Application for Direct Trustee to Trustee Transfer Non Taxable Amount Only RS5500 N to Request the Direct Transfer of Member Con Form

Understanding the Application for Direct Trustee to Trustee Transfer

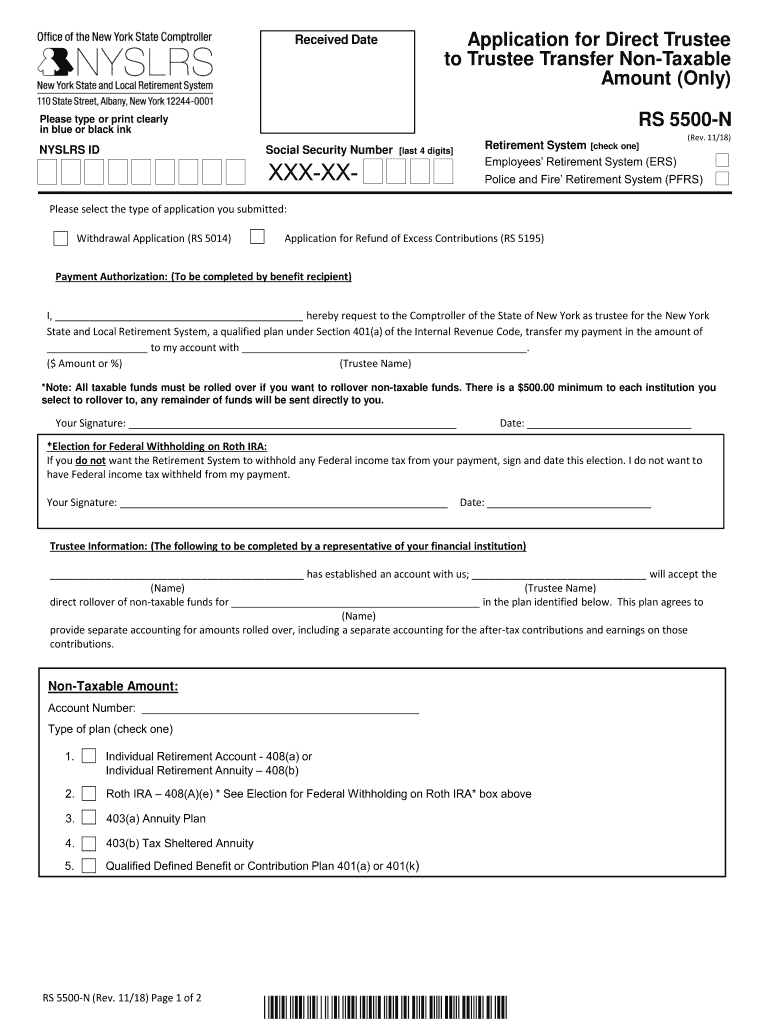

The Application for Direct Trustee to Trustee Transfer Non Taxable Amount Only RS5500 N is a crucial document for individuals looking to transfer member contributions or voluntary excess contributions to a qualified plan. This application allows for the transfer of funds without incurring tax liabilities, provided that the amount does not exceed RS5500 N. It is essential to understand the legal implications and requirements associated with this form, as it ensures compliance with federal regulations regarding retirement accounts.

Steps to Complete the Application

Completing the Application for Direct Trustee to Trustee Transfer involves several key steps:

- Gather necessary documentation, including your current account information and details of the qualified plan.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the application to the appropriate trustee for approval.

Following these steps will help streamline the transfer process and ensure compliance with all necessary regulations.

Eligibility Criteria for the Transfer

To qualify for the direct trustee to trustee transfer, certain eligibility criteria must be met:

- The transfer must involve member contributions or voluntary excess contributions.

- The total amount transferred should not exceed RS5500 N.

- The receiving plan must be a qualified retirement plan as defined by the IRS.

Ensuring you meet these criteria is essential for a successful transfer without tax implications.

Legal Use of the Application

The Application for Direct Trustee to Trustee Transfer serves a legal purpose in the context of retirement account management. It is designed to facilitate the transfer of funds between trustees while adhering to IRS regulations. Proper use of this application helps protect the interests of both the account holder and the financial institutions involved. It is advisable to retain a copy of the submitted application for your records, as it may be required for future reference or in case of disputes.

Required Documents for Submission

When submitting the Application for Direct Trustee to Trustee Transfer, certain documents are typically required:

- A copy of your current account statement from the transferring trustee.

- Details of the receiving qualified plan, including its account number.

- Any additional forms required by the receiving plan for processing the transfer.

Having these documents ready will facilitate a smoother submission process and help avoid delays.

Form Submission Methods

The Application for Direct Trustee to Trustee Transfer can be submitted through various methods, depending on the policies of the trustees involved. Common submission methods include:

- Online submission via the trustee's secure portal.

- Mailing the completed form to the designated address.

- In-person delivery at the trustee's office.

Choosing the appropriate submission method can impact the processing time, so it is advisable to verify the preferred method with your trustee.

Quick guide on how to complete application for direct trustee to trustee transfer non taxable amount only rs5500 n to request the direct transfer of member

Complete Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without delays. Manage Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con smoothly

- Locate Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Revise and eSign Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N'?

The 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N' is a form designed to facilitate the direct transfer of member contributions or voluntary excess contributions to a qualified plan. This process is essential for ensuring that your funds are correctly assigned without tax implications. Leveraging this application can streamline the transfer process, maintaining compliance and efficiency.

-

How do I fill out the Application For Direct Trustee To Trustee Transfer?

Filling out the 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N' involves providing personal and financial information accurately to ensure a smooth transfer. You'll need to specify the amounts being transferred and the intended qualified plan. Proper completion is crucial to avoid delays or complications in your transaction.

-

Is there a fee associated with using the application for transfers?

Generally, there may be fees involved when utilizing the 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N'; however, these fees can vary based on the financial institutions involved. It's advisable to check with your trustee regarding any applicable charges or fees. Using our services, you can also compare options to find the most cost-effective solution.

-

What are the benefits of using the Application For Direct Trustee To Trustee Transfer?

The 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N' offers numerous benefits, including tax-free transfers of contributions, reduced administrative burden, and faster processing times. By using this application, you're more likely to keep your retirement savings intact and ensure compliance with IRS regulations. Additionally, it helps in diversifying your retirement strategy.

-

Can I use this application for both member contributions and voluntary excess contributions?

Yes, the 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N' is designed for both member contributions and voluntary excess contributions. This flexibility allows you to manage different types of contributions in one application, streamlining the management of your retirement funds and ensuring that all contributions are appropriately directed.

-

How long does it take to process the Application For Direct Trustee To Trustee Transfer?

Processing times for the 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N' can vary depending on the institutions involved but typically range from a few days to a couple of weeks. It's essential to ensure that all information is accurate and complete to expedite processing. Monitoring the transfer closely can also help to resolve any issues that may arise promptly.

-

How does airSlate SignNow integrate with the Application For Direct Trustee To Trustee Transfer?

airSlate SignNow offers seamless integration with the 'Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N', allowing users to eSign and send documents securely. This integration enhances the user experience by streamlining document management processes, providing tracking and compliance capabilities, and ensuring that transactions are handled safely and efficiently.

Get more for Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con

- Mv9w form

- Fillable bank statement form

- Hdfc motor claim form 46209261

- Midwestern states word search puzzle find and circle twelve midwestern states in this puzzle form

- Presentation scoring sheet form

- Fct data sheet form

- Emergency medical consent form

- Silver award worksheets girl scouts western pennsylvania form

Find out other Application For Direct Trustee To Trustee Transfer Non Taxable Amount Only RS5500 N To Request The Direct Transfer Of Member Con

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement