Canada Refund under Tax Form

What is the Canada Refund Under Tax

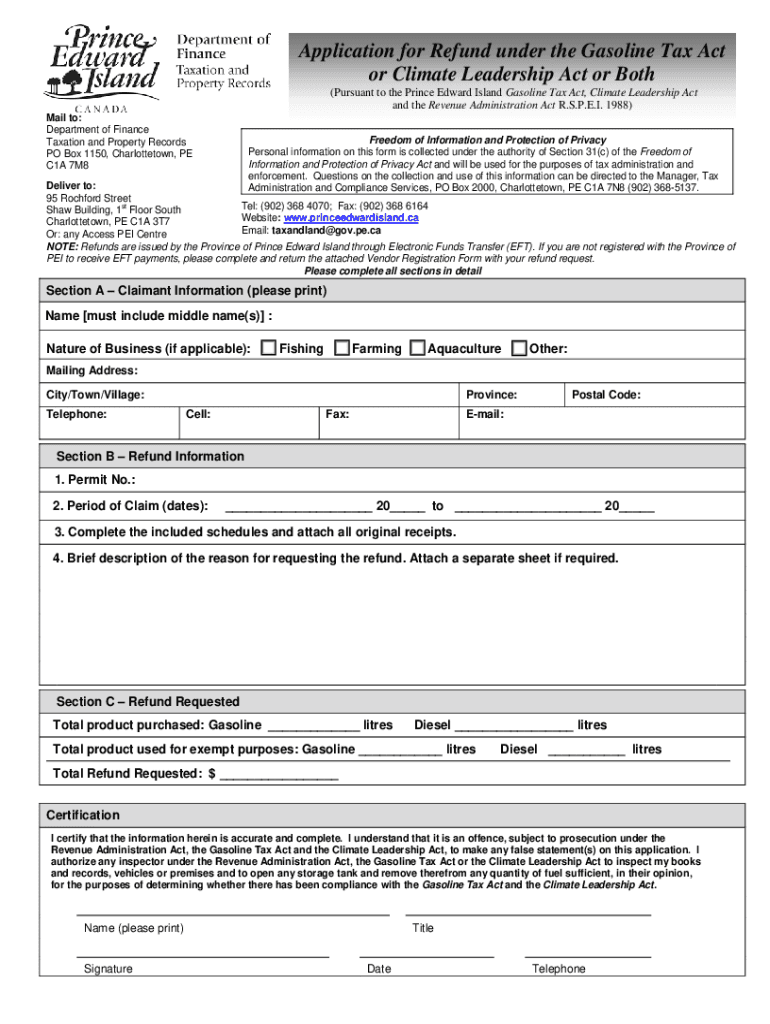

The Canada Refund Under Tax refers to a financial mechanism that allows eligible taxpayers to recover certain amounts paid in taxes. This refund is typically associated with specific tax credits or rebates that individuals or businesses may qualify for based on their financial activities or expenditures. Understanding the criteria and processes involved in claiming this refund is essential for taxpayers seeking to optimize their financial returns.

How to obtain the Canada Refund Under Tax

To obtain the Canada Refund Under Tax, taxpayers must first determine their eligibility. This involves reviewing the specific tax credits or rebates available and ensuring that all required conditions are met. Once eligibility is confirmed, the next step is to gather necessary documentation, such as proof of income and any relevant receipts. Taxpayers can then complete the appropriate forms, which may be submitted electronically or via traditional mail, depending on the specific requirements outlined by the tax authority.

Steps to complete the Canada Refund Under Tax

Completing the Canada Refund Under Tax involves several key steps:

- Determine eligibility by reviewing available tax credits and rebates.

- Gather required documentation, including income statements and receipts.

- Complete the necessary forms accurately, ensuring all information is correct.

- Submit the forms through the designated channels, either online or by mail.

- Monitor the status of the refund through the tax authority's tracking system.

Required Documents

When applying for the Canada Refund Under Tax, several documents are typically required to support the application. These may include:

- Proof of income, such as W-2 forms or pay stubs.

- Receipts for qualifying expenses that justify the refund claim.

- Completed tax forms relevant to the specific refund being sought.

- Any additional documentation requested by the tax authority.

Eligibility Criteria

Eligibility for the Canada Refund Under Tax varies based on the specific tax credits or rebates being claimed. Common criteria include:

- Residency status within Canada.

- Income level, which may affect the amount of refund available.

- Specific expenditures that qualify for rebates, such as those related to education or energy efficiency.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting their Canada Refund Under Tax forms. These methods include:

- Online submission through the tax authority's secure portal, which is often the fastest method.

- Mailing the completed forms to the designated tax office, ensuring that they are postmarked by the deadline.

- In-person submission at local tax offices, which may provide immediate assistance and confirmation.

Quick guide on how to complete canada refund under tax

Easily prepare Canada Refund Under Tax on any device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delay. Manage Canada Refund Under Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Canada Refund Under Tax effortlessly

- Find Canada Refund Under Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Canada Refund Under Tax and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for businesses in relation to tax Prince Edward Island?

airSlate SignNow offers flexible pricing plans designed to meet various business needs, including those in tax Prince Edward Island. We provide competitive pricing tiers based on the number of users and features required, ensuring that you get the best value for your electronic signing needs.

-

How can airSlate SignNow help facilitate tax documentation in Prince Edward Island?

Using airSlate SignNow, businesses can streamline the process of sending and signing tax documents in Prince Edward Island. Our platform allows users to create legally binding eSignatures, reducing the time and effort needed to manage tax-related paperwork effectively.

-

What features does airSlate SignNow offer for users dealing with tax in Prince Edward Island?

airSlate SignNow provides a variety of features beneficial for tax processes in Prince Edward Island, including customizable templates, secure eSignatures, and advanced document tracking. These features enhance efficiency and ensure compliance with local tax regulations.

-

Is airSlate SignNow suitable for tax professionals in Prince Edward Island?

Absolutely! airSlate SignNow is specifically designed to meet the needs of tax professionals in Prince Edward Island. Its user-friendly interface and robust features enable tax experts to manage client documents efficiently, ensuring a smooth workflow.

-

What are the main benefits of using airSlate SignNow for tax processes in Prince Edward Island?

The key benefits of using airSlate SignNow for tax processes in Prince Edward Island include enhanced efficiency, reduced processing time, and improved security. Our platform simplifies document management, allowing businesses to focus more on core operations rather than paperwork.

-

Does airSlate SignNow integrate with accounting software for tax purposes in Prince Edward Island?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software commonly used in Prince Edward Island. This integration allows for a streamlined flow of information, making it easier for businesses to manage their tax documentation and eSignatures in one place.

-

How secure is airSlate SignNow for handling tax documents in Prince Edward Island?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive tax documents in Prince Edward Island. We utilize advanced encryption protocols and comply with international security standards to ensure that all your documents are safe and secure.

Get more for Canada Refund Under Tax

Find out other Canada Refund Under Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors