For the Purposes of This Questionnaire, the Term Applicant Means the Credit Union and All Subsidiaries Being Form

Understanding the Form

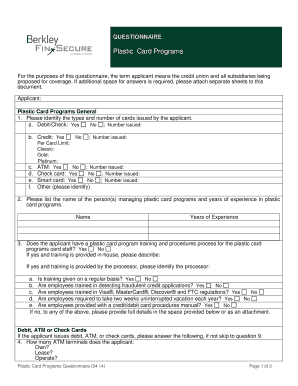

The form titled "For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being" serves as a critical document for credit unions and their subsidiaries. This form is designed to clarify the definition of "Applicant" within the context of various questionnaires and applications. By establishing this definition, the form ensures that all parties involved have a clear understanding of who is being referred to, which is essential for compliance and accurate processing of information.

Steps to Complete the Form

Completing the form requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Read the instructions carefully to understand the requirements.

- Gather all necessary information related to the credit union and its subsidiaries.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form as instructed, either electronically or via mail, depending on the guidelines provided.

Legal Use of the Form

This form is legally binding when completed correctly and submitted in accordance with applicable laws. It is essential to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) to ensure the validity of the electronic signatures. By adhering to these legal frameworks, credit unions can confidently utilize the form in their operations.

Key Elements of the Form

Several key elements are crucial for the effective use of the form:

- Applicant Definition: Clearly defines who is considered the applicant.

- Signature Requirements: Outlines the necessary signatures to validate the form.

- Submission Guidelines: Provides instructions on how to submit the form correctly.

- Compliance Information: Details related legal compliance requirements.

Examples of Using the Form

There are various scenarios in which this form may be utilized:

- When applying for loans or credit products as a credit union.

- During the onboarding process for new subsidiaries.

- For regulatory compliance during audits or reviews.

Eligibility Criteria

Eligibility to use this form generally includes any credit union and its subsidiaries that need to clarify their applicant status in various transactions. It is important to ensure that all entities involved meet the necessary criteria to avoid complications in processing.

Quick guide on how to complete for the purposes of this questionnaire the term applicant means the credit union and all subsidiaries being

Complete For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being effortlessly

- Obtain For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being' entail?

'For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being' refers to the credit union and its associated entities applying for services. Understanding this definition is essential for correctly filling out the necessary forms and documents in the application process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features that enhance document management, including e-signatures, templates for frequently used documents, and real-time collaboration tools. These capabilities are designed to streamline processes, making it easier for applicants to manage documentation efficiently.

-

How does airSlate SignNow support applicant collaboration?

Collaboration is made easy with airSlate SignNow, as multiple users can work on the same document simultaneously. This functionality allows applicants to leave comments and request revisions, ensuring that the document meets everyone's needs throughout the application process.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to meet the needs of different organizations, including those that fall under 'For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being.' Each plan includes a set of features that cater to the size and requirements of the applicant's business.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications such as CRM systems, productivity tools, and financial software. This allows applicants, as defined in 'For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being,' to enhance their workflow by connecting with other systems they already use.

-

What benefits does airSlate SignNow provide to financial institutions?

Financial institutions can signNowly benefit from using airSlate SignNow due to its secure e-signature capabilities and compliance with legal standards. These features mitigate risks and expedite document processing, particularly for those identified as 'For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being.'

-

How secure is the information shared through airSlate SignNow?

Security is a top priority for airSlate SignNow, which employs encryption and other security measures to protect sensitive information. This is particularly relevant for applicants who need to ensure that their data, as defined in 'For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being,' remains confidential and secure.

Get more for For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being

- Form 1239 verification of bank accounts

- The mitten michigan history magazine form

- Nordyne warranty claim form

- Particulars 100367887 form

- Ordering physician address map practitioner numb form

- Skin history form

- Spirit of sport skate a thon fundraiser participant pledge form

- Services child care time sheet form

Find out other For The Purposes Of This Questionnaire, The Term Applicant Means The Credit Union And All Subsidiaries Being

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure