Form Medicaid Transportation 2014

What is the Form Medicaid Transportation

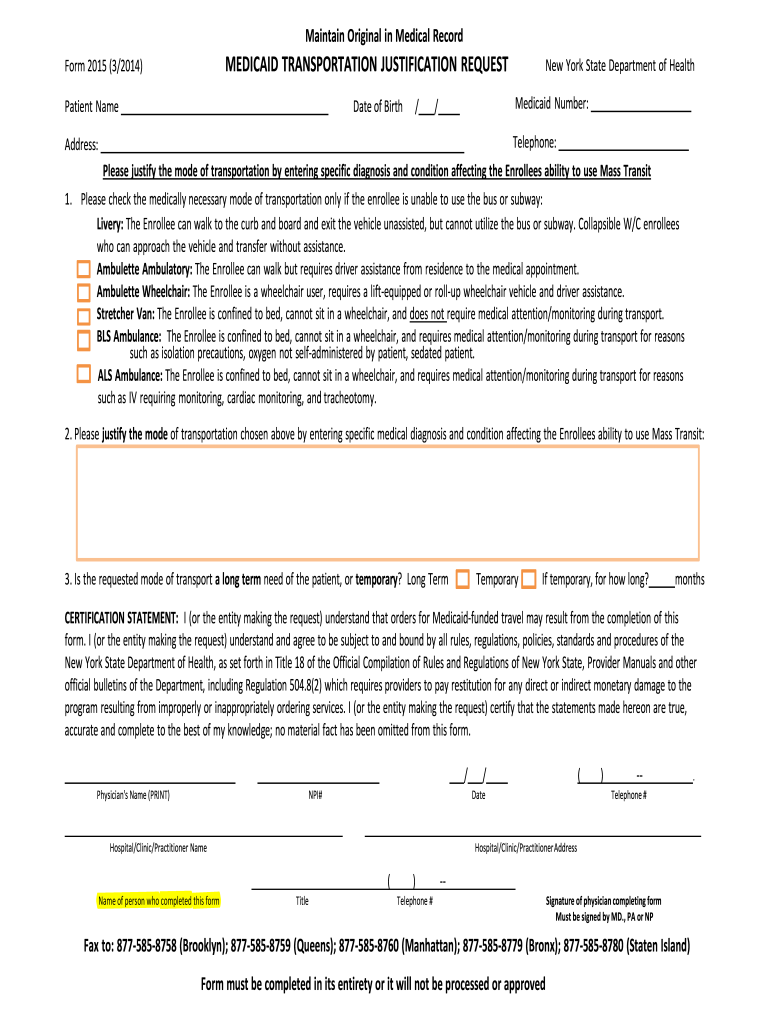

The Form Medicaid Transportation is a critical document used to request transportation services for Medicaid recipients in the United States. This form is essential for individuals who require assistance in getting to medical appointments or other healthcare services covered by Medicaid. It ensures that eligible individuals can access necessary medical care without the burden of transportation costs, which can be a significant barrier to receiving timely treatment.

How to use the Form Medicaid Transportation

Using the Form Medicaid Transportation involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained through state Medicaid offices or online resources. Next, fill out the required fields accurately, including personal information, details about the medical appointments, and any specific transportation needs. Once completed, submit the form according to your state's guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form Medicaid Transportation

Completing the Form Medicaid Transportation requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from your state Medicaid office.

- Fill in your personal information, including your Medicaid number and contact details.

- Provide information about your medical appointments, such as the date, time, and location.

- Indicate any special transportation needs, such as wheelchair access.

- Review the form for accuracy and completeness before submission.

Legal use of the Form Medicaid Transportation

The legal use of the Form Medicaid Transportation is governed by state and federal regulations. It is crucial to ensure that the form is filled out truthfully and submitted within the specified time frames to avoid any legal repercussions. Misuse of the form, such as providing false information, can lead to penalties, including loss of Medicaid benefits. Understanding the legal implications helps ensure compliance and protects the rights of the individual requesting transportation services.

State-specific rules for the Form Medicaid Transportation

Each state may have specific rules and procedures regarding the Form Medicaid Transportation. It is essential to familiarize yourself with your state's requirements, as these can vary significantly. Some states may have additional documentation requirements or different submission methods. Checking with your local Medicaid office can provide clarity on any state-specific rules that must be followed to ensure successful processing of the form.

Examples of using the Form Medicaid Transportation

Examples of using the Form Medicaid Transportation can illustrate its importance. For instance, an elderly individual needing regular dialysis treatment may use the form to secure transportation to their appointments. Similarly, a parent may fill out the form to arrange transportation for their child to a therapy session. These examples highlight how the form facilitates access to essential medical services, thereby improving health outcomes for Medicaid recipients.

Quick guide on how to complete tax forms 2015

The simplest method to locate and endorse Form Medicaid Transportation

On the scale of an entire organization, ineffective workflows concerning document authorization can take up a signNow amount of productive time. Completing paperwork like Form Medicaid Transportation is a routine aspect of operations in any enterprise, which is why the effectiveness of each contract's lifecycle is crucial to the company’s overall productivity. With airSlate SignNow, endorsing your Form Medicaid Transportation is as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can endorse it right away without the need for external applications on your computer or printing out hard copies.

Steps to obtain and endorse your Form Medicaid Transportation

- Browse our collection by category or use the search box to find the document you seek.

- Check the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any required information using the toolbar.

- When finished, click the Sign tool to endorse your Form Medicaid Transportation.

- Choose the signing method that is most suitable for you: Draw, Create initials, or upload a picture of your signature.

- Click Done to finish editing and move on to document-sharing options as necessary.

With airSlate SignNow, you possess everything necessary to manage your documentation effectively. You can search for, complete, edit, and even share your Form Medicaid Transportation all within a single tab without any difficulty. Optimize your workflows with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct tax forms 2015

FAQs

-

I have been accepted to MIT '20. How can I find outside scholarships to help fund for my education?

The other answers are optimistic. MIT offers generous financial aid, but it definitely does not match everyone's needs. In particular, they can assume that the student's parents are willing to make every sacrifice short of selling their house - and in reality many parents are unwilling or unable to do this.MIT does maintain a scholarships database. Look on their career centre website (called GECD), and also search for 'MIT distinguished fellowships'. Also, target scholarships for Latino women in science/nuclear engineers/Alaskans/lacrosse players/whatever you are. You'll have better luck if you focus on a few well-chosen applications than if you try to apply to everything.Finally, MIT has many campus jobs with a minimum wage of ~$10/hour. This won't pay your tuition, but it will cover your meals and textbooks, and you can get valuable work experience at the same time. Unlike many schools, our meal plan is optional, which will potentially save you an extra ~$3000/year compared to the sticker price. MIT also has a ridiculous amount of funding for student activities, study abroad programmes, etc, which you can exploit once you're in.Congratulations, and good luck!

-

I am an Indian citizen and living in India, but I'm employed by a US company working remotely from India, earning a salary in USD. What should I know about filing a tax return in India?

So even if you are employed by an US company, for the purpose of income tax laws, you are an Indian resident, your global income is taxable in India. To say it in simple terms, it is no different then you being employed by an Indian Company. In case your total income before deduction is above 2.5 lacs, you are required to file an income tax return. The due date for the current year is extended till 31st August otherwise it is normally 31st July of the following year of the financial year. Moreover since the tax might have been deducted by the US company from your salary, you may get a credit for such tax paid by your US employer against your Indian income tax liability. As far as Indian tax liability is concerned, you have to discharge this by way of advance tax in case the credit available in respect of tax deducted by your US employer is not sufficient. In case you have not been able to pay your advance tax, the same can be paid by way of self assessment tax. For delay or default in payment of advance tax, read the below article written by me.What if you have failed to pay advance tax? You can avail other tax deduction under Section 80 C, 80 D, 80 E in case you have taken education loan etc. In case you want to need clarification on any specific issue, please ask specific question as the area of income tax very wide and one is not able to under stand it fully even one signNowes grave.

-

I'm filling out a W-4 for 2015. If you want any additional amount taken out, would this apply to current tax year or apply to previous years tax debt?

The W-4 tells your employer how much federal income taxes to withhold from your paycheck. As such, it only effects paychecks going forward - it has no effect on paychecks already issued.The amount withheld is simply an estimate of how much federal income tax you will ultimately owe at year's end. The amount withhold may be more or less than you end up actually owing. If too much is withheld, you are entitled to a refund; if too little, you will owe taxes. You can change your W-4 withholding at any time by submitting an updated W-4 to your employer. You do not have to fill out a new W-4 every year, although your employer may require it.This form is retained by the employer, and is not submitted to the IRS.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the tax forms 2015

How to make an eSignature for the Tax Forms 2015 online

How to make an electronic signature for your Tax Forms 2015 in Google Chrome

How to generate an eSignature for signing the Tax Forms 2015 in Gmail

How to make an eSignature for the Tax Forms 2015 straight from your mobile device

How to make an electronic signature for the Tax Forms 2015 on iOS

How to generate an eSignature for the Tax Forms 2015 on Android

People also ask

-

What is the Form Medicaid Transportation and how does it work?

The Form Medicaid Transportation is a crucial document designed to facilitate non-emergency medical transportation for Medicaid recipients. By using airSlate SignNow, you can easily create, send, and eSign this form, ensuring that transportation requests are processed quickly and efficiently. This streamlines the process for healthcare providers and patients alike, enhancing accessibility to necessary medical services.

-

How can airSlate SignNow help with the Form Medicaid Transportation process?

airSlate SignNow simplifies the Form Medicaid Transportation process by allowing users to fill out, edit, and eSign documents seamlessly. With our user-friendly interface, healthcare providers can manage transportation requests more effectively, ensuring compliance with Medicaid regulations. This not only saves time but also improves the overall patient experience.

-

What are the benefits of using airSlate SignNow for Form Medicaid Transportation?

Using airSlate SignNow for Form Medicaid Transportation offers several benefits, including improved efficiency in processing transportation requests and enhanced security for sensitive patient information. Additionally, the platform supports electronic signatures, which speeds up the approval process and reduces paperwork. Overall, it helps healthcare providers deliver better service to their patients.

-

Is there a free trial for airSlate SignNow to manage Form Medicaid Transportation?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its features for managing Form Medicaid Transportation without any initial commitment. This trial period provides an opportunity to assess how our platform can streamline your documentation process and improve overall efficiency before making a purchase.

-

What pricing plans are available for airSlate SignNow to handle Form Medicaid Transportation?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it affordable to manage Form Medicaid Transportation. Plans typically include features such as unlimited documents and templates, secure cloud storage, and integrations with other software. You can choose a plan that fits your budget and operational requirements.

-

Can airSlate SignNow integrate with other healthcare management systems for Form Medicaid Transportation?

Absolutely! airSlate SignNow can easily integrate with various healthcare management systems, making it ideal for handling Form Medicaid Transportation. This integration allows for seamless data sharing and enhances workflow efficiency, ensuring that transportation requests are processed within the larger context of patient care.

-

How does airSlate SignNow ensure the security of Form Medicaid Transportation documents?

airSlate SignNow prioritizes the security of your Form Medicaid Transportation documents by employing advanced encryption protocols and secure cloud storage. All electronic signatures are legally binding and comply with HIPAA regulations, ensuring that patient information remains confidential and protected throughout the process.

Get more for Form Medicaid Transportation

- Uil waiver form

- Verification of enrollment request form

- Any differences form

- 2017 2018 family size clarification form university of houston

- 2020 2021 verification worksheet v1 independent student form

- Financial aid student loans and college edvisors form

- 2020 2021 verification worksheet university of st thomas form

- College of veterinary medicinelincoln memorial university form

Find out other Form Medicaid Transportation

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF