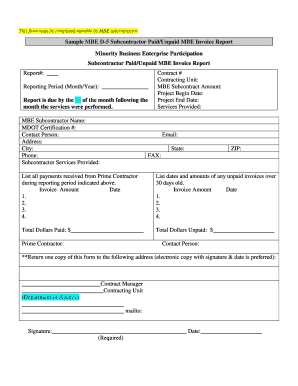

MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland Form

Understanding the unpaid invoice report

An unpaid invoice report is a crucial document for businesses, providing a detailed overview of outstanding invoices that have not yet been settled. This report helps organizations track their receivables, manage cash flow, and ensure timely follow-up with clients. It typically includes essential information such as invoice numbers, dates, amounts due, and client details, allowing businesses to prioritize collections effectively.

Steps to create an unpaid invoice report

Creating an unpaid invoice report involves several straightforward steps:

- Gather all unpaid invoices from your accounting system or records.

- Organize the invoices by date, client, or amount due to facilitate easy tracking.

- Include relevant details such as invoice numbers, issue dates, due dates, and total amounts owed.

- Consider adding notes for follow-up actions or client communications.

- Review the report for accuracy before sharing it with your team or stakeholders.

Key elements of an unpaid invoice report

To ensure your unpaid invoice report is comprehensive, include the following key elements:

- Invoice Number: A unique identifier for each invoice.

- Client Information: Name and contact details of the client responsible for payment.

- Invoice Date: The date the invoice was issued.

- Due Date: The date by which payment is expected.

- Amount Due: The total amount that remains unpaid.

- Status: Current status of the invoice (e.g., overdue, pending).

Legal considerations for unpaid invoice reports

When managing unpaid invoices, it is essential to be aware of legal considerations that may affect your reporting and collection processes. Ensure compliance with relevant laws, such as the Fair Debt Collection Practices Act (FDCPA), which governs how businesses can communicate with clients regarding debt. Additionally, maintaining accurate records can protect your business in case of disputes or legal actions.

Best practices for managing unpaid invoices

To effectively manage unpaid invoices, consider implementing these best practices:

- Send reminders promptly as the due date approaches.

- Establish clear payment terms and communicate them to clients upfront.

- Utilize electronic invoicing solutions to streamline the billing process.

- Maintain open lines of communication with clients to address any payment issues.

- Regularly review your unpaid invoice report to identify trends and areas for improvement.

Using electronic solutions for unpaid invoice reporting

Utilizing electronic solutions can enhance the efficiency of your unpaid invoice reporting process. Digital tools allow for real-time tracking of invoices, automated reminders for overdue payments, and easy generation of reports. By leveraging these technologies, businesses can reduce administrative burdens and improve cash flow management.

Quick guide on how to complete mbe attachment d 5 subcontractor paidunpaid mbe invoice report doit maryland

Complete MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an effective eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the essential tools to generate, modify, and eSign your documents swiftly without hindrances. Handle MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland with ease

- Obtain MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland and click on Get Form to commence.

- Make use of the features we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an unpaid invoice report and how can it benefit my business?

An unpaid invoice report is a detailed account of all invoices that have not yet been paid. This report helps businesses track outstanding payments and manage their cash flow effectively. By utilizing an unpaid invoice report, you can prioritize follow-ups and reduce payment delays.

-

How does airSlate SignNow streamline the process of generating an unpaid invoice report?

airSlate SignNow simplifies the creation of an unpaid invoice report by automating document management and tracking. The platform enables users to easily compile invoices, see payment statuses, and generate reports in real-time. This saves time and increases efficiency in managing unpaid invoices.

-

Can I integrate airSlate SignNow with my existing accounting software for unpaid invoice reports?

Yes, airSlate SignNow offers integrations with various accounting software solutions, allowing for seamless data transfer. This ensures that your unpaid invoice report reflects the most accurate financial data. Integrating with your existing system enhances overall financial visibility and efficiency.

-

Is there a limit to the number of invoices I can include in an unpaid invoice report?

No, airSlate SignNow does not impose a hard limit on the number of invoices that can be included in an unpaid invoice report. You can organize and manage as many invoices as needed. This scalability ensures that your reporting can grow along with your business.

-

What features does airSlate SignNow offer to improve the management of unpaid invoices?

AirSlate SignNow includes features like automated reminders, eSignature capabilities, and real-time tracking of invoice statuses. These tools enhance your ability to manage unpaid invoices effectively, reducing the risk of late payments and improving overall cash flow management.

-

How does an unpaid invoice report impact cash flow management?

An unpaid invoice report is crucial for cash flow management as it highlights outstanding debts that need to be addressed. By analyzing this report, businesses can take proactive measures to collect payments on time, ultimately improving liquidity and financial stability.

-

What is the cost associated with generating an unpaid invoice report using airSlate SignNow?

The cost of generating an unpaid invoice report with airSlate SignNow is included in the subscription plans, which are designed to be budget-friendly. The pricing is competitive for small to medium-sized businesses, ensuring you get valuable features without overspending.

Get more for MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland

Find out other MBE Attachment D 5 Subcontractor PaidUnpaid MBE Invoice Report Doit Maryland

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application