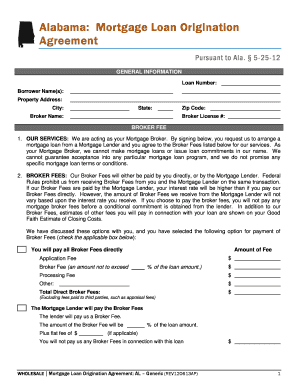

Mortgage Loan Origination Agreement Form

What is the Mortgage Loan Origination Agreement

The mortgage loan origination agreement is a crucial document that outlines the terms and conditions between a borrower and a lender during the loan application process. This agreement specifies the responsibilities of both parties, including fees, interest rates, and the duration of the loan. It serves as a formal contract that initiates the mortgage process, ensuring that both the lender and borrower understand their obligations. This document is essential for establishing a transparent relationship and protecting the interests of both parties involved in the transaction.

Key Elements of the Mortgage Loan Origination Agreement

Several key elements define the mortgage loan origination agreement, making it a comprehensive document. These elements typically include:

- Loan Amount: The total amount of money the borrower is seeking to borrow.

- Interest Rate: The percentage charged on the loan, which can be fixed or variable.

- Loan Term: The duration over which the loan will be repaid, often ranging from fifteen to thirty years.

- Fees: Any associated costs, including origination fees, appraisal fees, and closing costs.

- Conditions: Specific requirements that must be met for the loan to be approved, such as credit score and income verification.

Understanding these elements is vital for borrowers to make informed decisions about their mortgage options.

Steps to Complete the Mortgage Loan Origination Agreement

Completing the mortgage loan origination agreement involves several important steps. These steps ensure that all necessary information is accurately provided and that the agreement is legally binding:

- Gather Documentation: Collect all required documents, including proof of income, credit history, and identification.

- Fill Out the Agreement: Provide accurate information in the agreement, ensuring that all fields are completed.

- Review Terms: Carefully read through the terms and conditions, paying close attention to interest rates and fees.

- Sign the Agreement: Both parties must sign the document, either electronically or physically, to validate the agreement.

- Submit the Agreement: Send the completed agreement to the lender for processing.

Following these steps helps facilitate a smooth loan origination process.

Legal Use of the Mortgage Loan Origination Agreement

The legal use of the mortgage loan origination agreement is governed by various laws and regulations. In the United States, the agreement must comply with federal and state laws regarding lending practices. This includes adherence to the Truth in Lending Act (TILA), which mandates clear disclosure of loan terms, and the Real Estate Settlement Procedures Act (RESPA), which requires transparency in closing costs. Ensuring that the agreement meets these legal standards protects both the lender and the borrower and upholds the integrity of the mortgage process.

How to Obtain the Mortgage Loan Origination Agreement

Obtaining a mortgage loan origination agreement is a straightforward process. Borrowers can typically acquire this document through their lender or mortgage broker. Many lenders provide a digital version of the agreement on their websites, allowing for easy access and completion. Additionally, borrowers can request a physical copy during their initial consultation with the lender. It is essential to ensure that the agreement is tailored to the specific loan being sought, as different lenders may have varying formats and requirements.

Digital vs. Paper Version of the Mortgage Loan Origination Agreement

Both digital and paper versions of the mortgage loan origination agreement serve the same purpose, but they come with distinct advantages. The digital version allows for easier editing, faster processing, and the convenience of eSigning, which can expedite the loan origination process. In contrast, the paper version may be preferred by those who feel more comfortable with physical documents or who wish to keep a hard copy for their records. Regardless of the format, it is crucial that the agreement is filled out accurately and signed by both parties to ensure its validity.

Quick guide on how to complete mortgage loan origination agreement 42889008

Easily Prepare Mortgage Loan Origination Agreement on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without interruptions. Handle Mortgage Loan Origination Agreement on any platform with airSlate SignNow apps for Android or iOS and enhance any document-driven procedure today.

Effortlessly Modify and eSign Mortgage Loan Origination Agreement

- Find Mortgage Loan Origination Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent parts of your documents or redact sensitive information using the tools airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Mortgage Loan Origination Agreement and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage loan origination agreement?

A mortgage loan origination agreement is a legal document outlining the terms under which a lender will originate a mortgage loan. This agreement typically includes details about the fees, interest rates, and the obligations of both the borrower and the lender. Understanding this agreement is crucial for borrowers to ensure transparency throughout the mortgage process.

-

How does airSlate SignNow facilitate the mortgage loan origination agreement process?

airSlate SignNow streamlines the creation and signing of mortgage loan origination agreements with its intuitive eSignature solution. Users can easily upload their documents, invite stakeholders to sign, and track document progress in real-time. This simplifies the overall process, making it faster and more efficient for all parties involved.

-

What are the benefits of using airSlate SignNow for mortgage loan origination agreements?

Using airSlate SignNow for mortgage loan origination agreements provides multiple benefits, including improved efficiency, enhanced security, and reduced paper usage. The platform ensures that documents are securely signed and stored, helping to mitigate risks associated with traditional paper workflows. Additionally, it supports a smoother transaction experience for both lenders and borrowers.

-

What are the pricing options for airSlate SignNow when handling mortgage loan origination agreements?

airSlate SignNow offers a variety of pricing plans suitable for different business needs, including packages that cater specifically to handling mortgage loan origination agreements. Pricing tiers range from basic plans for startups to advanced features for larger organizations, ensuring that you can find a cost-effective solution that meets your requirements. Contact our sales team for detailed pricing information tailored to your needs.

-

Can airSlate SignNow integrate with other software for mortgage loan origination agreements?

Yes, airSlate SignNow integrates seamlessly with various CRM and financial software applications, enabling a streamlined process for mortgage loan origination agreements. This ensures that data flows smoothly between systems, reducing manual entry and errors. Popular integrations include platforms like Salesforce, HubSpot, and QuickBooks, enhancing overall productivity.

-

What types of businesses can benefit from using airSlate SignNow for mortgage loan origination agreements?

Any business involved in the lending process can benefit from using airSlate SignNow for mortgage loan origination agreements. This includes mortgage brokers, banks, credit unions, and real estate companies. By adopting an eSigning solution, these businesses can improve customer experience and speed up the loan origination process.

-

Is airSlate SignNow compliant with regulations for mortgage loan origination agreements?

Absolutely, airSlate SignNow adheres to strict compliance regulations to ensure that all mortgage loan origination agreements are legally binding and secure. The platform meets industry standards, including eSignature laws like ESIGN and UETA, offering peace of mind to both lenders and borrowers. This compliance is essential for maintaining trust and ensuring the validity of signed agreements.

Get more for Mortgage Loan Origination Agreement

Find out other Mortgage Loan Origination Agreement

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template