International Fuel Tax Agreement IFTA Tax Return Information and Instructions

What is the International Fuel Tax Agreement IFTA Tax Return Information And Instructions

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among the United States and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The IFTA tax return provides essential information on fuel consumption and taxes owed, allowing carriers to report their fuel usage and pay taxes in a streamlined manner. This agreement aims to reduce the complexity of fuel tax reporting for interstate and international trucking operations, ensuring that carriers only pay taxes based on their actual fuel consumption in each jurisdiction.

Steps to complete the International Fuel Tax Agreement IFTA Tax Return Information And Instructions

Completing the IFTA tax return involves several key steps that ensure accurate reporting and compliance with tax regulations. Begin by gathering all necessary documentation, including fuel purchase receipts and mileage logs for each jurisdiction. Next, calculate the total fuel consumed and the miles driven in each state or province. This information will be used to determine the tax owed or any credits due. Once calculations are complete, fill out the IFTA tax return form, ensuring all entries are accurate. Finally, submit the completed form by the designated deadline, either electronically or via mail, depending on your jurisdiction's requirements.

Legal use of the International Fuel Tax Agreement IFTA Tax Return Information And Instructions

The legal use of the IFTA tax return is governed by the agreement's regulations, which require accurate reporting of fuel usage and adherence to filing deadlines. Electronic submission of the IFTA tax return is legally recognized, provided that the electronic signature meets the necessary legal standards. Compliance with IFTA regulations is crucial to avoid penalties and ensure that all fuel taxes are correctly accounted for. Additionally, maintaining accurate records of fuel purchases and mileage is essential for legal compliance and audit readiness.

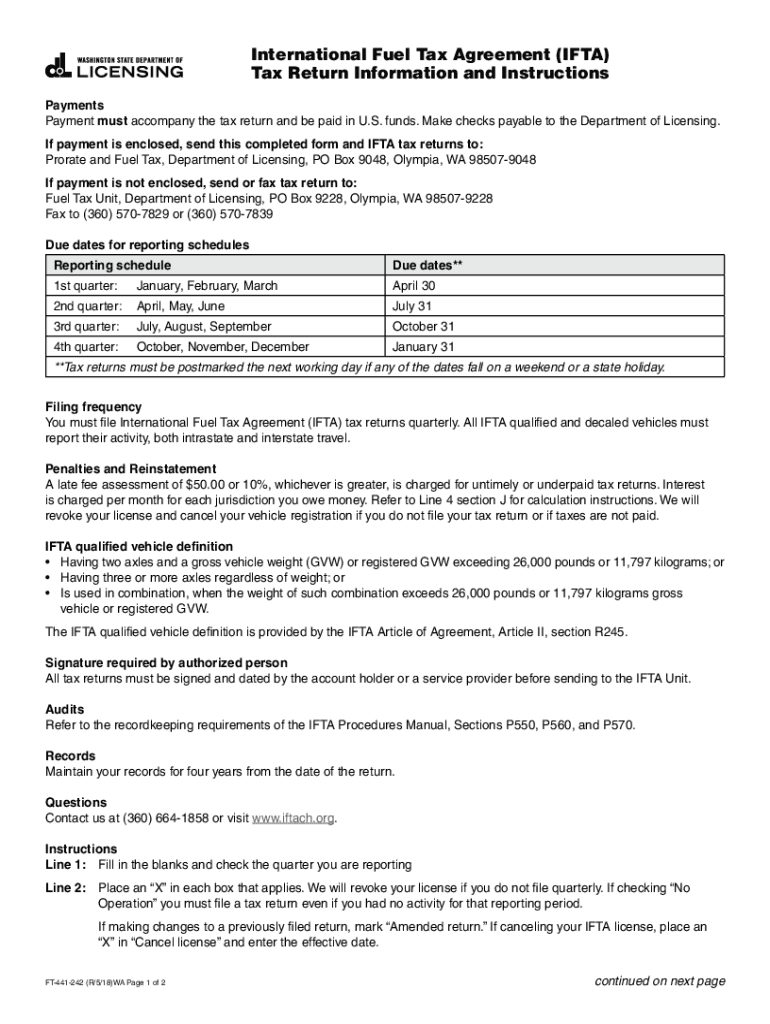

Filing Deadlines / Important Dates

Filing deadlines for the IFTA tax return vary by jurisdiction but generally occur quarterly. It is important to be aware of these dates to avoid late penalties. Typically, the due dates are at the end of the month following each quarter, such as January 31 for the first quarter, April 30 for the second quarter, July 31 for the third quarter, and October 31 for the fourth quarter. Some jurisdictions may have specific requirements or extensions, so checking local regulations is advisable.

Required Documents

To complete the IFTA tax return, several documents are necessary. These include:

- Fuel purchase receipts from all jurisdictions.

- Mileage logs detailing the distance traveled in each state or province.

- Previous IFTA tax returns, if applicable, for reference.

- Any additional documentation required by your specific jurisdiction.

Having these documents readily available will facilitate the accurate completion of the IFTA tax return.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties. These may include fines for late filings, interest on unpaid taxes, and potential audits. Non-compliance can also lead to the suspension or revocation of an IFTA license, which can severely impact a carrier's ability to operate across state lines. It is essential to adhere to all filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete international fuel tax agreement ifta tax return information and instructions

Handle International Fuel Tax Agreement IFTA Tax Return Information And Instructions effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without interruptions. Manage International Fuel Tax Agreement IFTA Tax Return Information And Instructions on any device with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The easiest way to modify and electronically sign International Fuel Tax Agreement IFTA Tax Return Information And Instructions without hassle

- Locate International Fuel Tax Agreement IFTA Tax Return Information And Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Decide how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign International Fuel Tax Agreement IFTA Tax Return Information And Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the International Fuel Tax Agreement (IFTA)?

The International Fuel Tax Agreement (IFTA) is an agreement between the contiguous United States and Canadian provinces for reporting fuel use by motor carriers. It simplifies the reporting of fuel taxes and helps ensure that truckers pay the correct amount across jurisdictions. For complete International Fuel Tax Agreement IFTA Tax Return Information And Instructions, refer to our comprehensive guide.

-

How do I file my IFTA tax return?

Filing your IFTA tax return involves gathering records of your fuel purchases and miles driven in each jurisdiction. Once you compile this information, you can complete the IFTA tax return forms as outlined in the International Fuel Tax Agreement IFTA Tax Return Information And Instructions. It's essential to follow these steps carefully to ensure compliance.

-

What documents do I need for my IFTA tax return?

To complete your IFTA tax return, you'll need your fuel receipts, mileage records, and any previous IFTA returns. These documents will help you accurately report your fuel use across different jurisdictions. Comprehensive International Fuel Tax Agreement IFTA Tax Return Information And Instructions can guide you in gathering the necessary documentation.

-

Are there penalties for late IFTA tax returns?

Yes, there are penalties for late IFTA tax returns, which can include fines and interest on unpaid taxes. It is crucial to file on time to avoid these additional costs. For more details about deadlines and penalties, refer to the International Fuel Tax Agreement IFTA Tax Return Information And Instructions.

-

How does airSlate SignNow help with my IFTA tax return?

airSlate SignNow provides an efficient and cost-effective solution for eSigning and sending your IFTA tax return documents securely. With our platform, you can easily manage your tax forms and ensure they are filed accurately and on time. Explore our International Fuel Tax Agreement IFTA Tax Return Information And Instructions to learn how we can assist you.

-

Can I integrate airSlate SignNow with other software for my IFTA filings?

Yes, airSlate SignNow offers integrations with various accounting and tax software platforms, making it easier to manage your IFTA filings. This seamless integration allows you to streamline your workflows and enhance productivity. Check the International Fuel Tax Agreement IFTA Tax Return Information And Instructions for specific integration options.

-

What are the benefits of using airSlate SignNow for IFTA tax returns?

Using airSlate SignNow for your IFTA tax returns offers several benefits, including easy eSigning, secure document management, and cost-efficiency. Our platform simplifies the tax filing process, allowing you to focus on your business. For more on how to utilize our service, see the International Fuel Tax Agreement IFTA Tax Return Information And Instructions.

Get more for International Fuel Tax Agreement IFTA Tax Return Information And Instructions

Find out other International Fuel Tax Agreement IFTA Tax Return Information And Instructions

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement