Use Excise Certificate Iowa Form

What is the Use Excise Certificate Iowa

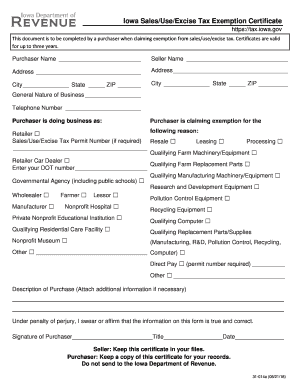

The Use Excise Certificate Iowa is a crucial document that allows businesses and individuals to claim exemption from sales tax on certain purchases. This certificate is specifically designed for transactions involving goods that will be used or consumed in a manner that qualifies for tax exemption under Iowa law. Understanding the purpose and application of this certificate is essential for compliance and effective tax management.

How to use the Use Excise Certificate Iowa

To utilize the Use Excise Certificate Iowa effectively, individuals or businesses must present it at the time of purchase. This certificate serves as proof that the buyer is eligible for a sales tax exemption. It is important to ensure that the certificate is filled out accurately, including the buyer's information and the specific reason for the exemption. Retaining a copy of the certificate for record-keeping is also recommended, as it may be required for future audits or inquiries.

Steps to complete the Use Excise Certificate Iowa

Completing the Use Excise Certificate Iowa involves several key steps:

- Obtain the certificate form from a reliable source.

- Fill in the required fields, including the buyer's name, address, and the seller's information.

- Clearly state the reason for the exemption, ensuring it aligns with Iowa tax regulations.

- Sign and date the certificate to validate it.

- Provide the completed certificate to the seller at the time of purchase.

Legal use of the Use Excise Certificate Iowa

The legal use of the Use Excise Certificate Iowa is governed by state tax laws. It is essential that the certificate is used only for eligible purchases, as misuse can lead to penalties or fines. Buyers must understand the specific criteria that qualify for exemption, such as purchasing items for resale or for use in manufacturing. Compliance with these regulations ensures that the certificate remains valid and protects against potential legal issues.

Eligibility Criteria

To qualify for the Use Excise Certificate Iowa, certain eligibility criteria must be met. Generally, the buyer must be purchasing goods that are intended for resale or for use in a tax-exempt manner. This includes items that will not be subject to sales tax when sold or used in manufacturing processes. It is important for buyers to review the Iowa Department of Revenue guidelines to confirm their eligibility before completing the certificate.

Form Submission Methods (Online / Mail / In-Person)

The Use Excise Certificate Iowa can be submitted in various ways, depending on the seller's preferences and the nature of the transaction. Buyers may provide the completed certificate in person at the point of sale, or they may send it via mail if prior arrangements have been made. Some businesses may also accept electronic versions of the certificate, provided they comply with legal requirements for digital documentation.

Key elements of the Use Excise Certificate Iowa

Key elements of the Use Excise Certificate Iowa include:

- The name and address of the buyer.

- The seller's name and address.

- A clear statement of the reason for the exemption.

- The buyer's signature and the date of completion.

Ensuring that all these elements are accurately filled out is essential for the certificate to be considered valid and legally binding.

Quick guide on how to complete use excise certificate iowa

Complete Use Excise Certificate Iowa effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow gives you all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Use Excise Certificate Iowa on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and electronically sign Use Excise Certificate Iowa without hassle

- Locate Use Excise Certificate Iowa and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign feature, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Use Excise Certificate Iowa and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Iowa sales tax exemption form?

The Iowa sales tax exemption form is a document that allows certain purchasers to buy goods and services without paying sales tax. This form is typically used by nonprofit organizations, government agencies, and certain businesses that qualify for exemptions. By utilizing the right Iowa sales tax exemption form, you can save signNowly on purchases.

-

How can I obtain the Iowa sales tax exemption form?

You can obtain the Iowa sales tax exemption form from the Iowa Department of Revenue's website or through your business's tax professional. It's important to ensure you have the correct and up-to-date version of this form to avoid any compliance issues. Utilizing tools like airSlate SignNow can streamline the process of filling out and submitting this form.

-

Is there a cost associated with using airSlate SignNow for the Iowa sales tax exemption form?

airSlate SignNow offers various pricing plans that can accommodate businesses of all sizes looking to manage their sales tax exemption forms. While there may be subscription fees, the software provides cost-effective solutions that often outweigh potential savings gained through efficient eSigning and document management. Explore our pricing options to find the best fit for your needs.

-

What features does airSlate SignNow provide for completing the Iowa sales tax exemption form?

airSlate SignNow provides essential features like customizable templates, secure eSigning, and real-time document tracking that help streamline the process for the Iowa sales tax exemption form. These features enhance efficiency and ensure compliance, making the form filling process smoother and hassle-free for users. You can easily collaborate with colleagues in real time, further speeding up the process.

-

Can I integrate airSlate SignNow with my existing software for managing the Iowa sales tax exemption form?

Yes, airSlate SignNow offers integration capabilities with various popular software applications, enhancing your overall workflow. This means you can connect it with your accounting systems, CRM tools, or other document management solutions to ensure that your Iowa sales tax exemption form is processed seamlessly. Integrations can help reduce redundancy and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Iowa sales tax exemption form?

Using airSlate SignNow for your Iowa sales tax exemption form allows you to manage documents effectively and securely. The platform enhances collaboration and signNowly reduces the turnaround time for completing forms. Its user-friendly interface helps ensure that even individuals who are not tech-savvy can complete and manage their forms easily.

-

How does airSlate SignNow ensure the security of my Iowa sales tax exemption form?

airSlate SignNow prioritizes security and uses advanced encryption technologies to protect your Iowa sales tax exemption form and other sensitive documents. The platform complies with industry-standard security measures, which means that your data remains safe and accessible only to authorized users. You can confidently manage your documents without fearing unauthorized access.

Get more for Use Excise Certificate Iowa

- Periodic table packet 1 form

- Lift truck operators daily weekly inspection report form

- Phlebotomy requisition form pdf

- 18003787262 form

- Patient assistance program enrollment form

- Aaa staffing timesheet form

- Boletn quincenal de ayudas subvenciones becas y premios form

- Installation de publicit extrieureentreprendre service public fr form

Find out other Use Excise Certificate Iowa

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF