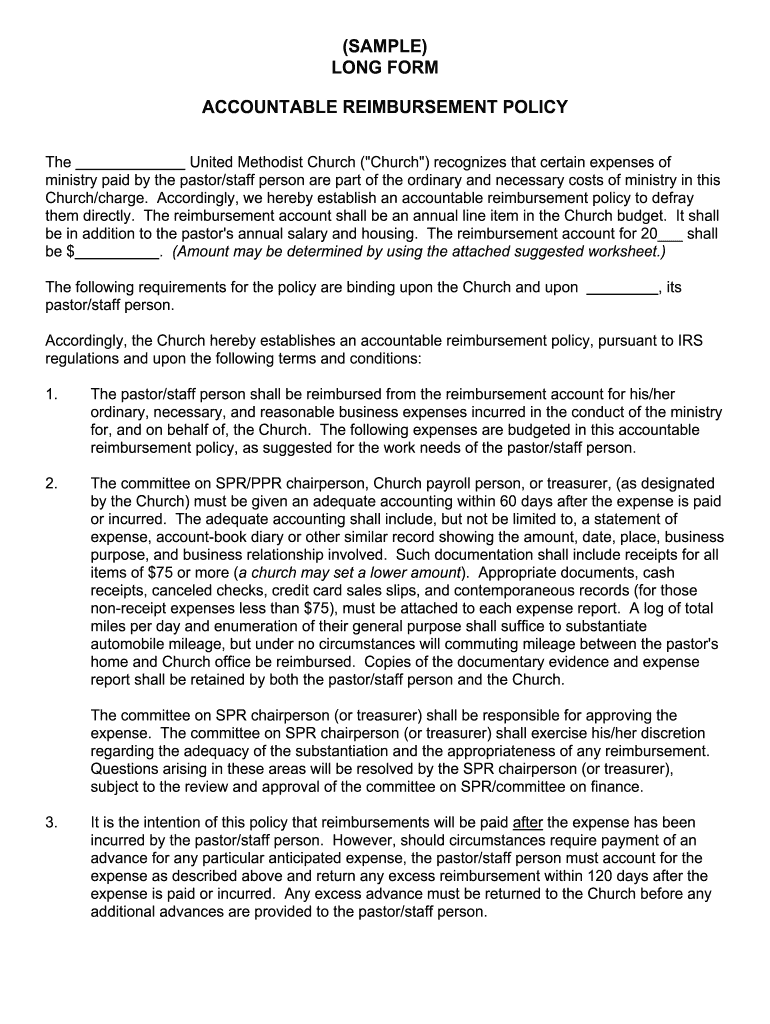

SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY

Understanding the accountable reimbursement policy

An accountable reimbursement policy is a structured approach that allows businesses to reimburse employees for expenses incurred during the course of their work. This type of plan requires employees to substantiate their expenses with receipts and to return any excess reimbursements. The primary goal is to ensure that reimbursements are directly related to business activities, making it a tax-deductible expense for the employer.

In contrast, a nonaccountable plan does not require such stringent documentation. Employees may receive a flat amount for expenses without needing to provide receipts or return any unused funds. This can lead to potential tax implications for both the employer and employee, as nonaccountable reimbursements are typically considered taxable income.

Key elements of the accountable reimbursement policy

Several key elements define an accountable reimbursement policy:

- Business Connection: Expenses must be directly related to business activities.

- Substantiation: Employees must provide receipts or other documentation to validate their expenses.

- Return of Excess Payments: Any reimbursements that exceed actual expenses must be returned to the employer.

- Timeliness: Employees should submit their expense reports within a reasonable time frame to ensure compliance.

These elements help maintain the integrity of the reimbursement process and ensure compliance with IRS regulations.

Steps to complete the accountable reimbursement policy

To effectively implement an accountable reimbursement policy, follow these steps:

- Develop a Clear Policy: Outline the types of expenses that are reimbursable and the documentation required.

- Communicate to Employees: Ensure all employees are aware of the policy and understand the requirements for reimbursement.

- Collect Documentation: Employees should gather receipts and proof of expenses incurred during their business activities.

- Review Submissions: Designate a person or team to review submitted expenses for compliance with the policy.

- Process Reimbursements: Once verified, process the reimbursements in a timely manner.

Following these steps can help ensure that the policy is effectively executed and compliant with tax regulations.

IRS guidelines for accountable reimbursement policies

The IRS has specific guidelines regarding accountable reimbursement policies. To qualify as an accountable plan, the following criteria must be met:

- Expenses must have a business connection.

- Employees must adequately account for these expenses within a reasonable period.

- Any excess reimbursement must be returned to the employer.

Failure to adhere to these guidelines may result in the IRS classifying the reimbursements as taxable income, which can lead to additional tax liabilities for both the employer and employee.

Examples of using the accountable reimbursement policy

Common scenarios where an accountable reimbursement policy is applied include:

- Travel Expenses: Employees traveling for business may incur costs for transportation, lodging, and meals, which can be reimbursed if documented properly.

- Office Supplies: Employees purchasing supplies necessary for their work can submit receipts for reimbursement.

- Client Entertainment: Expenses related to entertaining clients can also be reimbursed, provided they are substantiated with receipts.

These examples illustrate how an accountable reimbursement policy can effectively manage and document employee expenses.

Eligibility criteria for the accountable reimbursement policy

To be eligible for an accountable reimbursement policy, employees typically need to meet certain criteria:

- Employment status: Employees must be classified as full-time or part-time, depending on the company's policy.

- Nature of expenses: The expenses must be necessary and ordinary for the business.

- Compliance with documentation: Employees must adhere to the documentation requirements set forth in the policy.

Meeting these criteria ensures that both the employer and employee benefit from a structured and compliant reimbursement process.

Quick guide on how to complete sample long form accountable reimbursement policy

Complete SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY with ease on any device

Digital document management has gained popularity amongst companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, since you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly with no delays. Manage SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY effortlessly

- Locate SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the difference between an accountable vs nonaccountable plan?

An accountable plan allows employees to be reimbursed for business expenses with proper documentation, while a nonaccountable plan does not require such documentation and may result in taxable income. Understanding the accountable vs nonaccountable plan is crucial for businesses looking to manage expenses and employee reimbursements effectively.

-

How does airSlate SignNow support accountable and nonaccountable plans?

airSlate SignNow simplifies document management by allowing businesses to easily send, sign, and manage expense reimbursement documents under both accountable and nonaccountable plans, ensuring compliance and maintaining records efficiently.

-

What features does airSlate SignNow offer that relate to the accountable vs nonaccountable plan?

airSlate SignNow provides features like customizable document templates, secure eSignature options, and automated workflows that can be tailored to meet the specific needs of both accountable and nonaccountable plans, enabling seamless expense management.

-

Are there pricing differences based on accountable vs nonaccountable plan usage?

While the pricing for airSlate SignNow is generally consistent, businesses may find that their usage patterns differ based on whether they adopt an accountable vs nonaccountable plan. It's advisable to evaluate your document management needs linked to each plan to select the most cost-effective option.

-

Can I integrate airSlate SignNow with other tools for managing accountable and nonaccountable plans?

Yes, airSlate SignNow integrates seamlessly with various accounting and expense management software, which helps streamline the process of handling documents related to both accountable and nonaccountable plans. This integration enhances productivity by reducing the need for manual entry and ensuring accurate record-keeping.

-

What are the benefits of using airSlate SignNow for accountable plans?

Using airSlate SignNow for accountable plans provides businesses with an easy way to manage reimbursement documentation, helps ensure compliance with IRS regulations, and simplifies the tracking of reimbursable expenses for employees. This ultimately saves time and reduces administrative burdens.

-

How does eSigning in airSlate SignNow relate to accountable vs nonaccountable plans?

eSigning in airSlate SignNow can streamline the approval process for both accountable and nonaccountable plans. By using electronic signatures, businesses can ensure that all necessary parties approve expense reimbursements efficiently, thereby reducing delays and improving overall cash flow management.

Get more for SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY

Find out other SAMPLE LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer