Ides Wage Questionnaire Form

What is the IDES Wage Questionnaire

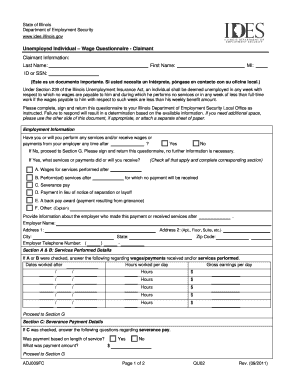

The IDES Wage Questionnaire is a crucial document used by the Illinois Department of Employment Security to gather information regarding an individual's employment status and earnings. This form is primarily utilized by individuals who are applying for unemployment benefits or need to verify their eligibility for continued assistance. The information collected helps the state assess the claimant's financial situation and determine the appropriate benefits.

Steps to Complete the IDES Wage Questionnaire

Completing the IDES Wage Questionnaire involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your employment history, wages, and any other relevant financial details. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to double-check your entries for any errors before submission. Finally, submit the questionnaire through the designated method, whether online or via mail, as specified by the Illinois Department of Employment Security.

Legal Use of the IDES Wage Questionnaire

The IDES Wage Questionnaire is legally binding when completed and submitted according to the guidelines set forth by the Illinois Department of Employment Security. This means that the information provided must be truthful and accurate, as any discrepancies could lead to penalties or denial of benefits. Compliance with state laws regarding unemployment benefits is essential for maintaining eligibility and avoiding legal repercussions.

How to Obtain the IDES Wage Questionnaire

Individuals can obtain the IDES Wage Questionnaire through the Illinois Department of Employment Security's official website. The form is typically available for download in a PDF format, allowing users to print and fill it out manually. Additionally, the questionnaire may also be accessible through local IDES offices, where individuals can request a physical copy if preferred.

Form Submission Methods

The IDES Wage Questionnaire can be submitted through various methods to accommodate different preferences. Individuals have the option to complete and submit the form online via the IDES website, which is often the quickest method. Alternatively, the completed questionnaire can be mailed to the appropriate IDES office or delivered in person. Each submission method has specific guidelines that must be followed to ensure proper processing.

Key Elements of the IDES Wage Questionnaire

The IDES Wage Questionnaire includes several key elements that are essential for accurately assessing an individual's unemployment benefits. These elements typically include personal identification information, details about previous employment, wages earned, and any additional income sources. Providing complete and accurate information in these sections is crucial for a successful application process.

Quick guide on how to complete ides wage questionnaire

Accomplish Ides Wage Questionnaire effortlessly on any gadget

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Ides Wage Questionnaire on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Ides Wage Questionnaire effortlessly

- Find Ides Wage Questionnaire and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from a device of your choice. Edit and eSign Ides Wage Questionnaire and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ides questionnaire?

An ides questionnaire is a specially designed form used to capture important information from users, enabling effective communication and streamlined processes. With airSlate SignNow, you can create customizable ides questionnaires that suit your business needs, making data collection easier and more efficient.

-

How does airSlate SignNow handle ides questionnaires?

airSlate SignNow simplifies the process of creating and managing ides questionnaires by allowing users to design forms that can be sent for electronic signatures. This feature ensures that all data gathered through your ides questionnaire is securely verified and legally binding.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows prospective customers to explore its features, including those for creating ides questionnaires. This trial period gives you the opportunity to test the functionality and see how it can benefit your business before committing to a subscription.

-

What are the key features of airSlate SignNow for ides questionnaires?

Some of the key features of airSlate SignNow for ides questionnaires include customizable templates, user-friendly editing tools, and robust security measures. These features help ensure your forms are professional, easy to understand, and compliant with regulations.

-

Can I integrate airSlate SignNow with other tools for ides questionnaires?

Absolutely! airSlate SignNow offers integrations with popular platforms like Google Drive and Salesforce, allowing you to incorporate your ides questionnaires seamlessly into your existing workflow. This helps enhance productivity and ensures that all your data is centralized.

-

What pricing plans does airSlate SignNow offer for its services?

airSlate SignNow offers several pricing plans tailored to fit different business needs and budgets. Each plan includes access to essential features, including those for creating and managing ides questionnaires, so you can select the one that best meets your requirements.

-

How can ides questionnaires benefit my business?

Using ides questionnaires through airSlate SignNow can enhance your business's operational efficiency by simplifying data collection and reducing paperwork. By digitizing the process, you can ensure quicker turnarounds and improved accuracy, ultimately leading to better customer satisfaction.

Get more for Ides Wage Questionnaire

- De 4581cto rev 6 5 04 form

- Patient exam form alf orthodontics

- Theme worksheet 4 answer key form

- Lower extremity functional scale pdf form

- Sngpl application status check by cnic 210095071 form

- Medicare preventive physical exam form

- Ga dol appeals form

- City of torrance underground electric waiver form

Find out other Ides Wage Questionnaire

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament