Cert 119 Form

What is the Cert 119

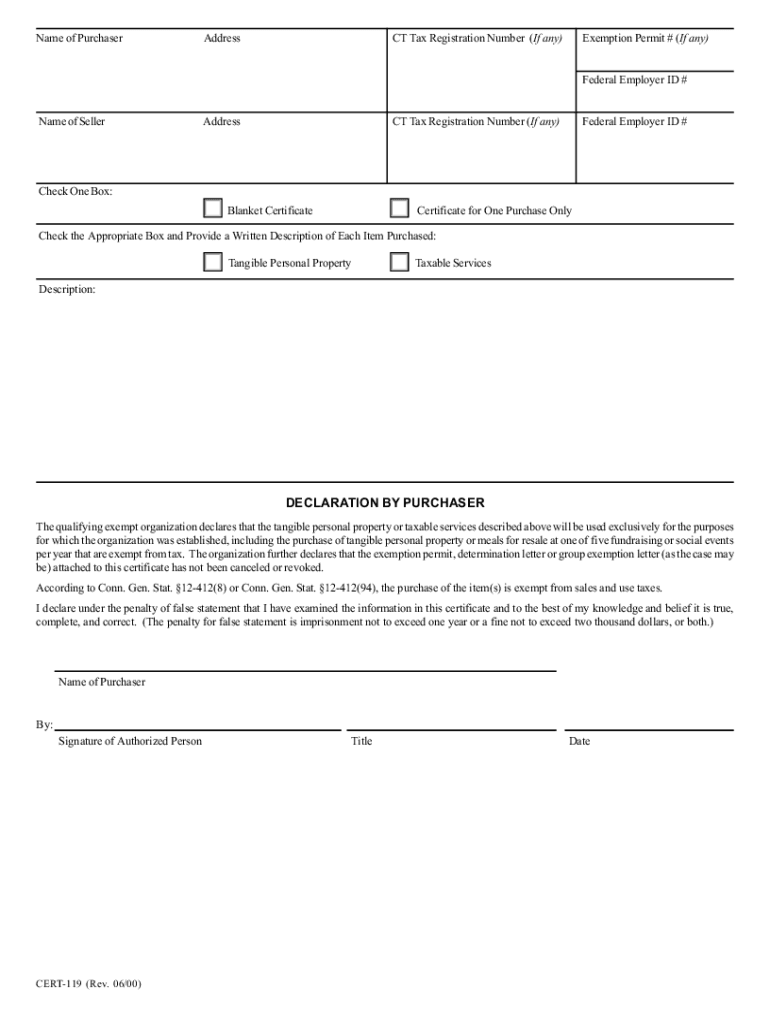

The Cert 119, also known as the exemption filed, is a form used by exempt organizations in the United States to claim exemption from certain taxes. This form is essential for entities that qualify under specific categories, allowing them to operate without the burden of certain tax liabilities. It serves as a declaration of the organization's status and is crucial for compliance with IRS regulations.

How to use the Cert 119

Using the Cert 119 involves filling out the form accurately to ensure that the exemption is recognized by the IRS. Organizations must provide detailed information about their status, including their legal name, address, and the specific type of exemption being claimed. Once completed, the form should be submitted to the appropriate tax authority for processing. It is important to keep a copy for your records.

Steps to complete the Cert 119

Completing the Cert 119 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your organization, including legal name and address.

- Identify the specific exemption category that applies to your organization.

- Fill out the Cert 119 form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the relevant tax authority, either online or by mail.

Legal use of the Cert 119

The legal use of the Cert 119 is governed by IRS guidelines and applicable state laws. To be considered valid, the form must be completed in compliance with these regulations. This includes ensuring that the organization meets the eligibility criteria for the claimed exemption. Proper use of the form helps protect the organization from potential penalties and ensures that it remains in good standing with tax authorities.

Eligibility Criteria

Eligibility for using the Cert 119 is determined by the type of organization and its specific activities. Generally, nonprofit organizations, religious institutions, and certain educational entities may qualify. To be eligible, the organization must demonstrate that it operates exclusively for exempt purposes and does not engage in activities that would disqualify it from exemption status. It is advisable to consult IRS guidelines to confirm eligibility before filing.

Form Submission Methods

The Cert 119 can be submitted through various methods, depending on the requirements of the tax authority. Organizations may choose to file the form online for quicker processing, or they can send it via mail. In-person submission may also be an option in certain jurisdictions. Each method has its advantages, and organizations should select the one that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete cert 119

Execute Cert 119 seamlessly on any gadget

Digital document administration has gained immense traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your paperwork swiftly and without obstacles. Manage Cert 119 on any device through the airSlate SignNow applications for Android or iOS, and streamline any document-centric process today.

The easiest way to modify and electronically sign Cert 119 without effort

- Locate Cert 119 and click on Get Form to begin.

- Employ the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or redact sensitive data with tools specifically provided by airSlate SignNow for that function.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred way to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Cert 119 and maintain excellent communication at every step of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is cert 119 in relation to airSlate SignNow?

Cert 119 refers to the certification that ensures compliance and security standards in electronic signature solutions. With airSlate SignNow, users can trust that their signed documents meet the strict criteria outlined in cert 119, enhancing the reliability of their electronic transactions.

-

How does airSlate SignNow support businesses looking for cert 119 compliance?

airSlate SignNow offers features that are designed to adhere to the cert 119 standards. By implementing strong encryption and secure document handling processes, businesses can confidently sign and send important documents while remaining compliant with industry regulations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides several pricing tiers to accommodate various business needs, all while ensuring compliance with cert 119. Plans start with a basic tier offering essential features and go up to advanced plans that include integrations and additional security measures. You can select the best fit based on your business requirements.

-

What features does airSlate SignNow offer to enhance document security?

AirSlate SignNow includes features such as secure cloud storage, user authentication, and audit trails, all supporting cert 119 compliance. These features protect sensitive data and ensure that electronic signatures are legally binding, adding an additional layer of confidence for users.

-

Can airSlate SignNow integrate with other software tools for enhanced workflow?

Yes, airSlate SignNow offers various integrations with popular software tools like CRM systems and document management software, ensuring that your processes remain smooth and compliant with cert 119. This flexibility enhances workflow efficiency and simplifies document management across platforms.

-

What are the benefits of using airSlate SignNow for electronic signatures?

Using airSlate SignNow for electronic signatures provides numerous benefits, including increased efficiency, reduced paper usage, and compliance with cert 119. The platform's user-friendly interface simplifies the signing process, making it easier for both senders and recipients to manage documents.

-

How do I get started with airSlate SignNow and cert 119 compliance?

Getting started with airSlate SignNow is easy and involves signing up for a free trial to explore the platform's capabilities related to cert 119. The onboarding process includes step-by-step guides and resources to help you understand how to integrate eSignatures into your workflows seamlessly.

Get more for Cert 119

Find out other Cert 119

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe