California Tax Table Form

What is the California Tax Table

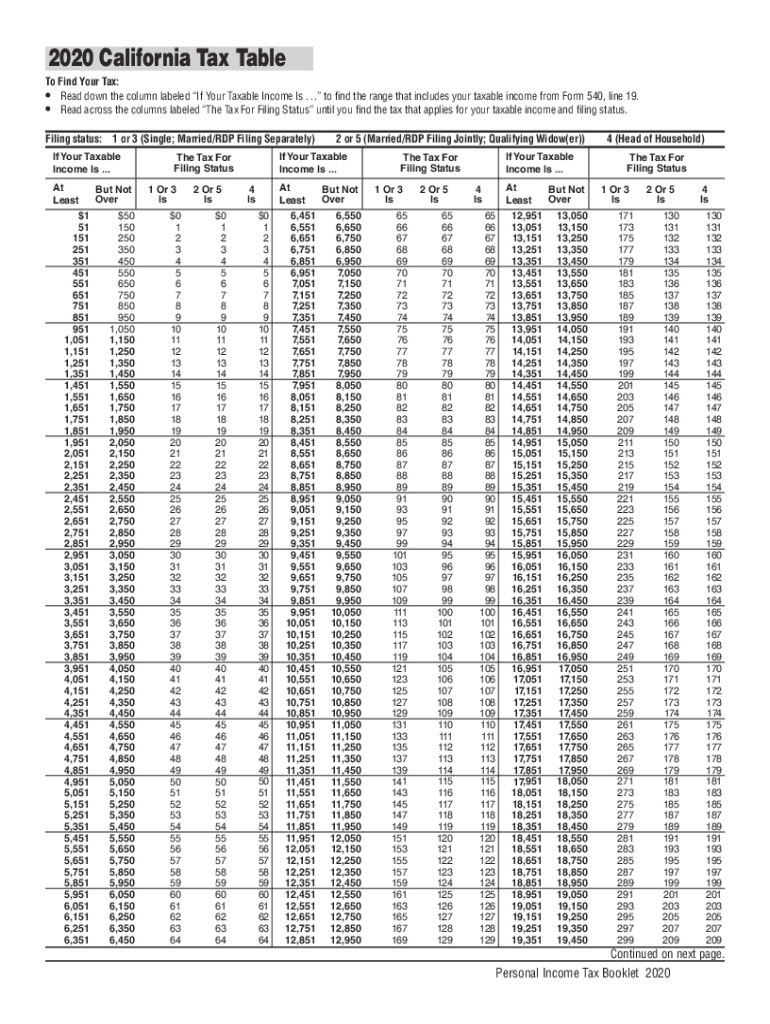

The California Tax Table is a crucial resource used to determine the amount of state income tax owed by individuals based on their taxable income. It is published annually by the California Franchise Tax Board (FTB) and provides a structured format for taxpayers to reference their tax obligations. The table categorizes income ranges and corresponding tax rates, allowing individuals to quickly ascertain their tax liability. Understanding this table is essential for accurate tax filing and compliance with state regulations.

How to use the California Tax Table

To effectively use the California Tax Table, follow these steps:

- Identify your filing status, as tax rates may vary based on whether you are filing as single, married, or head of household.

- Determine your taxable income by calculating your total income and subtracting any deductions or exemptions.

- Locate the appropriate income range in the tax table that corresponds to your taxable income.

- Read across the row to find the corresponding tax amount or rate that applies to your income level.

This process ensures that you accurately calculate your state income tax liability.

Steps to complete the California Tax Table

Completing the California Tax Table involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Calculate your total income and determine your taxable income by applying relevant deductions.

- Refer to the California Tax Table to find your tax obligation based on your taxable income.

- Document the calculated tax amount on your California tax return form.

Following these steps helps ensure that your tax return is accurate and complete.

Legal use of the California Tax Table

The California Tax Table is legally recognized for determining state income tax obligations. It is essential for taxpayers to use the most current version of the table, as outdated tables may lead to incorrect tax calculations. Compliance with the tax table ensures adherence to state tax laws, reducing the risk of penalties or audits. The California Franchise Tax Board provides the table as part of its official documentation, reinforcing its legal validity.

Key elements of the California Tax Table

Key elements of the California Tax Table include:

- Income Ranges: The table lists various income brackets that correspond to different tax rates.

- Tax Rates: Each income range has a specific tax rate that applies to taxpayers within that bracket.

- Filing Status: The table may differentiate tax rates based on whether the taxpayer is single, married, or filing jointly.

Understanding these elements is vital for accurate tax filing and compliance.

Filing Deadlines / Important Dates

Filing deadlines for California state taxes are crucial for taxpayers to note. Typically, the deadline for filing your state income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of any extensions that may be available, as well as deadlines for estimated tax payments. Staying informed about these dates helps ensure timely compliance with state tax obligations.

Quick guide on how to complete 2020 california tax table

Accomplish California Tax Table seamlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents quickly without delays. Manage California Tax Table on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to alter and electronically sign California Tax Table without any hassle

- Locate California Tax Table and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and electronically sign California Tax Table and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2020 FTB tax table?

The 2020 FTB tax table is a document that provides taxpayers with information on income tax rates and brackets for the tax year 2020 in California. It helps you determine your tax liability based on your income level. Understanding the 2020 FTB tax table is crucial for accurate tax filings and planning.

-

How can airSlate SignNow help with the 2020 FTB tax table?

With airSlate SignNow, you can easily send and eSign tax documents that reference the 2020 FTB tax table, streamlining your tax preparation process. Our platform allows for quick document turnaround, ensuring you meet deadlines for tax submissions. This feature greatly enhances efficiency when dealing with tax documents.

-

Is there a cost associated with accessing the 2020 FTB tax table through airSlate SignNow?

While the 2020 FTB tax table itself is publicly available from the California Franchise Tax Board, airSlate SignNow offers a subscription service for document management. The pricing is competitive and reflects the features you get, such as eSigning and sharing documents securely, which can simplify using the 2020 FTB tax table.

-

What features does airSlate SignNow offer that relate to the 2020 FTB tax table?

airSlate SignNow provides features like customizable templates and cloud storage that are beneficial when working with the 2020 FTB tax table. You can create templates for frequently used tax forms, and the ease of eSigning accelerates document processing. These tools take the stress out of your tax documentation tasks.

-

Can I integrate airSlate SignNow with other software to manage the 2020 FTB tax table efficiently?

Yes, airSlate SignNow offers integrations with popular accounting and filing software, enhancing your ability to work with the 2020 FTB tax table. This ensures that your tax forms and documents align with other financial tools, providing a seamless experience. Integrating helps maintain accuracy and saves time in the long run.

-

What are the benefits of using airSlate SignNow for tax-related documents involving the 2020 FTB tax table?

Using airSlate SignNow for your tax documents offers benefits such as increased efficiency, security, and convenience. You can easily eSign necessary forms related to the 2020 FTB tax table, reducing the time spent on filing taxes. Additionally, all documents are securely stored and easily accessible when needed.

-

Is there customer support available for questions about the 2020 FTB tax table when using airSlate SignNow?

Yes, airSlate SignNow provides customer support to assist you with any queries about using the platform for the 2020 FTB tax table and related documents. Whether you need guidance on features or troubleshooting, our support team is ready to help you navigate through it all. This support ensures you can utilize the service without hassle.

Get more for California Tax Table

Find out other California Tax Table

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now