401k Termination Form Colville 2012-2026

Understanding the ADP Rollover Form 280

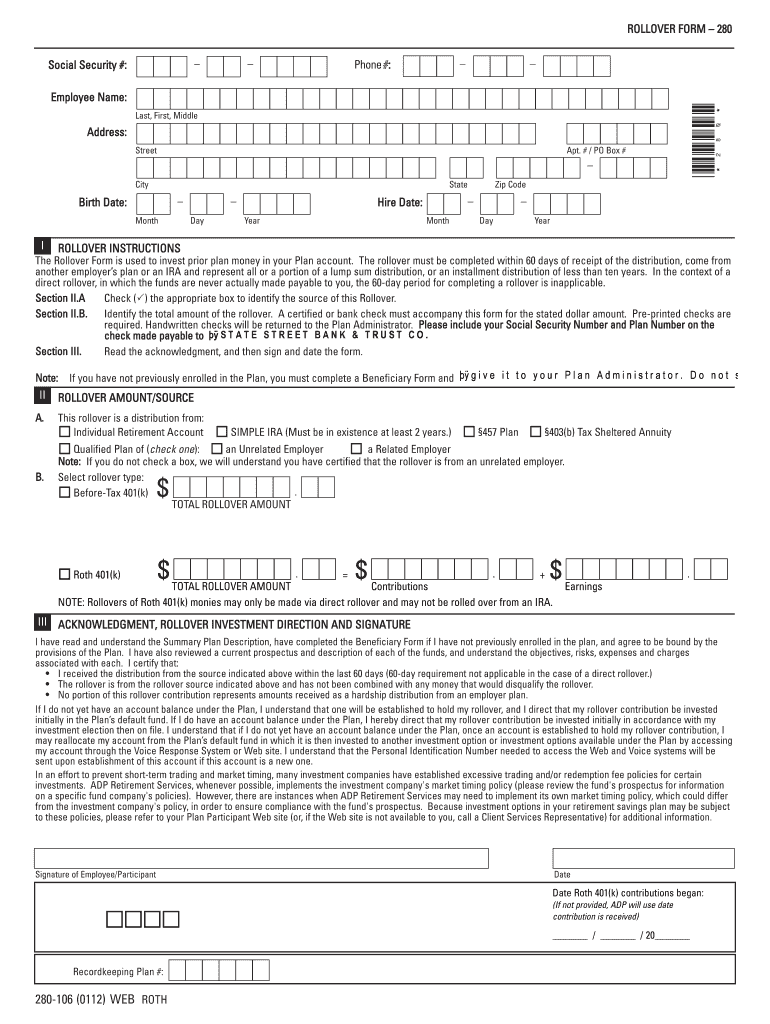

The ADP rollover form 280 is essential for employees looking to transfer their 401(k) funds to another retirement account. This form facilitates the movement of funds from one qualified retirement plan to another, ensuring that the employee maintains the tax-deferred status of their retirement savings. Understanding this form is crucial for anyone considering a rollover, as it outlines the necessary steps and requirements for a successful transfer.

Steps to Complete the ADP Rollover Form 280

Completing the ADP rollover form 280 involves several key steps:

- Gather Required Information: Collect personal information, including your Social Security number, account numbers, and details of the new retirement account.

- Fill Out the Form: Carefully complete each section of the form, ensuring accuracy to avoid delays in processing.

- Review for Errors: Double-check all entries for accuracy. Mistakes can lead to complications in the rollover process.

- Submit the Form: Follow the submission instructions provided on the form, whether online, by mail, or in person.

Required Documents for ADP Rollover Form 280

When completing the ADP rollover form 280, certain documents may be necessary to support your application:

- Proof of identity, such as a driver's license or passport.

- Details of the existing 401(k) plan, including account statements.

- Information on the receiving retirement account, such as a recent statement or account opening documents.

Legal Use of the ADP Rollover Form 280

The ADP rollover form 280 must be used in compliance with IRS regulations governing retirement accounts. This form allows for tax-free transfers between qualified accounts, provided the rollover is completed within the specified time frame. Understanding the legal implications helps ensure that the rollover process does not incur unnecessary tax liabilities.

Filing Deadlines for the ADP Rollover Form 280

It is important to be aware of the deadlines associated with the ADP rollover form 280. Generally, the rollover must be completed within sixty days of receiving the distribution from the previous plan. Missing this deadline can result in taxes and penalties. Always check for any specific deadlines related to your employer's plan.

Eligibility Criteria for Using the ADP Rollover Form 280

Not all employees are eligible to use the ADP rollover form 280. Eligibility typically depends on factors such as:

- Employment status with the company offering the 401(k) plan.

- Type of distribution received (e.g., termination of employment, retirement).

- Compliance with any waiting periods set by the employer’s plan.

Examples of Using the ADP Rollover Form 280

There are various scenarios in which an employee might use the ADP rollover form 280:

- Transferring funds from a previous employer's 401(k) to a new employer's plan.

- Rolling over a 401(k) into an Individual Retirement Account (IRA).

- Moving funds from a 401(k) to a Roth IRA, subject to tax implications.

Quick guide on how to complete 401k termination form colville

Accomplish 401k Termination Form Colville seamlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It serves as a flawless eco-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage 401k Termination Form Colville on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign 401k Termination Form Colville effortlessly

- Find 401k Termination Form Colville and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign 401k Termination Form Colville and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 401k termination form colville

Create this form in 5 minutes!

How to create an eSignature for the 401k termination form colville

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ADP rollover form 280?

The ADP rollover form 280 is a document used to facilitate the transfer of retirement funds from one account to another. This form is essential for ensuring that your rollover is processed correctly and complies with IRS regulations. Using airSlate SignNow, you can easily eSign and send the ADP rollover form 280 securely.

-

How can I obtain the ADP rollover form 280?

You can obtain the ADP rollover form 280 directly from your ADP account or by contacting your HR department. Additionally, airSlate SignNow provides templates that can help you create and customize the ADP rollover form 280 for your specific needs. This makes the process more efficient and user-friendly.

-

What are the benefits of using airSlate SignNow for the ADP rollover form 280?

Using airSlate SignNow for the ADP rollover form 280 offers several benefits, including ease of use, cost-effectiveness, and enhanced security. The platform allows you to eSign documents quickly, reducing the time spent on paperwork. Moreover, it ensures that your sensitive information is protected throughout the process.

-

Is there a cost associated with using airSlate SignNow for the ADP rollover form 280?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is generally affordable, especially considering the time and resources saved by using the platform for the ADP rollover form 280. You can choose a plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other software for the ADP rollover form 280?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your documents, including the ADP rollover form 280. This integration helps streamline your workflow and ensures that all your data is synchronized across platforms.

-

How secure is the airSlate SignNow platform for handling the ADP rollover form 280?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including the ADP rollover form 280. The platform is compliant with industry standards, ensuring that your sensitive information remains confidential and secure during the signing process.

-

What features does airSlate SignNow offer for managing the ADP rollover form 280?

airSlate SignNow provides a range of features for managing the ADP rollover form 280, including customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency and ensure that you can easily manage your rollover process from start to finish.

Get more for 401k Termination Form Colville

Find out other 401k Termination Form Colville

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed