List of Itemized Deductions Worksheet Form

What is the teacher deduction worksheet?

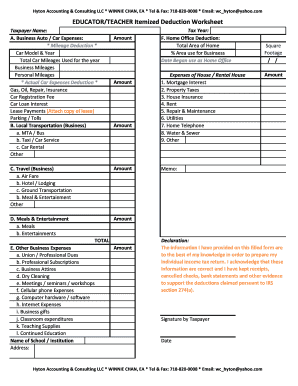

The teacher deduction worksheet is a specialized tax form designed for educators to track and report eligible expenses incurred in the course of their teaching duties. This worksheet allows teachers to itemize deductions for various expenses, such as classroom supplies, professional development courses, and other educational materials. By using this worksheet, educators can ensure they maximize their tax benefits while complying with IRS regulations. It is particularly beneficial for teachers who may not receive full reimbursement for out-of-pocket expenses related to their profession.

How to use the teacher deduction worksheet

Using the teacher deduction worksheet involves a few straightforward steps. First, gather all relevant receipts and documentation for expenses you wish to claim. This may include items such as books, supplies, and educational software. Next, fill out the worksheet by entering each expense in the designated sections. Be sure to categorize your expenses accurately to ensure compliance with IRS guidelines. Once completed, you can transfer the totals to your tax return, allowing you to claim the deductions effectively.

Key elements of the teacher deduction worksheet

The teacher deduction worksheet includes several key elements that help educators itemize their expenses. These elements typically consist of:

- Expense categories: Sections for different types of expenses, such as classroom supplies, professional development, and technology.

- Total expenses: A summary section where educators can total their deductions for easy reporting.

- Signature and date: A place for the educator to sign and date the worksheet, affirming the accuracy of the information provided.

Understanding these elements can help ensure that all eligible deductions are captured accurately.

Steps to complete the teacher deduction worksheet

Completing the teacher deduction worksheet involves a systematic approach. Here are the steps to follow:

- Collect receipts: Gather all receipts and documentation for eligible expenses.

- Fill in the worksheet: Enter each expense in the appropriate category on the worksheet.

- Calculate totals: Add up the expenses in each category to determine your total deductions.

- Review for accuracy: Double-check all entries for accuracy and completeness.

- Sign and date: Sign and date the worksheet to validate the information provided.

Following these steps can help ensure that the worksheet is completed correctly and efficiently.

IRS guidelines for the teacher deduction worksheet

The IRS provides specific guidelines for educators regarding the use of the teacher deduction worksheet. According to IRS rules, teachers can deduct up to a certain amount for unreimbursed expenses related to their profession. It is essential to keep accurate records and receipts to substantiate any claims made on the worksheet. Additionally, educators should be aware of any changes in tax laws that may affect their eligibility for deductions, as these can vary from year to year.

Eligibility criteria for using the teacher deduction worksheet

To use the teacher deduction worksheet, educators must meet specific eligibility criteria set by the IRS. Generally, the primary requirements include:

- Being a qualified educator, which typically means teaching kindergarten through grade twelve.

- Incurring unreimbursed expenses for classroom supplies and materials.

- Meeting the income thresholds as defined by the IRS for the tax year in question.

Understanding these criteria can help educators determine their eligibility for claiming deductions on their tax returns.

Quick guide on how to complete list of itemized deductions worksheet

Effortlessly Prepare List Of Itemized Deductions Worksheet on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle List Of Itemized Deductions Worksheet on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign List Of Itemized Deductions Worksheet with Ease

- Find List Of Itemized Deductions Worksheet and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choosing. Edit and eSign List Of Itemized Deductions Worksheet and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a teacher deduction worksheet and how can it help me?

A teacher deduction worksheet is a useful tool that allows educators to track various expenses they can deduct on their taxes. By organizing expenses such as classroom supplies and professional development costs, you can maximize your eligible deductions, ultimately lowering your taxable income. Therefore, using a teacher deduction worksheet can signNowly benefit your annual tax preparation.

-

Does airSlate SignNow offer a template for the teacher deduction worksheet?

Yes, airSlate SignNow provides customizable templates, including a teacher deduction worksheet. This means teachers can easily input their expenses and organize their financial records efficiently. Our platform helps you streamline the completion and submission of your deduction worksheet, saving you time during tax season.

-

How much does it cost to use airSlate SignNow for my teacher deduction worksheet?

airSlate SignNow offers flexible pricing plans that cater to various budgets. Our competitive plans include features for efficiently managing your teacher deduction worksheet, such as e-signing and document storage. You can choose the plan that fits your needs without compromising on the quality of service.

-

Can I integrate airSlate SignNow with other tools to manage my teacher deduction worksheet?

Absolutely! airSlate SignNow seamlessly integrates with various productivity and accounting tools. This allows you to easily link your teacher deduction worksheet with other platforms you may be using, ensuring a smooth and efficient workflow. Integrations facilitate easy data transfer and document management.

-

What features does airSlate SignNow provide for managing my teacher deduction worksheet?

With airSlate SignNow, you can take advantage of features such as e-signatures, document sharing, and secure storage for your teacher deduction worksheet. Additionally, our user-friendly interface simplifies the process of organizing and accessing your financial documents. You can track all related documents in one place, making tax preparation stress-free.

-

Is my data safe when I use airSlate SignNow for my teacher deduction worksheet?

Yes, airSlate SignNow prioritizes the security and privacy of all user data. We provide encrypted storage and advanced security measures to ensure that your teacher deduction worksheet remains confidential. Our commitment to data protection allows you to focus on your tasks without worrying about data bsignNowes.

-

How do I access my teacher deduction worksheet after signing it on airSlate SignNow?

After signing your teacher deduction worksheet on airSlate SignNow, you can access it anytime through your secure account. You can download or share the signed document with ease, ensuring you have it readily available for tax filing or record-keeping. Our platform keeps your signed documents organized for quick retrieval.

Get more for List Of Itemized Deductions Worksheet

Find out other List Of Itemized Deductions Worksheet

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy