Form 13818 5 Limited Payability Claim Against the United States

What is the Form 13818 Limited Payability Claim Against The United States

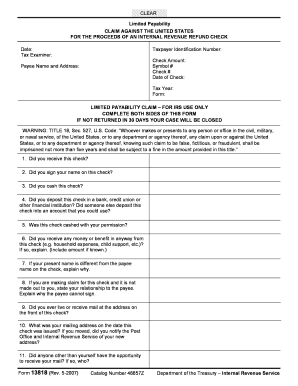

The Form 13818, also known as the Limited Payability Claim Against The United States, is a document used by individuals seeking to claim a refund for a check issued by the IRS that has not been cashed within the designated time frame. This form is particularly relevant for taxpayers who have received a check refund but are unable to cash it due to various reasons, such as loss or expiration. By submitting this form, individuals can request a replacement check and ensure that their claim for the IRS refund is processed efficiently.

How to use the Form 13818 Limited Payability Claim Against The United States

To use the Form 13818, taxpayers must first complete the document with accurate information, including details about the original check, the reason for the claim, and personal identification information. Once completed, the form should be submitted to the appropriate IRS address, as indicated in the form's instructions. It is essential to ensure that all information is correct to avoid delays in processing the claim. Utilizing a reliable eSignature solution can facilitate the signing and submission process, making it easier to manage documentation electronically.

Steps to complete the Form 13818 Limited Payability Claim Against The United States

Completing the Form 13818 involves several key steps:

- Download the Form 13818 from the IRS website or obtain a physical copy.

- Fill out the required fields, including your name, address, and taxpayer identification number.

- Provide details about the original check, such as the check number and the amount.

- Indicate the reason for the claim, ensuring clarity and accuracy.

- Sign and date the form, confirming the information provided is true and correct.

- Submit the completed form to the IRS, either electronically or by mail, following the guidelines provided.

IRS Guidelines

The IRS has specific guidelines regarding the submission of Form 13818. Taxpayers should ensure they are familiar with these guidelines to avoid any issues. Key points include:

- Claims must be submitted within a certain time frame after the check is issued.

- Supporting documentation may be required to validate the claim.

- Taxpayers should retain copies of all submitted documents for their records.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers submitting Form 13818. Generally, the claim must be filed within one year from the date the check was issued. It is advisable to check the IRS website for any updates or changes to these deadlines, as they can affect the eligibility of the claim. Staying informed about important dates ensures that taxpayers can effectively manage their refund claims.

Required Documents

When submitting Form 13818, certain documents may be required to support the claim. These may include:

- A copy of the original check, if available.

- Proof of identity, such as a driver's license or Social Security card.

- Any correspondence from the IRS regarding the original check.

Providing these documents can help expedite the processing of the claim and ensure compliance with IRS requirements.

Quick guide on how to complete form 13818 5 2007 limited payability claim against the united states

Effortlessly Prepare Form 13818 5 Limited Payability Claim Against The United States on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, since you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 13818 5 Limited Payability Claim Against The United States on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and Electronically Sign Form 13818 5 Limited Payability Claim Against The United States with Ease

- Acquire Form 13818 5 Limited Payability Claim Against The United States and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management requirements in a few clicks from any device you choose. Revise and electronically sign Form 13818 5 Limited Payability Claim Against The United States and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for filing for an IRS refund using airSlate SignNow?

To file for an IRS refund using airSlate SignNow, start by preparing your required tax documents digitally. Utilize our eSignature features to sign your forms securely. Once completed, submit them to the IRS through the appropriate online channels or by print and mail. This streamlined process ensures you can efficiently claim your IRS refund.

-

Are there any costs associated with using airSlate SignNow for IRS refund documentation?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large corporation, our solutions remain cost-effective and help streamline the preparation for your IRS refund. Explore our pricing options to find the best fit for your organization while ensuring easy eSigning of your tax documents.

-

Can I sign my IRS refund documents on mobile with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to sign your IRS refund documents from anywhere. Our mobile app ensures that you can easily access, fill out, and eSign your documents on the go. This flexibility helps expedite your process in claiming your IRS refund.

-

What features does airSlate SignNow offer for IRS refund filing?

airSlate SignNow provides a range of features that assist in the efficient preparation of IRS refund documentation. These include eSigning, document templates, and cloud storage for easy access. With these tools, you can manage your IRS refund-related paperwork seamlessly and securely.

-

How does airSlate SignNow enhance the security of my IRS refund documentation?

Security is a top priority at airSlate SignNow. We implement industry-standard encryption to protect your IRS refund documents throughout the signing process. You can feel confident in knowing that your sensitive information is safeguarded against unauthorized access.

-

Does airSlate SignNow integrate with IRS tax filing software?

Yes, airSlate SignNow easily integrates with various IRS tax filing software platforms. This integration enables you to send your completed IRS refund documentation directly from your chosen software. The result is a cohesive workflow that minimizes errors and saves you time.

-

What are the benefits of using airSlate SignNow for my IRS refund process?

Using airSlate SignNow for your IRS refund process offers numerous benefits, including improved efficiency and reduced turnaround time. The user-friendly interface enables quick adoption by your team. Additionally, our cost-effective solutions help ensure that managing IRS-related documents is hassle-free.

Get more for Form 13818 5 Limited Payability Claim Against The United States

Find out other Form 13818 5 Limited Payability Claim Against The United States

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement