Nonresident Alien Intake and Interview Sheet IRS Gov Form

Understanding the Nonresident Alien Intake and Interview Sheet

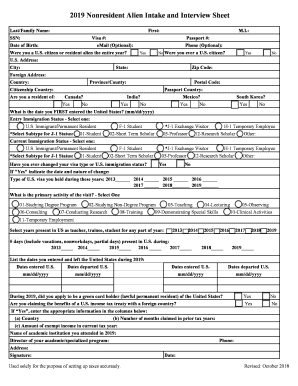

The Nonresident Alien Intake and Interview Sheet is a crucial document for individuals who are classified as nonresident aliens for tax purposes in the United States. This form is designed to collect essential information from nonresident aliens, ensuring compliance with IRS regulations. It includes details about personal identification, visa status, and income sources, which are necessary for accurate tax reporting. Understanding this form is vital for dependent students, as it affects their tax obligations and eligibility for certain benefits.

Steps to Complete the Nonresident Alien Intake and Interview Sheet

Completing the Nonresident Alien Intake and Interview Sheet involves several key steps:

- Gather Required Information: Collect personal identification details, including your name, address, and visa information.

- Detail Your Income Sources: List all sources of income, including scholarships, wages, and any other earnings.

- Provide Tax Identification Numbers: Include your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if applicable.

- Review and Sign: Carefully review all entries for accuracy before signing the form to certify that the information is correct.

Legal Use of the Nonresident Alien Intake and Interview Sheet

The Nonresident Alien Intake and Interview Sheet serves as a legally binding document when filled out accurately. It ensures that the information provided is used for tax compliance and reporting purposes. This form is essential for dependent students who may be receiving scholarships or working in the U.S. Understanding the legal implications of this form helps protect against potential penalties for non-compliance with IRS regulations.

Required Documents for Submission

When submitting the Nonresident Alien Intake and Interview Sheet, certain documents may be required to support your claims. These documents can include:

- Passport or visa to verify your nonresident status.

- Proof of income, such as pay stubs or scholarship award letters.

- Any previous tax returns if applicable, especially if you have filed taxes in the U.S. before.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Nonresident Alien Intake and Interview Sheet. Generally, the deadline for submission aligns with the tax filing season in the U.S. For most individuals, this is April 15 each year. However, dependent students should check for any specific extensions or deadlines that may apply to their situation, especially if they are on a different visa status.

Eligibility Criteria for Nonresident Alien Status

To be classified as a nonresident alien, individuals must meet specific eligibility criteria set by the IRS. This includes:

- Maintaining a physical presence in the U.S. for less than 183 days during the tax year.

- Having a valid visa that allows for temporary residence in the U.S.

- Not qualifying as a resident alien based on the substantial presence test.

Examples of Using the Nonresident Alien Intake and Interview Sheet

Understanding practical scenarios can help clarify the use of the Nonresident Alien Intake and Interview Sheet. For instance, a dependent student receiving a scholarship may need to complete this form to report their income accurately. Similarly, a nonimmigrant student working on-campus must provide this information to ensure compliance with tax laws. These examples highlight the importance of the form in various situations faced by nonresident aliens.

Quick guide on how to complete nonresident alien intake and interview sheet irsgov

Accomplish Nonresident Alien Intake And Interview Sheet IRS gov effortlessly on any gadget

Web-based document organization has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to draft, revise, and eSign your documents promptly without delays. Manage Nonresident Alien Intake And Interview Sheet IRS gov on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign Nonresident Alien Intake And Interview Sheet IRS gov with ease

- Find Nonresident Alien Intake And Interview Sheet IRS gov and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign function, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and eSign Nonresident Alien Intake And Interview Sheet IRS gov and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a dependent student and how does it affect my documentation?

A dependent student is someone who relies on their parents or guardians for financial support and is typically included in their tax returns. This status can impact the required documents when applying for financial aid or scholarships. Understanding your status as a dependent student can help streamline the eSigning process with airSlate SignNow.

-

How can airSlate SignNow help a dependent student with document signing?

airSlate SignNow provides an efficient and secure platform for dependent students to electronically sign important documents such as financial aid applications and school enrollment forms. The platform simplifies the process by allowing for quick access and easy collaboration with parents or guardians, ensuring all necessary signatures are obtained promptly.

-

What pricing plans does airSlate SignNow offer for dependent students?

airSlate SignNow offers flexible pricing plans that cater to both individual and business needs. For dependent students, the cost-effective solutions are designed to provide essential features at an affordable rate, making it easier to handle document signing without breaking the bank. Check our website for more details on student discounts available.

-

Are there any specific features in airSlate SignNow beneficial for dependent students?

Yes, airSlate SignNow includes features such as template creation, easy document sharing, and real-time tracking. These tools are particularly beneficial for dependent students who often need to gather signatures from parents or guardians. The user-friendly interface also simplifies the document management process for students.

-

Can dependent students integrate airSlate SignNow with other tools they use?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and Microsoft Outlook, enhancing the workflow for dependent students. This means they can easily manage documents stored in their preferred platforms and streamline their signing process in one place.

-

What benefits does airSlate SignNow provide to dependent students?

airSlate SignNow empowers dependent students by providing a reliable and efficient way to manage their document signing needs. This benefits students by reducing the time spent on paperwork, minimizing errors, and ensuring secure electronic signatures, allowing them to focus more on their education rather than administrative tasks.

-

Is it safe for dependent students to use airSlate SignNow for sensitive documents?

Yes, safety is a top priority at airSlate SignNow. The platform employs robust security measures, including encryption and secure cloud storage, to protect sensitive information. Dependent students can confidently sign and manage important documents knowing that their data is secure.

Get more for Nonresident Alien Intake And Interview Sheet IRS gov

Find out other Nonresident Alien Intake And Interview Sheet IRS gov

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure