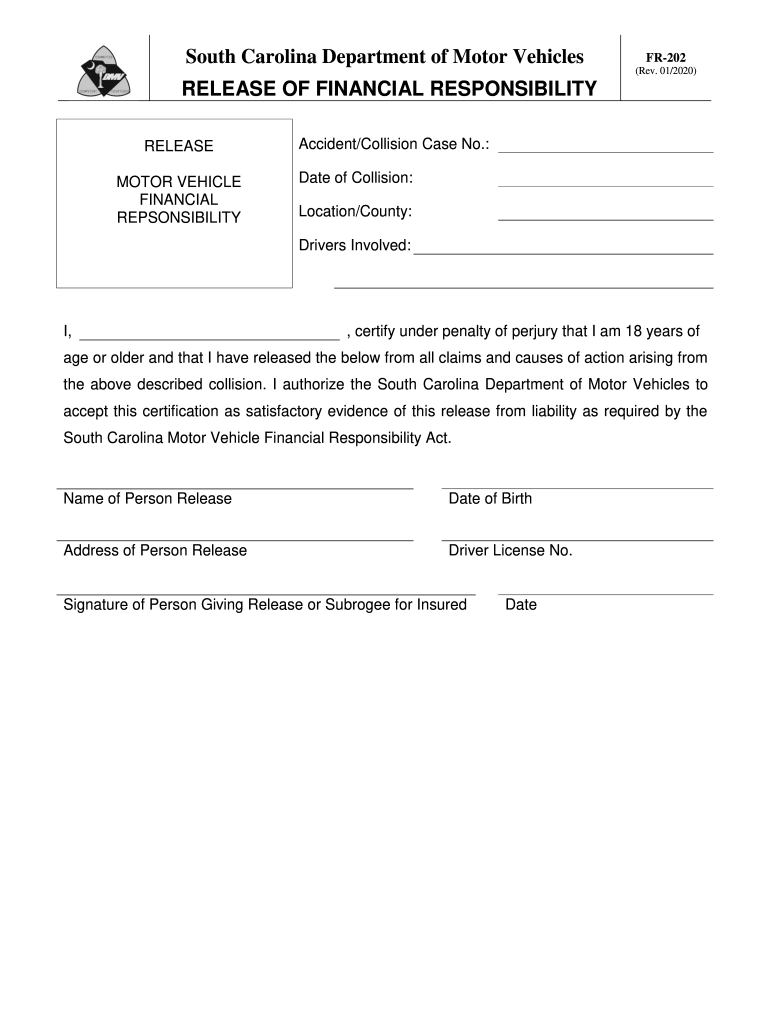

FR 202 Form

What is the FR 202

The FR 202 form is a crucial document used primarily for tax purposes in the United States. It is designed to gather essential information from individuals or entities for accurate tax reporting and compliance. This form plays a significant role in ensuring that taxpayers meet their obligations under federal tax laws. Understanding the purpose and requirements of the FR 202 is essential for anyone involved in the tax process.

How to use the FR 202

Using the FR 202 form involves a straightforward process that ensures all necessary information is accurately captured. Taxpayers need to fill out the form with relevant personal or business information, including income details, deductions, and credits. It is important to read the instructions carefully to avoid common mistakes that could lead to delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on the taxpayer's preference.

Steps to complete the FR 202

Completing the FR 202 form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Provide details about your income sources and any applicable deductions.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or by mail, ensuring you keep a copy for your records.

Legal use of the FR 202

The FR 202 form is legally binding when completed correctly and submitted in accordance with IRS regulations. To ensure its validity, taxpayers must adhere to the guidelines set forth by the IRS, including accurate reporting of income and adherence to deadlines. Utilizing a reliable eSignature platform can enhance the legal standing of the form by providing a secure method for signing and submitting electronically.

Filing Deadlines / Important Dates

Timely filing of the FR 202 form is essential to avoid penalties. The IRS typically sets specific deadlines for submission, which may vary based on the taxpayer's situation. For most individuals, the deadline falls on April fifteenth of each year. However, extensions may be available under certain circumstances. It is crucial to stay informed about these dates to ensure compliance and avoid unnecessary fees.

Required Documents

To complete the FR 202 form accurately, several documents are typically required. These may include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical or educational costs.

- Previous year’s tax return for reference.

Having these documents ready will streamline the completion process and help ensure that all necessary information is reported correctly.

Quick guide on how to complete fr 202

Complete FR 202 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers since you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage FR 202 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign FR 202 with ease

- Locate FR 202 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign FR 202 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is FR 202 in relation to airSlate SignNow?

FR 202 refers to the enhanced features and capabilities of the airSlate SignNow platform. It streamlines document management and electronic signature processes, ensuring that businesses can eSign documents securely and efficiently. With FR 202, users can expect improved functionality, making it a valuable tool for increasing productivity.

-

How does pricing work for the FR 202 plan?

The FR 202 plan offers flexible pricing tailored to businesses of all sizes. Users can choose from monthly or annual subscriptions, allowing them to select a payment option that best fits their budget. By opting for the FR 202 plan, businesses can take advantage of cost-effective rates while accessing powerful document signing features.

-

What features are included in the FR 202 plan?

The FR 202 plan includes a host of powerful features designed to streamline your document workflow. Key functionalities include template creation, multi-party signing, and real-time tracking of document status. Additionally, FR 202 provides advanced security measures to ensure that your documents are protected throughout the signing process.

-

What are the benefits of using airSlate SignNow's FR 202 plan?

Using the FR 202 plan offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. By automating signature requests, businesses can focus on other critical tasks while ensuring compliance and security. Moreover, the user-friendly interface of FR 202 makes it suitable for any team member, regardless of technical skill.

-

Can I integrate airSlate SignNow with other business tools while using FR 202?

Yes, the FR 202 plan is designed to integrate seamlessly with various business tools and applications. Users can connect airSlate SignNow with CRM systems, cloud storage services, and productivity tools, enhancing overall workflow efficiency. These integrations make it easier to manage documents and maintain a smooth business process.

-

Is there a free trial available for the FR 202 plan?

Yes, airSlate SignNow offers a free trial for the FR 202 plan, allowing users to explore its features before committing. The trial gives prospective customers a hands-on experience with the platform's capabilities to evaluate its fit for their business needs. It’s an excellent opportunity for businesses to understand the value that FR 202 can bring.

-

How do I get support for any issues related to the FR 202 plan?

Support for the FR 202 plan is readily available through multiple channels. Users can access comprehensive resources, including tutorials and FAQs, via the airSlate SignNow website. Additionally, customer support representatives are available to assist with any specific queries or challenges related to using FR 202.

Get more for FR 202

- Chauffeur license south carolina form

- Genetics worksheet form

- Line clearance form

- Bedford housing application form

- Copyright permission form template

- Test security supplement form

- North dakota department of corrections ampamp rehabilitation form

- Affidavit for proof of massachusetts residency for health form

Find out other FR 202

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy