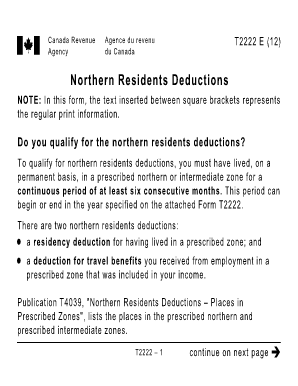

T2222 Form 2012

What is the T2222 Form

The T2222 form is a specific document used primarily in tax-related processes. It serves as a declaration or application for various tax benefits or obligations. Understanding the purpose of this form is crucial for individuals and businesses alike, as it can impact tax filings and compliance with federal regulations. The T2222 form is particularly relevant for those navigating the complexities of the U.S. tax system, ensuring that all necessary information is accurately reported.

How to use the T2222 Form

Using the T2222 form involves several steps that ensure proper completion and submission. Begin by gathering all necessary information, including personal identification details and financial data relevant to the form. Carefully read the instructions provided with the form to understand what is required. Fill out each section accurately, ensuring that all entries are clear and legible. Once completed, review the form for any errors before submission to avoid delays or complications.

Steps to complete the T2222 Form

Completing the T2222 form requires a systematic approach. Follow these steps for a successful submission:

- Gather all required documents, including identification and financial records.

- Read the instructions thoroughly to understand the sections of the form.

- Fill in your personal information, ensuring accuracy in names and numbers.

- Provide any necessary financial details as specified in the form.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified method, whether online or by mail.

Legal use of the T2222 Form

The T2222 form is legally binding when filled out correctly and submitted according to the regulations set forth by the IRS. It is essential to ensure that all information provided is truthful and accurate to avoid potential legal repercussions. Misrepresentation or errors may lead to penalties or issues with tax compliance. Utilizing a reliable electronic signature solution can enhance the legal standing of the form, ensuring that it meets all necessary electronic signature requirements.

Key elements of the T2222 Form

Several key elements are critical to the T2222 form's functionality and compliance. These include:

- Personal Information: Accurate identification details of the individual or entity submitting the form.

- Financial Data: Relevant financial information that supports the claims made on the form.

- Signature: A valid signature, whether electronic or handwritten, to authenticate the submission.

- Submission Date: The date on which the form is completed and submitted, which may be important for deadlines.

Form Submission Methods (Online / Mail / In-Person)

The T2222 form can be submitted through various methods, depending on the preferences of the user and the requirements set by the IRS. Common submission methods include:

- Online Submission: Many users prefer to submit the form electronically through authorized platforms, which can streamline the process.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring that it is sent with sufficient time to meet deadlines.

- In-Person: In certain cases, individuals may choose to submit the form in person at designated IRS offices.

Quick guide on how to complete t2222 form 100106684

Effortlessly Prepare T2222 Form on Any Device

Digital document management has gained signNow traction among organizations and individuals. It presents an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any delays. Handle T2222 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest method to modify and eSign T2222 Form with ease

- Find T2222 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark signNow sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiresome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign T2222 Form to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2222 form 100106684

Create this form in 5 minutes!

How to create an eSignature for the t2222 form 100106684

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2012 t2222 fillable form?

The 2012 t2222 fillable form is a standardized document used by businesses to streamline their reporting processes. It can be easily filled out digitally, which simplifies the submission and tracking of important data. Using the airSlate SignNow platform, you can fill out and eSign the 2012 t2222 fillable form efficiently.

-

How can I access the 2012 t2222 fillable form using airSlate SignNow?

You can access the 2012 t2222 fillable form by logging into your airSlate SignNow account and searching for the template library. Within the library, locate the 2012 t2222 fillable form and customize it as needed for your business. This ensures you have the latest version and simplifies the eSigning process.

-

Is there a cost associated with using the 2012 t2222 fillable form on airSlate SignNow?

Yes, using the 2012 t2222 fillable form on airSlate SignNow falls under our pricing plans. We offer various subscription options to suit different business needs, allowing you to choose a package that best fits your budget. You can enjoy features like unlimited eSigning and document storage.

-

What features does the airSlate SignNow platform offer for the 2012 t2222 fillable form?

The airSlate SignNow platform provides numerous features for the 2012 t2222 fillable form, including editable fields, eSigning capabilities, and templates. Additionally, our platform supports team collaboration, allowing multiple users to work on the form simultaneously. This makes managing your documents more efficient.

-

Can the 2012 t2222 fillable form be integrated with other software solutions?

Absolutely! The airSlate SignNow platform allows for integrations with various software solutions, making it easy to link your business tools. You can integrate the 2012 t2222 fillable form with CRMs, accounting software, and more, enhancing your workflow and data management.

-

What are the benefits of using the 2012 t2222 fillable form over a traditional paper form?

Using the 2012 t2222 fillable form offers several benefits compared to traditional paper forms, including reduced physical storage space and a quicker submission process. The digital format also minimizes the risk of errors and enhances the auditing trails for compliance. Additionally, eSigning makes it available for remote teams to collaborate seamlessly.

-

Is it secure to use the 2012 t2222 fillable form on airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform uses industry-standard encryption and follows compliance regulations to ensure your data is protected when using the 2012 t2222 fillable form. You can trust that your sensitive information remains confidential and safe.

Get more for T2222 Form

- Foundations in personal finance chapter 9 answer key form

- Bdsm negotiation form

- Verkoopovereenkomst auto 102094590 form

- Crazy coyote pet sitting form

- Bagpipe apush form

- Receipt for purchase of puppy form

- Formulaire d39inscription logement pdf moser vernet amp cie

- Summarize the renaissance and identify why it started in italy form

Find out other T2222 Form

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form