Internal Revenue Service Plan Form

What is the Internal Revenue Service Plan

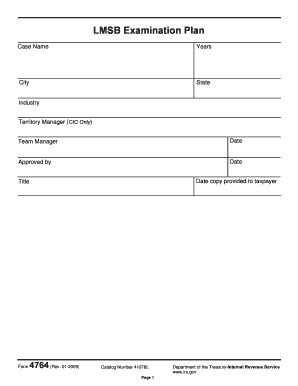

The Internal Revenue Service (IRS) Plan refers to the structured approach used by the IRS to manage tax compliance and enforcement. This plan outlines the procedures and guidelines that taxpayers must follow to ensure they meet their tax obligations. It includes various forms, such as the 4764 form, which is specifically designed for certain tax examinations and compliance checks. Understanding the IRS Plan is crucial for individuals and businesses to navigate their tax responsibilities effectively.

Steps to complete the Internal Revenue Service Plan

Completing the Internal Revenue Service Plan involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and previous tax returns. Next, carefully review the specific requirements outlined for the 4764 form, as these will guide the information you need to provide. Fill out the form completely, ensuring that all sections are addressed. After completing the form, double-check for any errors or omissions before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by the IRS.

Legal use of the Internal Revenue Service Plan

The legal use of the Internal Revenue Service Plan is essential for ensuring that all tax-related activities comply with federal regulations. The IRS Plan provides a framework that outlines the legal obligations of taxpayers and the rights they hold. When completing forms like the 4764, it is important to adhere to the guidelines set forth by the IRS to avoid potential penalties or legal issues. Utilizing a reliable eSignature solution can enhance the legal validity of the documents submitted, ensuring compliance with relevant laws such as ESIGN and UETA.

Key elements of the Internal Revenue Service Plan

Key elements of the Internal Revenue Service Plan include compliance requirements, documentation standards, and submission procedures. Compliance requirements dictate the obligations taxpayers must fulfill, including accurate reporting of income and expenses. Documentation standards specify the types of records that must be maintained and submitted, such as financial statements and tax returns. Submission procedures outline how and when forms must be filed, including deadlines and acceptable submission methods. Understanding these elements helps taxpayers navigate their responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines and important dates are critical components of the Internal Revenue Service Plan. Taxpayers must be aware of specific dates for submitting forms like the 4764 to avoid penalties. Typically, the IRS sets annual deadlines for tax filings, which vary depending on the type of taxpayer (individual, business, etc.). It is advisable to keep a calendar of these important dates to ensure timely compliance and avoid any late fees or interest charges.

Required Documents

When preparing to complete the Internal Revenue Service Plan, it is essential to gather all required documents. These may include financial statements, previous tax returns, and any supporting documentation relevant to the 4764 form. Ensuring that all necessary documents are in order can streamline the completion process and help avoid delays or complications during submission. Taxpayers should check the IRS guidelines for a comprehensive list of required documents specific to their situation.

Quick guide on how to complete internal revenue service plan

Effortlessly Prepare Internal Revenue Service Plan on Any Device

The management of documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Internal Revenue Service Plan on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric operation today.

Effortless Editing and eSigning of Internal Revenue Service Plan

- Obtain Internal Revenue Service Plan and select Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal weight as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your updates.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Internal Revenue Service Plan to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 4764?

airSlate SignNow is an electronic signature platform that enables businesses to send and sign documents effortlessly. By using the code '4764', users can access special features that streamline the signing process, making document management more efficient.

-

What are the pricing plans for airSlate SignNow for the code 4764?

The pricing plans for airSlate SignNow vary based on features and user needs. Using the promotional code '4764' can provide potential discounts, making it a cost-effective solution for businesses looking to enhance their document workflow.

-

What features does airSlate SignNow offer that incorporate 4764?

airSlate SignNow offers a range of features such as mobile signing, templates, and document tracking. The code '4764' specifically highlights advanced functionalities that empower users to customize their document workflows easily.

-

How can airSlate SignNow benefit my business using 4764?

By utilizing airSlate SignNow, businesses can experience faster turnaround times and reduced paperwork. The benefits associated with code '4764' enhance collaboration and save resources, leading to improved overall efficiency.

-

What integrations does airSlate SignNow support when using the 4764 code?

airSlate SignNow integrates seamlessly with various applications, including CRMs and cloud storage solutions. Utilizing the '4764' code can unlock integrations that facilitate better data sharing and communication across platforms.

-

Is airSlate SignNow secure for handling documents with the 4764 code?

Yes, airSlate SignNow prioritizes security and employs encryption to protect your documents. When using the code '4764', additional security features are accessible, ensuring that sensitive information remains confidential.

-

Can I try airSlate SignNow for free with the 4764 code?

Yes, airSlate SignNow often offers free trials for new users. Entering the code '4764' during signup can allow trial users to explore premium features, helping them determine the platform's fit for their needs.

Get more for Internal Revenue Service Plan

- Epf form 12a in excel format download

- Da form 7667

- Change family unit sask health form

- Ti 021a form

- Childrens florida obsessive compulsive inventory pdf form

- Ssa pain questionnaire pdf form

- Form 8493 notification regarding a death in home and community based services hcs texas home living txhml and deaf blind with

- Gravamen de proteccin civil autoliquidacin form

Find out other Internal Revenue Service Plan

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile