ST30, Notice of Business Change Minnesota Department of Revenue Revenue State Mn Form

What is the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn

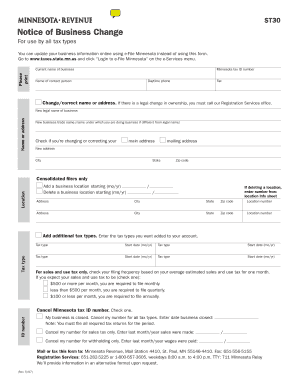

The ST30, Notice of Business Change, is a form used by businesses in Minnesota to officially notify the Minnesota Department of Revenue about changes in their business structure or operations. This includes updates on ownership, business name, or address changes. Filing this form is essential for maintaining compliance with state regulations and ensuring that the Department of Revenue has accurate records regarding your business activities.

Steps to complete the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn

Completing the ST30 form involves several important steps:

- Gather necessary information: Collect details about your business, including your current business name, address, and the specific changes you are reporting.

- Fill out the form: Accurately complete all required fields on the ST30 form, ensuring that all information is correct and up-to-date.

- Review the form: Double-check the completed form for any errors or omissions that could delay processing.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person, as specified by the Minnesota Department of Revenue.

How to use the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn

The ST30 form is utilized by businesses to communicate significant changes to their operational status. To use the form effectively, ensure that you provide detailed and accurate information regarding the changes being made. This may involve specifying the nature of the change, such as a new business address or a change in ownership structure. Proper use of the form helps avoid potential compliance issues and ensures that the state has the most current information about your business.

Legal use of the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn

The legal use of the ST30 form is crucial for businesses operating in Minnesota. Filing the form correctly and on time ensures compliance with state laws and regulations. It is legally binding once submitted and can be used as evidence of changes in your business structure should any disputes arise. Adhering to the guidelines set forth by the Minnesota Department of Revenue helps protect your business from potential penalties or legal complications.

Required Documents

When submitting the ST30 form, certain documents may be required to support your changes. Commonly required documents include:

- Proof of identity for the business owner(s)

- Documentation supporting the change, such as a new lease agreement or partnership agreement

- Any prior business registration documents that may need updating

Form Submission Methods (Online / Mail / In-Person)

The ST30 form can be submitted through various methods, depending on what is most convenient for your business:

- Online: Many businesses opt to submit the form electronically through the Minnesota Department of Revenue's online portal.

- By Mail: You can also print the completed form and send it via postal service to the designated office.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local Department of Revenue office is an option.

Quick guide on how to complete st30 notice of business change minnesota department of revenue revenue state mn

Effortlessly prepare ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without unnecessary wait times. Handle ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-related workflow today.

How to edit and eSign ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn with ease

- Locate ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn?

The ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn, is a form used to notify the Minnesota Department of Revenue about changes in your business status. This form ensures that your business records are up-to-date, which is crucial for compliance with state regulations.

-

How can airSlate SignNow help with the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn?

airSlate SignNow streamlines the process of completing and eSigning the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn. Our platform allows you to fill out the form digitally, making it easy to manage and submit your business changes efficiently.

-

Is airSlate SignNow cost-effective for handling forms like ST30?

Yes, airSlate SignNow offers an affordable solution for handling documents like the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn. Our pricing plans are designed to cater to businesses of all sizes, providing signNow value without compromising on features.

-

What features does airSlate SignNow provide for managing the ST30 form?

With airSlate SignNow, you have access to features like document templates, secure eSigning, and easy sharing options for forms such as the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn. These features enhance the efficiency of your document management process.

-

Can I integrate airSlate SignNow with other tools I use for my business?

Absolutely! airSlate SignNow integrates with various business tools and applications, making it easier to manage the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn alongside your existing workflows. This integration streamlines processes and improves productivity.

-

What benefits do I gain by using airSlate SignNow for the ST30 form?

Using airSlate SignNow for the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn comes with benefits such as faster processing times, reduced paperwork, and improved compliance. Our solution helps you keep track of your submissions, ensuring you meet all necessary deadlines.

-

Is it easy to learn how to use airSlate SignNow for the ST30 form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to use it for forms like the ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn. Our comprehensive support resources and tutorials help users navigate the platform with ease.

Get more for ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn

Find out other ST30, Notice Of Business Change Minnesota Department Of Revenue Revenue State Mn

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter