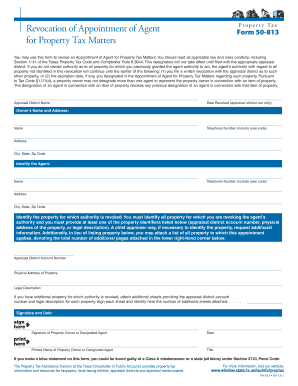

Appointment Agent Property Tax Form

What is the Appointment Agent Property Tax

The Appointment Agent Property Tax is a legal designation that allows a property owner in Texas to appoint an individual or entity to act on their behalf regarding property tax matters. This agent can manage communications with tax authorities, file necessary documents, and represent the property owner during tax assessments or disputes. Understanding this designation is crucial for property owners who wish to streamline their tax management processes.

Steps to Complete the Appointment Agent Property Tax

Completing the Appointment Agent Property Tax involves several straightforward steps:

- Obtain the appropriate form from the Texas Comptroller's website or local tax office.

- Fill out the form with accurate information, including details about the property and the appointed agent.

- Sign the form to validate your appointment of the agent.

- Submit the completed form to your local appraisal district, either online, by mail, or in person.

Following these steps ensures that your appointment is processed efficiently and legally recognized.

Legal Use of the Appointment Agent Property Tax

Utilizing the Appointment Agent Property Tax is governed by state laws and regulations. It is essential that the appointed agent acts within the legal framework set by the Texas Property Tax Code. This includes adhering to deadlines for filing and responding to tax notices. Failure to comply with these regulations can lead to penalties or invalidation of the appointment.

Required Documents

When completing the Appointment Agent Property Tax, certain documents are required to ensure the process is valid:

- The completed Appointment Agent form.

- Proof of identity for both the property owner and the appointed agent.

- Any additional documentation that may support the appointment, such as a power of attorney.

Gathering these documents ahead of time can facilitate a smoother submission process.

Eligibility Criteria

To appoint an agent for property tax matters in Texas, the property owner must meet specific eligibility criteria. These include being the legal owner of the property and having the authority to make decisions regarding property taxes. Additionally, the appointed agent must be an individual or entity capable of fulfilling the responsibilities associated with property tax management.

Form Submission Methods

Property owners can submit the Appointment Agent Property Tax form through various methods:

- Online: Many appraisal districts offer online submission options for convenience.

- Mail: Forms can be printed and sent via postal service to the local appraisal district.

- In-Person: Property owners can also deliver the form directly to the appraisal district office.

Choosing the right submission method can help ensure timely processing of your appointment.

Quick guide on how to complete appointment agent property tax

Prepare Appointment Agent Property Tax effortlessly on any device

Web-based document organization has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Appointment Agent Property Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Appointment Agent Property Tax effortlessly

- Locate Appointment Agent Property Tax and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign functionality, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you'd like to send your form: by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Appointment Agent Property Tax and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for managing Texas tax matters?

airSlate SignNow offers robust features that streamline the management of Texas tax matters, such as electronic signatures, document tracking, and collaboration tools. Our platform ensures compliance with Texas laws and provides templates specifically designed for tax-related documents. This user-friendly solution helps businesses save time and reduce errors in their tax documentation process.

-

How does airSlate SignNow help with compliance in Texas tax matters?

With airSlate SignNow, users can easily stay compliant with Texas tax matters through its legally binding eSignatures and secure document storage. Our platform adheres to local regulations, ensuring that all electronic signatures are valid and enforceable in the state. Utilizing our tools can signNowly minimize risks associated with tax compliance.

-

What pricing plans does airSlate SignNow offer for managing Texas tax matters?

airSlate SignNow provides competitive pricing plans tailored to different business needs regarding Texas tax matters. Whether you are a small business or a large enterprise, we have flexible pricing options that allow you to choose the features that best fit your requirements. Contact us for a quote to find the right plan for your tax management needs.

-

Can airSlate SignNow be integrated with other tax software for Texas tax matters?

Yes, airSlate SignNow seamlessly integrates with various tax software solutions to help manage Texas tax matters efficiently. This integration allows for automatic data transfer and simplifies the workflow for your tax documentation process. Enhance your productivity by connecting our eSigning platform with your existing tools.

-

What benefits does airSlate SignNow provide for Texas businesses dealing with tax matters?

AirSlate SignNow offers numerous benefits for Texas businesses handling tax matters, including increased efficiency, improved collaboration, and cost savings. By digitizing the signing process, businesses can expedite their tax documentation, reducing the time spent on paper processes. Our solution also enhances security and allows for real-time tracking of document status.

-

Is there a trial period available for airSlate SignNow for Texas tax matters?

Yes, airSlate SignNow offers a free trial period, allowing users to explore our solutions for Texas tax matters without any commitment. This trial gives businesses the opportunity to test our features and determine how effectively they can manage their tax documents. Sign up today to see how airSlate SignNow can simplify your Texas tax processes.

-

How secure is airSlate SignNow for handling sensitive Texas tax matters?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to Texas tax matters. Our platform ensures that all documents and signatures are stored securely, safeguarding them against unauthorized access. You can trust airSlate SignNow to handle your tax documentation with the utmost care.

Get more for Appointment Agent Property Tax

- Nzoia sugar company organization structure form

- Proof of payment capitec form

- Romeo and juliet plot diagram form

- Stomp out loud worksheet answers key form

- Id1 form download

- New york statedepartment of statedivision of cor form

- Este documento del comit espaol de representantes de personas con discapacidad form

- Conselleria deducaci universitats i ocupaci form

Find out other Appointment Agent Property Tax

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free