 'oregon 029' service. The platform employs advanced encryption methods and complies with industry standards to protect your sensitive information. With airSlate SignNow, you can trust that your documents are secure throughout the signing process.

Get more for Form 150 206 029

Find out other Form 150 206 029

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement