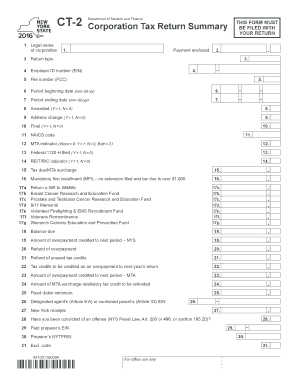

CT-2 - Corporation Tax Return Summary Form

What is the CT-2 - Corporation Tax Return Summary

The CT-2, or Corporation Tax Return Summary, is a crucial document that corporations in New York must file to report their income, deductions, and tax liability. This form is specifically designed for corporations that are subject to the New York corporation tax. The CT-2 provides a comprehensive overview of a corporation's financial activities during the tax year, allowing the New York State Department of Taxation and Finance to assess the appropriate tax owed. Understanding the CT-2 is essential for compliance with state tax laws and for ensuring that corporations fulfill their tax obligations accurately.

Steps to complete the CT-2 - Corporation Tax Return Summary

Completing the CT-2 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, accurately report your corporation's gross income and any applicable deductions on the form. It is essential to follow the specific instructions provided with the CT-2 to ensure all required information is included. Once completed, review the form for accuracy, sign it, and prepare it for submission. Corporations can file the CT-2 online, by mail, or in person, depending on their preference and the requirements set forth by the New York State Department of Taxation and Finance.

Legal use of the CT-2 - Corporation Tax Return Summary

The CT-2 serves as a legally binding document when filed correctly. To ensure its legal standing, it must be completed in accordance with New York State tax laws and regulations. This includes providing accurate financial information and signatures from authorized representatives of the corporation. Additionally, the electronic submission of the CT-2 is recognized as legally valid under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Compliance with these laws ensures that the CT-2 is accepted by the state and can be used as a legitimate record of the corporation's tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the CT-2 are critical for corporations to avoid penalties and interest. Generally, corporations must file their CT-2 by the 15th day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the filing deadline is April 15. It is important to stay informed about any changes to deadlines or extensions that may be offered by the New York State Department of Taxation and Finance. Keeping track of these dates ensures timely compliance and helps avoid unnecessary financial consequences.

Required Documents

To complete the CT-2 accurately, corporations must gather several key documents. These typically include financial statements, such as income statements and balance sheets, which provide a comprehensive view of the corporation's financial health. Additionally, any documentation supporting deductions claimed on the CT-2 should be included, such as receipts, invoices, and records of expenses. Having these documents readily available streamlines the completion process and ensures that all necessary information is reported accurately.

Form Submission Methods (Online / Mail / In-Person)

Corporations have multiple options for submitting the CT-2. The preferred method is online filing, which is often faster and more efficient. However, corporations can also submit the form by mail or in person at designated tax offices. When filing online, it is important to ensure that all electronic signatures and required information are correctly entered to avoid delays. If submitting by mail, corporations should consider using a trackable mailing service to confirm that their CT-2 is received by the New York State Department of Taxation and Finance on time.

Quick guide on how to complete new york tax return

Effortlessly Complete CT-2 - Corporation Tax Return Summary on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools you require to create, amend, and electronically sign your documents swiftly without delays. Oversee CT-2 - Corporation Tax Return Summary on any device using the airSlate SignNow apps for Android or iOS, and streamline your document processes today.

How to Modify and Electronically Sign CT-2 - Corporation Tax Return Summary with Ease

- Obtain CT-2 - Corporation Tax Return Summary and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign CT-2 - Corporation Tax Return Summary and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New York tax summary?

A New York tax summary provides a comprehensive overview of an individual's or business's tax obligations and filings within the state of New York. It outlines essential information such as income, deductions, and credits, ensuring taxpayers are aware of their tax responsibilities. Using airSlate SignNow can streamline the documentation process when filing your New York tax summary.

-

How can airSlate SignNow help with my New York tax summary?

AirSlate SignNow simplifies the process of gathering and signing documents essential for your New York tax summary. With our intuitive platform, you can easily send, receive, and eSign all necessary paperwork, ensuring timely and accurate submission of your tax summary. This efficient workflow allows you to focus on your tax strategy rather than paperwork.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans suitable for individuals and businesses of all sizes, starting from a basic plan designed for simple needs to more comprehensive packages that accommodate complex requirements. Regardless of your budget, you can find a plan that aligns with your needs for managing your New York tax summary paperwork. Visit our pricing page for detailed information.

-

Is airSlate SignNow compliant with New York tax regulations?

Yes, airSlate SignNow is fully compliant with New York tax regulations, ensuring that your electronic signatures and documents meet all legal standards. This compliance is crucial when dealing with your New York tax summary, as it guarantees that your submissions will be valid and accepted by regulatory authorities. Trust our platform for secure and compliant document management.

-

Can I integrate airSlate SignNow with other software for managing my New York tax summary?

Absolutely! AirSlate SignNow easily integrates with various accounting and financial management software, allowing for seamless data transfer and efficient handling of your New York tax summary. These integrations help streamline your workflow and enhance productivity by minimizing the time spent on document preparation and filing.

-

What features does airSlate SignNow offer for tax documentation?

AirSlate SignNow provides a range of features tailored for tax documentation, including custom templates for your New York tax summary, automated reminders for deadlines, and real-time tracking of document status. These features make it easy to organize and manage your tax-related documents efficiently. Enhance your tax preparation experience with our user-friendly features.

-

How secure is my data with airSlate SignNow when preparing my New York tax summary?

Security is a top priority for airSlate SignNow. We employ advanced encryption protocols and strict access controls to protect your sensitive data when preparing your New York tax summary. You can rest assured that your information is safe with us, enabling you to focus on your tax responsibilities without worry.

Get more for CT-2 - Corporation Tax Return Summary

Find out other CT-2 - Corporation Tax Return Summary

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile