Prince Edward Island Form

What is the Prince Edward Island

The Prince Edward Island form is a tax document used by residents of Prince Edward Island to report their income and calculate their tax obligations. This form is crucial for ensuring compliance with local tax regulations. It captures various sources of income, including wages, business profits, and investment earnings. Properly filling out this form is essential for determining the correct amount of tax owed or any potential refunds.

Steps to complete the Prince Edward Island

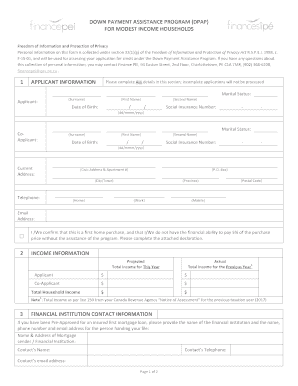

Completing the Prince Edward Island form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, accurately report your total income in the designated sections of the form. Deduct any eligible expenses to arrive at your taxable income. Finally, calculate your tax liability based on the current tax rates and ensure all information is entered correctly before submission.

Legal use of the Prince Edward Island

The legal use of the Prince Edward Island form is defined by tax regulations set forth by the provincial government. It must be filled out accurately to reflect all income and deductions. Failure to comply with these regulations can result in penalties, including fines or additional taxes owed. Utilizing electronic signatures through platforms like signNow can enhance the legal validity of your submission, ensuring that all documents are securely signed and stored.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Prince Edward Island form. Typically, the deadline for submission is April 30 of the following year for individual taxpayers. If this date falls on a weekend or holiday, the deadline may be extended. Being aware of these dates helps prevent late filing penalties and ensures timely processing of your tax return.

Required Documents

To complete the Prince Edward Island form accurately, certain documents are required. These include income statements such as W-2s and 1099s, receipts for deductible expenses, and any other relevant financial records. Having these documents organized and readily available will facilitate a smoother filing process and help ensure that all income and deductions are reported correctly.

Examples of using the Prince Edward Island

Examples of using the Prince Edward Island form can vary based on individual circumstances. For instance, a self-employed individual would report their business income and expenses, while a salaried employee would primarily focus on their W-2 income. Understanding these examples can help taxpayers identify which sections of the form apply to their specific situations, ensuring accurate reporting and compliance with tax laws.

Quick guide on how to complete 2020 prince edward island

Effortlessly Prepare Prince Edward Island on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Prince Edward Island on any device with airSlate SignNow's Android or iOS applications, streamlining any document-related task today.

How to Edit and eSign Prince Edward Island with Ease

- Locate Prince Edward Island and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this task.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Prince Edward Island to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing of airSlate SignNow for 2020 Prince Edward Island?

AirSlate SignNow offers flexible pricing plans that are suited for businesses in 2020 Prince Edward Island. Depending on the features and number of users, you can choose from basic, business, or enterprise plans. Each plan is designed to provide signNow value, ensuring that your document signing needs are met affordably.

-

What features does airSlate SignNow provide for users in 2020 Prince Edward Island?

In 2020 Prince Edward Island, airSlate SignNow provides an array of features including eSignature capabilities, document templates, and real-time tracking. Users can enjoy the convenience of cloud storage and robust security measures that comply with legal standards. This empowers businesses to streamline their document workflows effectively.

-

How can airSlate SignNow benefit businesses in 2020 Prince Edward Island?

AirSlate SignNow offers a range of benefits for businesses in 2020 Prince Edward Island by enhancing operational efficiency. It reduces the time spent on document processing and minimizes the need for physical signatures, leading to faster transaction times. Additionally, it helps in maintaining compliance with local regulations, which is crucial for businesses.

-

Can airSlate SignNow be integrated with other tools for businesses in 2020 Prince Edward Island?

Yes, airSlate SignNow can easily integrate with various tools and applications that businesses in 2020 Prince Edward Island might already be using. This includes popular platforms like Google Drive, Salesforce, and Microsoft Office. Such integrations allow users to streamline their workflow and improve productivity.

-

Is airSlate SignNow user-friendly for those in 2020 Prince Edward Island?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, especially for users in 2020 Prince Edward Island. The intuitive interface allows users to create, send, and sign documents with minimal training or experience. This ensures that even those who are not tech-savvy can effectively utilize the platform.

-

How secure is airSlate SignNow for users in 2020 Prince Edward Island?

Security is a top priority for airSlate SignNow, particularly for businesses in 2020 Prince Edward Island. The platform uses advanced encryption methods to protect sensitive documents and complies with industry standards for data security. This gives users peace of mind knowing that their information is safe during the signing process.

-

What types of documents can be signed using airSlate SignNow in 2020 Prince Edward Island?

In 2020 Prince Edward Island, airSlate SignNow allows users to sign a variety of document types, including contracts, agreements, forms, and more. The platform supports multiple file formats, ensuring flexibility for different business needs. This versatility makes it an ideal choice for various industries.

Get more for Prince Edward Island

Find out other Prince Edward Island

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now