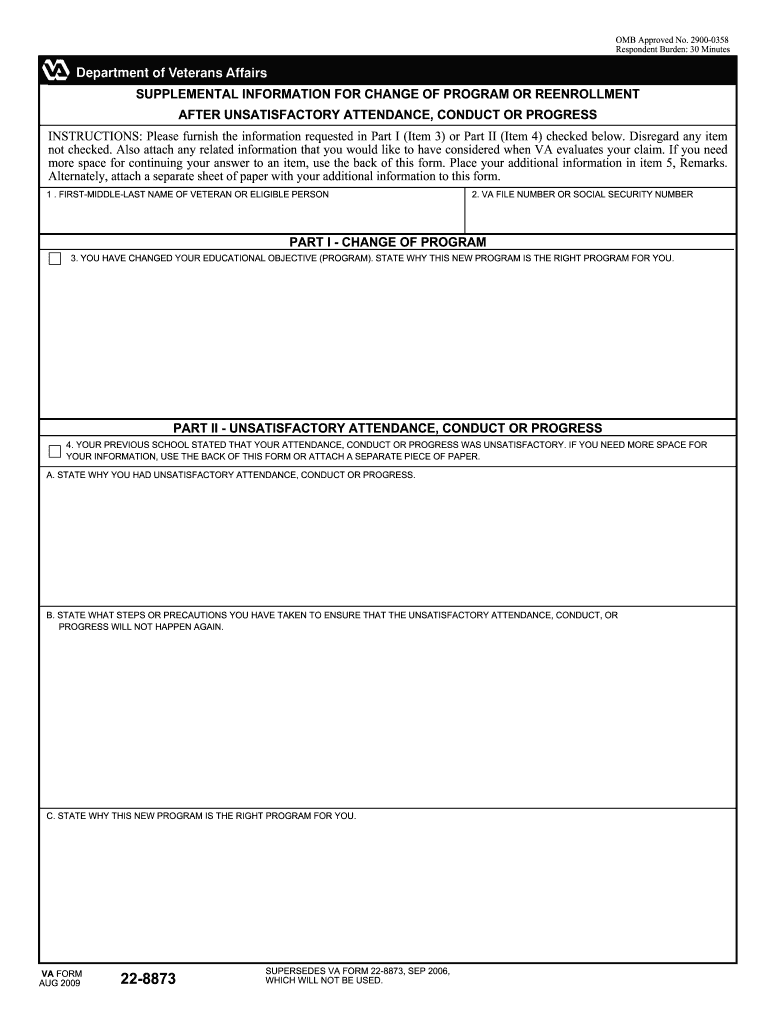

8873 2009-2026

What is the 8873?

The 8873 form, officially known as the "Program 8873 Template," is a document used primarily for tax purposes in the United States. This form is utilized to report specific information related to tax credits and deductions that may be applicable to certain programs. It is essential for individuals and businesses looking to maximize their tax benefits while ensuring compliance with IRS regulations. Understanding the purpose and requirements of the 8873 form is crucial for accurate tax filing.

How to use the 8873

Using the 8873 form involves several key steps. First, gather all necessary financial documents and information related to the tax credits or deductions you are claiming. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the IRS guidelines for the specific program associated with the 8873. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements of the IRS.

Steps to complete the 8873

Completing the 8873 form requires attention to detail and adherence to specific guidelines. Here are the essential steps:

- Review the instructions provided by the IRS for the 8873 form.

- Collect all relevant financial information, including income statements and previous tax returns.

- Fill out the form accurately, ensuring that you provide all required information.

- Double-check your entries for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the 8873

The legal use of the 8873 form is governed by IRS regulations. To ensure that your submission is legally binding, it is important to comply with all relevant tax laws and guidelines. This includes providing accurate information and submitting the form within the required timeframe. Failure to comply with these regulations may result in penalties or delays in processing your tax return. Utilizing a reliable eSignature solution can further enhance the legal standing of your completed form.

Filing Deadlines / Important Dates

Filing deadlines for the 8873 form are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, specific programs may have different deadlines. It is essential to stay informed about any changes to these dates to ensure timely submission. Mark important dates on your calendar to help manage your filing schedule effectively.

Who Issues the Form

The 8873 form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement. The IRS provides detailed instructions and guidelines for completing the form, ensuring that taxpayers have the necessary resources to comply with tax laws. It is important to refer to the official IRS website or documentation for the most accurate and up-to-date information regarding the 8873 form.

Quick guide on how to complete 8873

Easily Prepare 8873 on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the right forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle 8873 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and eSign 8873 Effortlessly

- Obtain 8873 and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Decide how you want to send your form: via email, text (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign 8873 and ensure seamless communication during every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8873

Create this form in 5 minutes!

How to create an eSignature for the 8873

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow 8873?

airSlate SignNow 8873 is a comprehensive eSignature solution designed for businesses. It enables users to send, sign, and manage documents efficiently, streamlining your workflow. With its user-friendly interface, airSlate SignNow 8873 ensures you can focus on your core activities while handling document management seamlessly.

-

How much does airSlate SignNow 8873 cost?

The pricing for airSlate SignNow 8873 is competitive, offering various plans to fit different business needs. You can choose from basic to advanced packages that provide features tailored to your specific requirements. Visit our pricing page to find the most suitable plan for your company.

-

What features does airSlate SignNow 8873 offer?

airSlate SignNow 8873 comes packed with essential features such as customizable templates, real-time tracking, and multi-party signing. Additionally, it provides secure document storage and integrations with popular applications to enhance your efficiency. These features make managing eSignatures straightforward and reliable.

-

How can airSlate SignNow 8873 benefit my business?

By using airSlate SignNow 8873, businesses can signNowly reduce the time spent on document processing. The solution promotes faster turnaround times, improved accuracy, and cost savings on paper and mailing. These benefits lead to increased productivity and satisfaction among clients and employees alike.

-

Is airSlate SignNow 8873 easy to use?

Yes, airSlate SignNow 8873 has been designed with user experience in mind. Its intuitive interface allows users to navigate effortlessly through the signing process, making it accessible for everyone, regardless of technical skill. Quick onboarding and easy-to-follow tutorials help users get started in no time.

-

Can I integrate airSlate SignNow 8873 with other apps?

Absolutely! airSlate SignNow 8873 supports a wide range of integrations with popular applications like Google Drive, Salesforce, and Microsoft 365. This capability allows you to enhance your existing workflow and synchronize your document management processes effortlessly.

-

How secure is airSlate SignNow 8873?

Security is a top priority for airSlate SignNow 8873. The platform employs advanced encryption protocols and complies with international security standards to keep your documents safe. You can confidently send and sign sensitive information knowing it is protected from unauthorized access.

Get more for 8873

- Position at finish form

- Non resident proof of financial responsibility wyoming department dot state wy form

- Beneficiarys change of address form code dm14 form trsnyc

- Client server survival guide 3rd edition pdf no download needed form

- Letter of engagement 299989160 form

- Fill and sign the appearance bond 497300397 form

- Dispossessory proceeding clayton county government claytoncountyga form

- General construction contract template form

Find out other 8873

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors