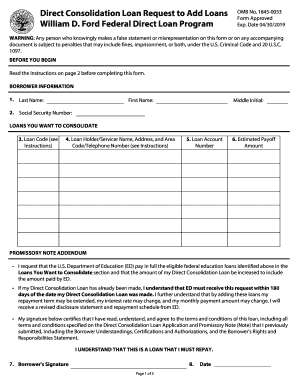

Direct Consolidation Loan Request to Add Loans Direct Consolidation Loan Request to Add Loans Form

Understanding the Direct Consolidation Loan Request

The Direct Consolidation Loan is a federal program that allows borrowers to combine multiple federal student loans into a single loan. This process simplifies repayment by providing one monthly payment instead of multiple payments. The Direct Consolidation Loan is particularly beneficial for borrowers looking to streamline their finances and manage their debt more effectively. It is important to understand the eligibility criteria and the specific loans that can be consolidated under this program.

Steps to Complete the Direct Consolidation Loan Request

Completing the Direct Consolidation Loan request involves several straightforward steps:

- Gather necessary information about your existing federal loans, including loan balances and servicer details.

- Visit the official Federal Student Aid website to access the Direct Consolidation Loan application.

- Fill out the application form, ensuring all information is accurate and complete.

- Select a repayment plan that suits your financial situation.

- Submit the application electronically or print it out to send by mail.

By following these steps, borrowers can efficiently submit their consolidation loan request.

Key Elements of the Direct Consolidation Loan Request

When filling out the Direct Consolidation Loan request, it is essential to include key elements to ensure the application is processed smoothly:

- Personal Information: Provide your name, address, Social Security number, and contact information.

- Loan Information: List all federal loans you wish to consolidate, including loan types and balances.

- Repayment Plan Selection: Choose a repayment plan that aligns with your financial goals, such as the Standard, Graduated, or Income-Driven repayment plans.

- Signature: Ensure your application is signed and dated to validate the request.

Including these elements will help facilitate the approval process for your consolidation loan.

Legal Use of the Direct Consolidation Loan Request

The Direct Consolidation Loan request is a legally binding document once completed and submitted. It is important to understand that by signing the request, you are agreeing to the terms and conditions associated with the consolidation of your loans. This includes the repayment plan and any adjustments to your loan terms. Compliance with all federal regulations is essential to ensure that your request is processed without issues.

Eligibility Criteria for the Direct Consolidation Loan

To qualify for a Direct Consolidation Loan, borrowers must meet specific eligibility criteria:

- You must have at least one federal student loan that is in repayment, in grace period, or in deferment.

- All loans being consolidated must be federal loans; private loans cannot be included.

- You must not be in default on any of the loans you wish to consolidate.

Meeting these criteria is crucial for a successful application for a Direct Consolidation Loan.

Obtaining the Direct Consolidation Loan Request

The Direct Consolidation Loan request can be obtained through the Federal Student Aid website. This online platform provides access to the application form and detailed instructions on how to complete it. Borrowers can also find resources and guidance on the consolidation process, making it easier to navigate the requirements and ensure that all necessary information is provided.

Quick guide on how to complete direct consolidation loan request to add loans direct consolidation loan request to add loans

Prepare Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans on any device with airSlate SignNow's Android or iOS applications and improve any document-related workflow today.

How to modify and eSign Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans with ease

- Locate Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a direct consolidation loan?

A direct consolidation loan is a financial solution that combines multiple federal student loans into a single loan with a fixed interest rate. This simplifies your repayment process by consolidating various loans into one monthly payment, making it easier to manage.

-

How can a direct consolidation loan benefit me?

The primary benefit of a direct consolidation loan is simplifying your student loan repayment process. This not only reduces the number of payments you need to manage but can also provide access to specialized repayment plans and forgiveness programs, enhancing your financial flexibility.

-

Are there any fees associated with a direct consolidation loan?

No, there are no fees associated with obtaining a direct consolidation loan. This makes it a cost-effective option for borrowers looking to streamline their student loan payments without incurring additional financial burdens.

-

How does the interest rate work for a direct consolidation loan?

The interest rate for a direct consolidation loan is the weighted average of the interest rates of your existing loans, rounded up to the nearest one-eighth percent. This ensures that while you are consolidating, you are not paying more than necessary while still benefiting from a fixed interest rate.

-

Can I include private loans in a direct consolidation loan?

Unfortunately, a direct consolidation loan can only include federal student loans. However, if you have private loans, you may consider refinancing them separately through financial institutions that specialize in private loan consolidation.

-

What documents do I need to apply for a direct consolidation loan?

To apply for a direct consolidation loan, you generally need to provide information such as your loan details, Social Security number, and income information. You'll also need to complete the Direct Consolidation Loan Application and Promissory Note, ensuring all necessary documentation is included.

-

How long does it take to process a direct consolidation loan?

The processing time for a direct consolidation loan typically takes a few weeks after your application is submitted. Once processed, your previous loans will be paid off, and you’ll be informed about your new consolidated loan terms.

Get more for Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans

Find out other Direct Consolidation Loan Request To Add Loans Direct Consolidation Loan Request To Add Loans

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now