Vehicle Dealer Inventory Loan Notice Michigan Form

Understanding the Vehicle Dealer Inventory Loan Notice in Michigan

The Vehicle Dealer Inventory Loan Notice in Michigan is a crucial document for businesses involved in vehicle sales. This notice serves as a formal declaration to lenders regarding the inventory held by a dealer. It is essential for securing financing, as it provides lenders with a clear understanding of the assets that are being financed. The notice must comply with state regulations to ensure its validity and effectiveness.

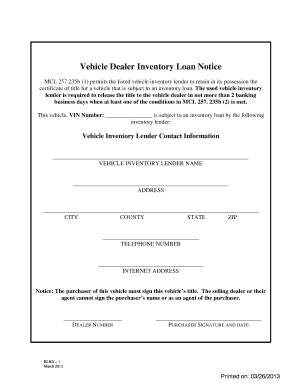

How to Complete the Vehicle Dealer Inventory Loan Notice in Michigan

Completing the Vehicle Dealer Inventory Loan Notice involves several key steps. First, gather all necessary information about the vehicles in your inventory, including make, model, year, and Vehicle Identification Number (VIN). Next, accurately fill out the form, ensuring that all details are correct and up-to-date. Once completed, the notice must be signed by an authorized representative of the dealership to validate the document. It is advisable to keep a copy for your records.

Legal Considerations for the Vehicle Dealer Inventory Loan Notice in Michigan

The legal use of the Vehicle Dealer Inventory Loan Notice is governed by Michigan state law. This document must meet specific legal requirements to be considered valid. For instance, it should include accurate descriptions of the inventory and be signed by the appropriate parties. Compliance with these regulations ensures that the notice is enforceable in the event of a dispute or audit.

Key Elements of the Vehicle Dealer Inventory Loan Notice in Michigan

Several key elements must be included in the Vehicle Dealer Inventory Loan Notice for it to be effective. These include:

- Dealer Information: Name, address, and contact details of the dealership.

- Inventory Details: Comprehensive list of vehicles, including make, model, year, and VIN.

- Lender Information: Name and contact details of the financial institution providing the loan.

- Signatures: Authorized signatures from both the dealer and lender.

Obtaining the Vehicle Dealer Inventory Loan Notice in Michigan

To obtain the Vehicle Dealer Inventory Loan Notice, dealers can access the form through state regulatory websites or financial institutions that provide the necessary documentation. It is important to ensure that the form is the most current version to comply with Michigan's legal requirements. Additionally, consulting with a legal advisor or financial expert can provide guidance on the proper completion and submission of the notice.

Examples of Using the Vehicle Dealer Inventory Loan Notice in Michigan

There are various scenarios in which the Vehicle Dealer Inventory Loan Notice may be utilized. For example, a dealership looking to expand its inventory may use the notice to secure additional financing from a lender. Similarly, if a dealer is facing cash flow issues, this notice can help in obtaining a loan against the existing inventory to maintain operations. Each instance highlights the importance of accurately completing and submitting the notice to ensure financial stability.

Quick guide on how to complete vehicle dealer inventory loan notice michigan

Effortlessly Complete Vehicle Dealer Inventory Loan Notice Michigan on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Handle Vehicle Dealer Inventory Loan Notice Michigan on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

How to Alter and eSign Vehicle Dealer Inventory Loan Notice Michigan with Ease

- Obtain Vehicle Dealer Inventory Loan Notice Michigan and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your edits.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, the hassle of tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Vehicle Dealer Inventory Loan Notice Michigan to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What types of loan options are available in Michigan?

In Michigan, borrowers can explore various loan options, including personal loans, auto loans, and home loans. Each type of loan Michigan offers has different terms and interest rates, catering to specific needs. It's essential to compare options to find the one that best suits your situation.

-

How can I apply for a loan in Michigan?

Applying for a loan Michigan is straightforward. You typically start by filling out an online application with your lender, providing essential information such as your income and credit score. After submission, lenders usually conduct a review and guide you through the approval process.

-

What are the average interest rates for loans in Michigan?

Interest rates for loan Michigan can vary signNowly based on the type of loan and the borrower's creditworthiness. As of recent data, personal loans may have rates starting around 6%, while mortgage loans can range from 3% to 4%. Always check with multiple lenders to ensure you secure a competitive rate.

-

Can I get a loan in Michigan with bad credit?

Yes, obtaining a loan Michigan with bad credit is possible, though it may come with higher interest rates. Lenders often provide specialized loan products for individuals with less-than-perfect credit. Make sure to research options and speak with lenders who focus on bad credit loans.

-

What documents are needed for a loan application in Michigan?

When applying for a loan Michigan, you typically need to provide identification, proof of income, and financial statements. Additional documents may include tax returns and employment verification. Having these documents ready can expedite the application process.

-

What benefits do I gain from using airSlate SignNow for loan-related documents?

Using airSlate SignNow for your loan Michigan documents streamlines the eSigning process, making it quick and efficient. Our platform is designed to enhance productivity, allowing you to send and receive signed documents securely. This means fewer delays and simplified management of your paperwork.

-

Are there any fees associated with loans in Michigan?

Yes, loan Michigan may come with various fees, including origination fees, application fees, and late payment fees. It's crucial to read the loan agreement carefully to understand all potential costs involved. This transparency helps you budget effectively and avoid unexpected expenses.

Get more for Vehicle Dealer Inventory Loan Notice Michigan

Find out other Vehicle Dealer Inventory Loan Notice Michigan

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal