Gap Addendum Form

What is the Gap Addendum

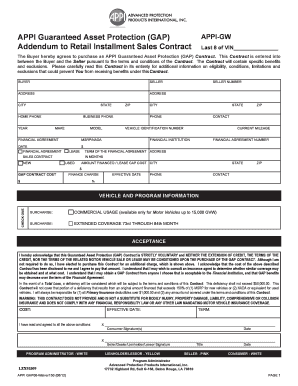

The Gap Addendum is a legal document that serves to bridge the difference between the amount owed on a vehicle and its actual cash value in the event of a total loss. This addendum is often included in auto financing agreements to protect borrowers from financial loss. When a vehicle is declared a total loss by an insurance company, the Gap Addendum ensures that the borrower is not left with a deficit, especially if the vehicle's value has depreciated significantly. Understanding this addendum is essential for anyone financing a vehicle, as it can provide crucial financial protection.

Steps to Complete the Gap Addendum

Completing the Gap Addendum involves several straightforward steps to ensure that all necessary information is accurately provided. Start by gathering relevant documents, such as the vehicle purchase agreement and insurance policy details. Next, fill out the addendum with the required information, including the vehicle identification number (VIN), purchase price, and any financing details. It is important to review the addendum for accuracy before signing. Finally, submit the completed addendum to the lender or dealership as part of your financing agreement.

Legal Use of the Gap Addendum

The Gap Addendum is legally binding when properly executed, meaning that it must adhere to specific legal requirements to be enforceable. This includes ensuring that both parties—typically the borrower and the lender—sign the document. Additionally, the addendum must clearly outline the terms of coverage, including any limitations or exclusions. Legal compliance is crucial for the addendum to provide the intended protection in the event of a total loss of the vehicle.

Key Elements of the Gap Addendum

Several key elements are essential to the Gap Addendum. These include:

- Vehicle Information: Details such as the VIN, make, model, and year of the vehicle.

- Purchase Price: The total amount financed for the vehicle.

- Insurance Details: Information about the borrower's insurance coverage, including policy numbers and coverage limits.

- Terms of Coverage: Specific conditions under which the gap coverage applies, including any exclusions.

- Signatures: Signatures from both the borrower and the lender to validate the agreement.

How to Obtain the Gap Addendum

Obtaining the Gap Addendum typically occurs during the vehicle financing process. When purchasing a vehicle, inquire with the dealership or lender about including a Gap Addendum in your financing agreement. They can provide the necessary documentation and explain the terms of the addendum. If you are refinancing or need a separate addendum, you may also contact your insurance provider or a financial institution that offers gap insurance products.

Examples of Using the Gap Addendum

Understanding practical scenarios can illustrate the importance of the Gap Addendum. For instance, if a borrower finances a car for twenty thousand dollars and, after an accident, the insurance company determines the car's value to be twelve thousand dollars, the borrower would still owe eight thousand dollars on the loan. The Gap Addendum would cover this difference, preventing the borrower from having to pay out of pocket. Another example is when a borrower trades in a vehicle that has depreciated significantly; the addendum can help ensure that any remaining balance on the loan is covered in case of a total loss.

Quick guide on how to complete gap addendum

Prepare Gap Addendum effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a flawless eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Gap Addendum on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task immediately.

The easiest method to modify and eSign Gap Addendum seamlessly

- Search for Gap Addendum and then click Get Form to begin.

- Employ the tools at your disposal to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Gap Addendum and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the appi gap in relation to airSlate SignNow?

The appi gap refers to the distance between the functionality of traditional document signing methods and the capabilities offered by modern eSignature solutions like airSlate SignNow. By closing this appi gap, businesses can enhance their efficiency and streamline document workflows.

-

How does airSlate SignNow help in reducing the appi gap?

airSlate SignNow bridges the appi gap by providing a user-friendly platform that simplifies document sending and signing. Its comprehensive features enable businesses to manage eSignatures seamlessly, making it easier to adopt digital solutions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, effectively addressing the appi gap for different sizes of organizations. Users can choose from individual plans or team subscriptions to find the right fit for their document management requirements.

-

What features does airSlate SignNow provide to improve document management?

Key features of airSlate SignNow include customizable templates, advanced security measures, and real-time tracking of document status. These features effectively close the appi gap, ensuring users can efficiently manage their eSignature needs.

-

What benefits can businesses expect from using airSlate SignNow?

Businesses can expect increased productivity, faster turnaround times, and reduced paper usage from integrating airSlate SignNow. By leveraging this eSignature solution, companies can signNowly minimize the appi gap and enhance their operational workflows.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers robust integrations with various CRM, accounting, and productivity tools. This capability helps organizations bridge the appi gap, allowing for seamless data transfer and improved collaboration across platforms.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be cost-effective and easy to use, making it an excellent choice for small businesses looking to address the appi gap in their document signing processes. Its scalability ensures that businesses can grow without switching platforms.

Get more for Gap Addendum

Find out other Gap Addendum

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple