DATCP Home Consumer Protection Fact Sheet Living Trusts Form

What is the DATCP Home Consumer Protection Fact Sheet Living Trusts

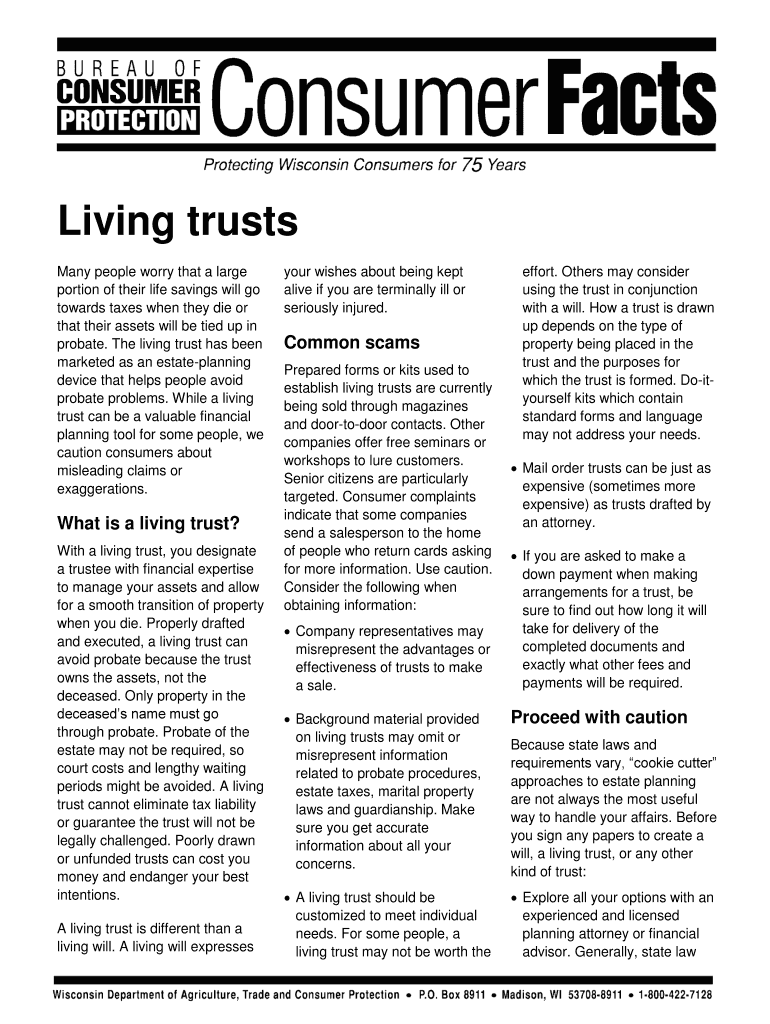

The DATCP Home Consumer Protection Fact Sheet Living Trusts is a resource designed to provide individuals with essential information regarding living trusts. A living trust is a legal document that allows a person to place their assets into a trust during their lifetime, which can then be managed by a trustee for the benefit of the trust's beneficiaries. This fact sheet outlines the purpose, benefits, and considerations involved in establishing a living trust, ensuring that consumers are well-informed about their options for asset management and estate planning.

How to use the DATCP Home Consumer Protection Fact Sheet Living Trusts

To effectively use the DATCP Home Consumer Protection Fact Sheet Living Trusts, individuals should first review the information provided to understand the fundamental aspects of living trusts. This includes the advantages of avoiding probate, maintaining privacy, and providing for the management of assets in case of incapacity. Once familiar with the content, consumers can take the next steps, such as consulting with a legal professional to discuss their specific situation and determine if a living trust is appropriate for their needs.

Steps to complete the DATCP Home Consumer Protection Fact Sheet Living Trusts

Completing the DATCP Home Consumer Protection Fact Sheet Living Trusts involves several key steps:

- Review the Fact Sheet: Understand the definitions, benefits, and limitations of living trusts.

- Gather Necessary Information: Collect details about your assets, beneficiaries, and any specific wishes regarding asset distribution.

- Consult a Legal Professional: Seek advice from an attorney specializing in estate planning to ensure that your trust is set up correctly.

- Draft the Trust Document: Work with your attorney to create a living trust document that reflects your intentions.

- Fund the Trust: Transfer ownership of your assets into the trust to ensure they are managed according to your wishes.

Key elements of the DATCP Home Consumer Protection Fact Sheet Living Trusts

Key elements of the DATCP Home Consumer Protection Fact Sheet Living Trusts include:

- Trustee Selection: Identifying a reliable trustee who will manage the trust assets.

- Beneficiary Designation: Clearly naming beneficiaries who will receive the assets upon your passing.

- Asset Management: Outlining how assets will be managed during your lifetime and after your death.

- Revocation Terms: Stipulating whether the trust can be modified or revoked at any time.

Legal use of the DATCP Home Consumer Protection Fact Sheet Living Trusts

The legal use of the DATCP Home Consumer Protection Fact Sheet Living Trusts involves adhering to state laws governing trusts. It is crucial to ensure that the trust complies with legal requirements to be enforceable. This includes proper execution of the trust document, funding the trust with assets, and following any specific state regulations regarding living trusts. Consulting with a legal expert can help ensure that all legal aspects are addressed appropriately.

Examples of using the DATCP Home Consumer Protection Fact Sheet Living Trusts

Examples of using the DATCP Home Consumer Protection Fact Sheet Living Trusts can illustrate its practical applications:

- A married couple establishing a living trust to ensure their home and savings are passed to their children without going through probate.

- An individual creating a trust to manage their assets in case of incapacity, ensuring that their wishes are honored even if they cannot make decisions.

- A parent setting up a living trust to provide for a child with special needs, ensuring that the child’s eligibility for government benefits is not affected.

Quick guide on how to complete datcp home consumer protection fact sheet living trusts

Complete DATCP Home Consumer Protection Fact Sheet Living Trusts effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to locate the necessary template and securely save it in the cloud. airSlate SignNow provides all the features you require to create, modify, and eSign your documents quickly without any hold-ups. Handle DATCP Home Consumer Protection Fact Sheet Living Trusts on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to adjust and eSign DATCP Home Consumer Protection Fact Sheet Living Trusts without stress

- Locate DATCP Home Consumer Protection Fact Sheet Living Trusts and then click Get Form to begin.

- Utilize the features we offer to finalize your document.

- Highlight important sections of the documents or obscure private information with tools that airSlate SignNow provides specifically for that use.

- Generate your eSignature using the Sign tool, which takes just moments and holds the exact same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would prefer to share your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Adjust and eSign DATCP Home Consumer Protection Fact Sheet Living Trusts and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the DATCP Home Consumer Protection Fact Sheet on Living Trusts?

The DATCP Home Consumer Protection Fact Sheet on Living Trusts provides essential information on creating and managing living trusts in Wisconsin. It outlines the benefits, how they work, and important legal considerations to ensure your assets are protected. This resource is invaluable for anyone considering a living trust as a means to manage their estate effectively.

-

How can airSlate SignNow help with living trusts?

airSlate SignNow simplifies the process of managing your living trusts by providing an easy-to-use platform for sending and eSigning necessary documents. With convenient templates and features for collaboration, you can ensure all parties involved are aligned and consent is properly documented. This streamlines the legal processes associated with living trusts, making it accessible for everyone.

-

What are the benefits of using living trusts as highlighted in the DATCP Home Consumer Protection Fact Sheet?

According to the DATCP Home Consumer Protection Fact Sheet on Living Trusts, some key benefits include avoiding probate, maintaining privacy, and offering flexibility in asset management. Living trusts also provide a clear structure for distribution of assets after death. Understanding these benefits can help individuals in making informed decisions about their estate planning.

-

Is there a cost associated with setting up a living trust using airSlate SignNow?

Using airSlate SignNow to create and manage living trust documents is cost-effective and can signNowly reduce legal fees typically associated with traditional methods. Digital signing and document management tools are available at competitive pricing, making it accessible for everyone. You can review the plans on our website to find the best option that suits your needs.

-

What features does airSlate SignNow offer for managing living trusts?

airSlate SignNow offers numerous features that benefit users managing living trusts, such as customizable templates, secure eSignature functionality, and document tracking. These features ensure that your trust documents are processed efficiently and securely. The platform is designed to enhance communication and collaboration, essential for all parties involved in a living trust.

-

How does airSlate SignNow ensure the security of the living trust documents?

Security is a top priority at airSlate SignNow. We use industry-standard encryption, secure cloud storage, and various authentication options to protect your living trust documents. Compliance with data privacy regulations also ensures that your personal information remains confidential and safe throughout the process.

-

Can I integrate airSlate SignNow with other applications for managing my living trust?

Yes, airSlate SignNow offers integration capabilities with various applications, allowing you to manage your living trust seamlessly. These integrations can enhance your workflows by connecting with platforms such as Google Drive, Dropbox, and CRM systems. This flexibility ensures that you can maintain organized records and access your documents whenever needed.

Get more for DATCP Home Consumer Protection Fact Sheet Living Trusts

Find out other DATCP Home Consumer Protection Fact Sheet Living Trusts

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed